Overview of Recent Transaction

On September 30, 2024, Independent Franchise Partners LLP (Trades, Portfolio) made a significant addition to its investment portfolio by acquiring 11,243,085 shares of Fox Corporation (FOX, Financial). This transaction, executed at a price of $38.80 per share, increased the firm's total holdings in Fox Corp to 16,266,915 shares. This move not only reflects a substantial investment but also marks a notable increase in the firm's stake in the media giant, impacting its portfolio by 3.86%.

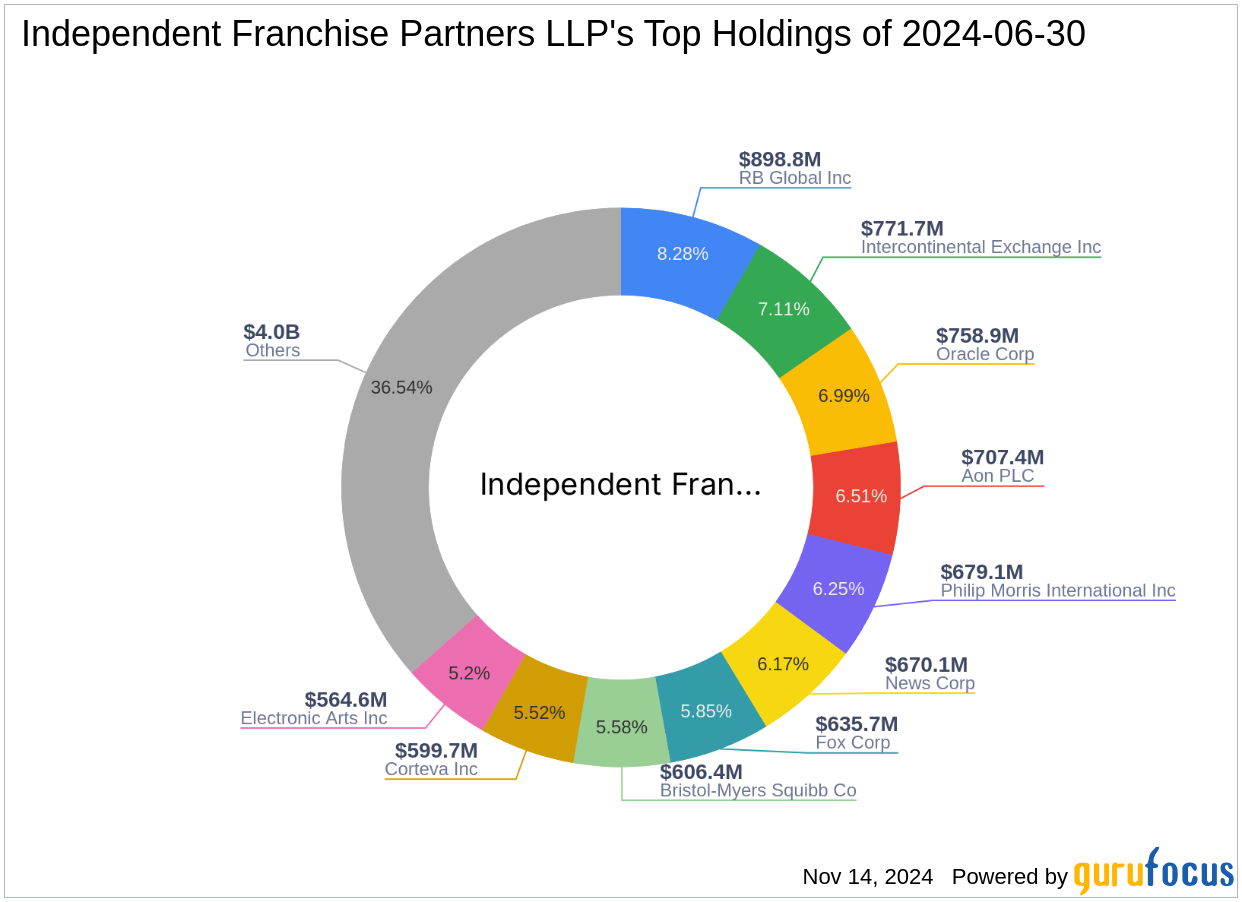

Independent Franchise Partners LLP (Trades, Portfolio): A Profile

Independent Franchise Partners LLP (Trades, Portfolio), established following a spin-off from Morgan Stanley in 2002, is a London-based investment management firm known for its rigorous in-house research and bottom-up investment approach. With a focus on public equity markets globally, the firm benchmarks its performance against major indices like the S&P 500 and MSCI World Index. Specializing primarily in the information technology sector, Independent Franchise Partners also has significant investments in healthcare, consumer staples, and financial services. As of now, the firm manages over $13.5 billion in assets, serving a diverse clientele that includes pension plans and corporate entities.

Impact of the Trade on Portfolio

The recent acquisition of Fox Corp shares has increased Independent Franchise Partners LLP (Trades, Portfolio)’s position in the company to 7.20%, making it a significant stakeholder. This strategic move aligns with the firm's investment philosophy of focusing on value and long-term growth, enhancing its exposure in the communication services sector, which is a top sector in its portfolio alongside financial services.

Insight into Fox Corp

Fox Corp operates primarily through its cable networks and television segments, including prominent names like Fox News and Fox Business. Following the divestiture of its entertainment assets to Disney in 2019, Fox has pivoted to focus on live news and sports content. Controlled by the Murdoch family, Fox Corp has streamlined its operations to leverage its strong presence in the broadcasting sector.

Financial and Market Analysis of Fox Corp

Currently, Fox Corp holds a market capitalization of $20.56 billion with a stock price of $43.45, reflecting an 11.98% increase since the transaction date. The company is rated as modestly overvalued with a GF Value of $36.76. Despite this, Fox shows a strong GF Score of 83/100, indicating good potential for future performance. The firm's financial strength and profitability are solid, with an Profitability Rank of 8/10 and a Piotroski F-Score of 6, suggesting reasonable financial health and operational efficiency.

Comparative and Sector Analysis

Independent Franchise Partners LLP (Trades, Portfolio) is not alone in its bullish stance on Fox Corp. Other major investors include Dodge & Cox and Yacktman Asset Management (Trades, Portfolio), highlighting a consensus of confidence among seasoned investors. This collective interest from prominent firms underscores the strategic importance of Fox within the communication services sector, a key area of focus for Independent Franchise Partners LLP (Trades, Portfolio).

Conclusion

The recent acquisition by Independent Franchise Partners LLP (Trades, Portfolio) is a strategic enhancement to its portfolio, reflecting a deep conviction in Fox Corp's value and growth prospects. This move not only solidifies the firm's position in the media sector but also aligns with its broader investment strategy aimed at long-term capital growth. As Fox continues to adapt and thrive in a dynamic media landscape, this investment may well prove to be a pivotal part of Independent Franchise Partners LLP (Trades, Portfolio)’s portfolio.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: