Overview of Meteora Capital's Recent Acquisition

On September 30, 2024, Meteora Capital, LLC (Trades, Portfolio) marked a significant portfolio addition by purchasing 1,118,672 shares of ConnectM Technology Solutions Inc (CNTM, Financial) at a price of $1.15 per share. This transaction not only signifies a new holding for the firm but also reflects a strategic investment in the burgeoning clean energy sector. The shares acquired represent a 5.29% ownership in CNTM, positioning Meteora Capital as a notable stakeholder in the company.

Insight into Meteora Capital, LLC (Trades, Portfolio)

Located at 840 Park Drive East, Boca Raton, FL, Meteora Capital, LLC (Trades, Portfolio) is a distinguished investment firm with a portfolio that includes 208 stocks, predominantly in the financial services and industrials sectors. The firm manages an equity portfolio valued at approximately $361 million, with top holdings in companies like Frontier Communications Parent Inc (FYBR, Financial) and Investcorp Europe Acquisition Corp I (IVCB, Financial). Meteora Capital is known for its strategic investment choices, focusing on sectors that promise substantial growth and innovation.

ConnectM Technology Solutions Inc at a Glance

ConnectM Technology Solutions Inc, headquartered in the USA, operates within the clean energy technology landscape. Since its IPO on July 15, 2024, the company has aimed to revolutionize the energy sector by providing advanced digital solutions for solar and all-electric systems in residential and light commercial settings. Despite its recent market challenges, ConnectM continues to innovate in energy efficiency and reduction of carbon footprints.

Financial and Market Position of ConnectM

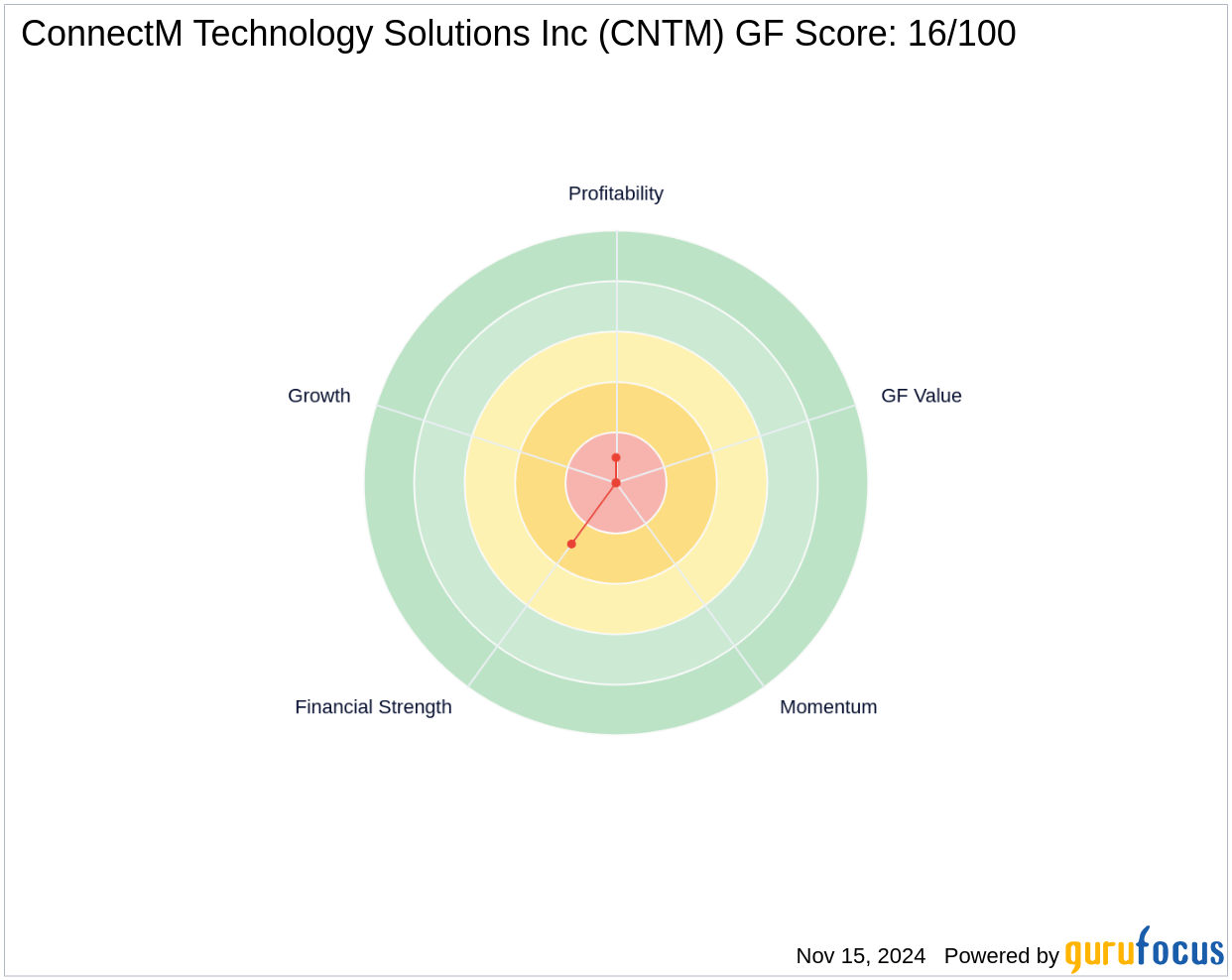

As of the latest data, ConnectM holds a market capitalization of $19.47 million with a current stock price of $0.92, reflecting a 20% decrease since Meteora Capital's acquisition. The company's performance metrics such as a PE Ratio of 14.15 and a GF Score of 16/100 indicate significant challenges ahead in terms of profitability and market position.

Strategic Impact of the Acquisition on Meteora Capital

The acquisition of a 0.23% position in their portfolio through this transaction underscores Meteora Capital's commitment to integrating innovative clean energy solutions within its investment strategy. This move not only diversifies their holdings but also aligns with broader market trends focusing on sustainability and technological advancements in energy.

Market Trends and Sector Analysis

Meteora Capital's focus on financial services and industrials is complemented by this venture into the clean energy sector, reflecting a strategic alignment with global shifts towards sustainability. The firm's adeptness at capitalizing on market trends is evident from its portfolio's structure, geared towards sectors poised for significant future growth.

Future Prospects for ConnectM and Meteora Capital

Looking ahead, ConnectM faces the dual challenge of navigating a competitive clean energy market and improving its financial health. For Meteora Capital, the firm's ability to leverage ConnectM's potential breakthroughs in technology could yield substantial returns, albeit with associated risks given the company's current financial metrics.

Concluding Thoughts

This acquisition by Meteora Capital, LLC (Trades, Portfolio) is a calculated move to stake a claim in the clean energy sector through ConnectM Technology Solutions Inc. It reflects a broader strategy of investing in technologically innovative and environmentally sustainable enterprises. As both entities move forward, the integration of this new holding could play a pivotal role in shaping Meteora Capital's portfolio performance and ConnectM's market standing.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.