Overview of the Recent Transaction

On September 30, 2024, Two Seas Capital LP (Trades, Portfolio) made a notable addition to its investment portfolio by acquiring 6,584,278 shares of Esperion Therapeutics Inc (NASDAQ:ESPR). This transaction, executed at a price of $1.65 per share, represents a significant increase in the firm's holdings in the company, boosting its total share count by 848,618. This move has increased the firm's position in Esperion Therapeutics to 3.30% of its total portfolio, marking a substantial commitment to the pharmaceutical company.

Profile of Two Seas Capital LP (Trades, Portfolio)

Two Seas Capital LP (Trades, Portfolio), based at 1 Read Court, New York, NY, operates as a prominent investment firm with a keen focus on value-driven opportunities primarily within the healthcare and utilities sectors. With an equity portfolio valued at $597 million and top holdings in companies like Avadel Pharmaceuticals PLC (AVDL, Financial) and Indivior PLC (INDV, Financial), Two Seas Capital LP (Trades, Portfolio) employs a strategic approach to investment, emphasizing long-term growth and stability across its 19 stock positions.

Introduction to Esperion Therapeutics Inc

Esperion Therapeutics Inc, headquartered in the USA, is a pharmaceutical company dedicated to the development and commercialization of non-statin, oral therapies for individuals with elevated low-density lipoprotein cholesterol (LDL-C). Since its IPO on June 26, 2013, the company has introduced products like NEXLETOL and NEXLIZET, focusing on a single business segment of LDL-C management therapies.

Detailed Analysis of the Trade Impact

The recent acquisition by Two Seas Capital LP (Trades, Portfolio) has not only increased its stake in Esperion Therapeutics but also underscored its confidence in the company's market potential. The trade has a moderate impact of 0.23% on the firm's portfolio, reflecting a strategic rather than speculative investment stance.

Market Performance and Financial Health of Esperion Therapeutics

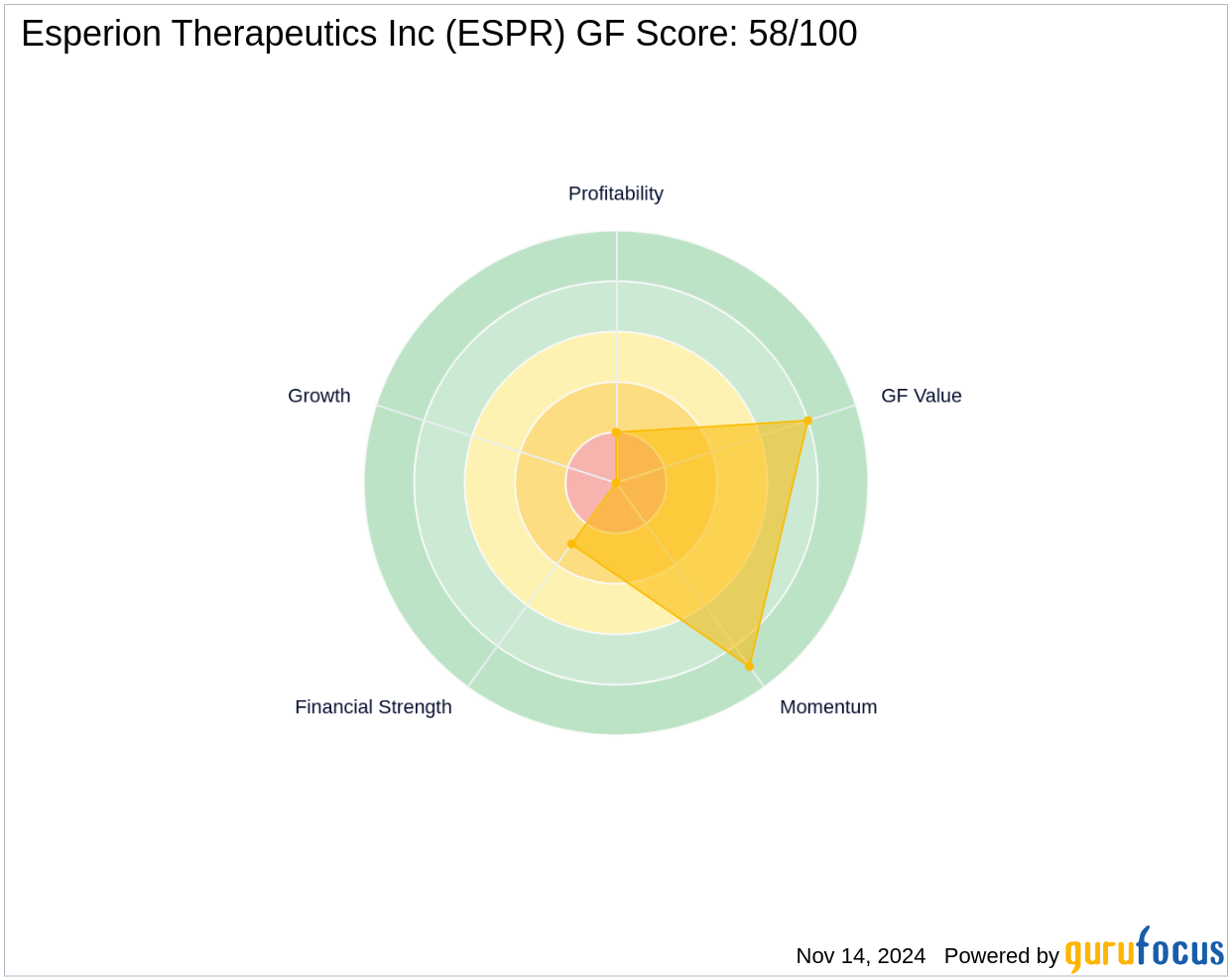

Esperion Therapeutics currently holds a market capitalization of approximately $424.61 million, with a recent stock price of $2.155, which is a 30.61% increase since the transaction date. Despite this positive price movement, the company's GF Score of 58 suggests a cautious outlook on its future performance potential. The firm's financial health, indicated by a Financial Strength rank of 3/10 and a Profitability Rank of 2/10, further emphasizes the need for careful analysis before investment.

Comparative Industry Analysis

Within the Drug Manufacturers industry, Esperion Therapeutics faces stiff competition and challenges, particularly in financial stability and growth metrics. The company's performance ranks lower in several key areas compared to industry peers, necessitating a strategic approach to leverage its specialized product offerings in the competitive market.

Future Outlook and Market Sentiment

The future performance of Esperion Therapeutics' stock appears mixed, with significant risks highlighted by its current valuation status as a "Possible Value Trap" according to GF Valuation. Investors should weigh these risks against the potential for recovery and growth, especially in the evolving pharmaceutical landscape.

Conclusion

The recent acquisition by Two Seas Capital LP (Trades, Portfolio) reflects a calculated enhancement to its portfolio, aligning with its investment philosophy and focus on healthcare. As Esperion Therapeutics continues to navigate the challenges of the pharmaceutical industry, this investment may play a pivotal role in shaping the firm's future financial landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.