Overview of AQR Capital Management's Recent Trade

On September 30, 2024, AQR Capital Management LLC marked a significant portfolio addition by acquiring 803,497 shares of Alchemy Investments Acquisition Corp 1 (ALCY, Financial). This transaction, categorized as "New Holdings," was executed at a price of $10.87 per share. The total shares now held by the firm in ALCY amount to 803,497, representing a 0.01% impact on AQR’s portfolio and establishing a 6.64% ownership stake in the company.

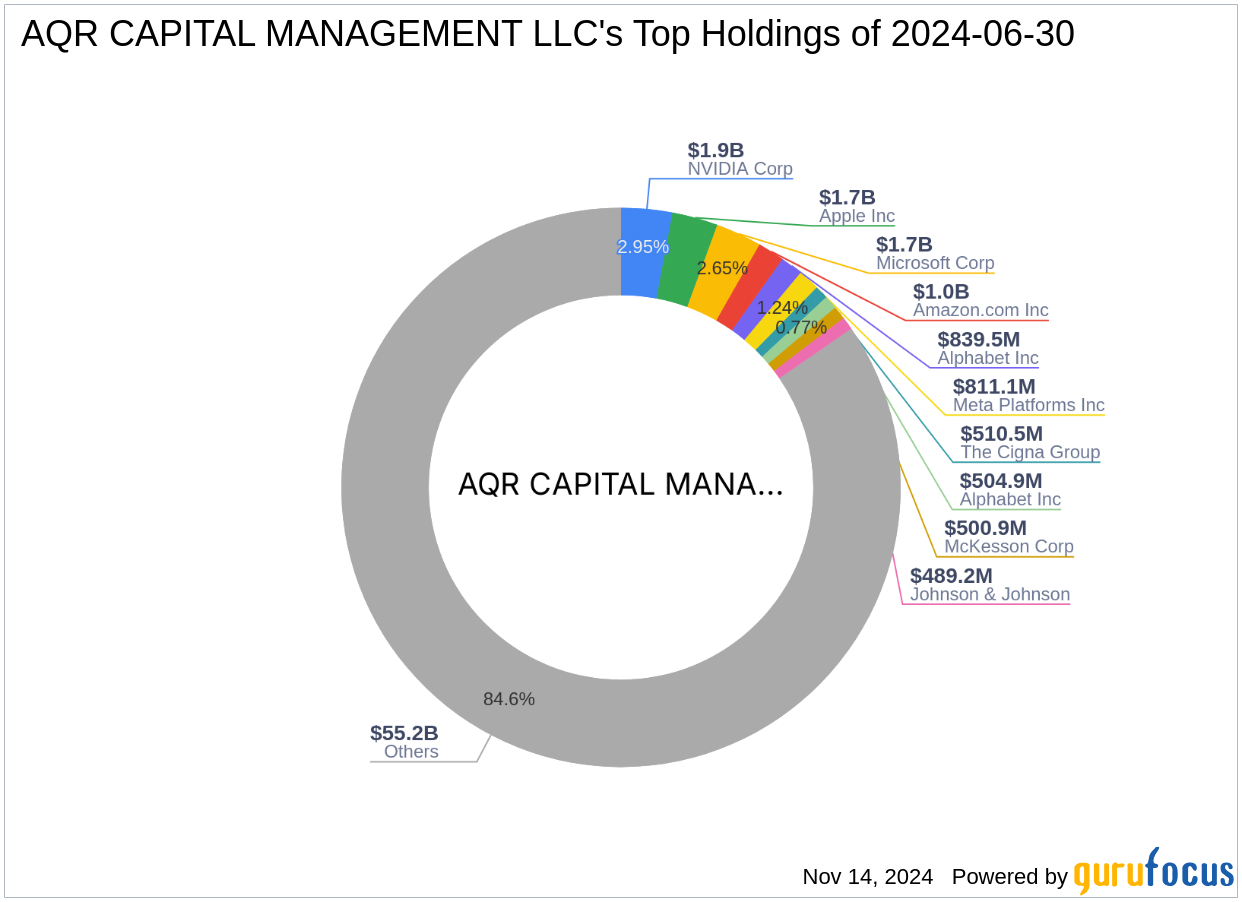

Insight into AQR Capital Management LLC

AQR Capital Management LLC, established in 1998, has grown into a prominent investment management firm with a diverse range of strategies. The firm's approach is deeply rooted in quantitative analysis aimed at isolating significant market factors and enduring rigorous testing. AQR’s broad client base includes pension funds, insurance companies, and sovereign wealth funds, among others. With a robust team of over 500 employees, the firm manages assets worth approximately $132 billion as of 2015.

Alchemy Investments Acquisition Corp 1 at a Glance

Alchemy Investments Acquisition Corp 1, a blank check company based in the USA, was established with the purpose of effectuating mergers, capital stock exchanges, asset acquisitions, stock purchases, and reorganizations. Since its IPO on June 26, 2023, ALCY has shown a modest stock price increase of 9.85% and a year-to-date performance improvement of 7.96%. The company currently holds a market capitalization of approximately $168.57 million.

Analysis of the Trade's Impact

The acquisition of ALCY shares by AQR Capital Management LLC is a strategic move, reflecting a minor yet potentially strategic position within their extensive portfolio. The trade's impact, though seemingly small at a 0.01% portfolio influence, aligns with AQR’s history of diversified and quantitative-driven investment decisions. This new holding could be indicative of AQR's confidence in ALCY's future growth or potential market positioning.

Current Market Valuation and Stock Performance

As of the latest data, Alchemy Investments Acquisition Corp 1’s stock price stands at $11.26, marking a 3.59% increase since the acquisition by AQR. Despite the company's low GF Score of 24/100, indicating potential challenges in future performance, the firm’s interest might be driven by specific financial metrics or market opportunities not fully reflected in the GF Score.

Strategic Implications of AQR's Investment in ALCY

The decision by AQR to invest in ALCY could be driven by various strategic considerations, including the potential for significant operational changes or market expansions that ALCY might be planning. This investment aligns with AQR’s methodology of identifying undervalued assets that offer long-term growth prospects, supported by rigorous quantitative analysis.

Conclusion

AQR Capital Management LLC’s recent acquisition of shares in Alchemy Investments Acquisition Corp 1 underscores a strategic addition to its diverse portfolio. While the immediate impact on AQR’s portfolio is minimal, the long-term implications and strategic rationale behind this move reflect AQR’s commitment to data-driven investment decisions. This trade not only diversifies AQR’s holdings but also positions it to potentially capitalize on future growth opportunities within the financial services sector.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.