Overview of the Recent Transaction

Capital World Investors (Trades, Portfolio), a prominent investment firm, has recently adjusted its holdings in Agilon Health Inc (AGL, Financial) by reducing its stake. On September 30, 2024, the firm sold 2,954,215 shares of Agilon Health at a price of $3.93 per share. This transaction decreased the firm's total holdings in Agilon Health to 48,368,009 shares, reflecting a significant shift in its investment strategy with a trade impact of 0% on its portfolio.Capital World Investors (Trades, Portfolio) at a Glance

Located at 333 South Hope Street, Los Angeles, CA, Capital World Investors (Trades, Portfolio) is known for its strategic investment decisions. The firm manages a diverse portfolio across various sectors, with top holdings including Broadcom Inc (AVGO, Financial), Meta Platforms Inc (META, Financial), and Microsoft Corp (MSFT, Financial). With an equity portfolio valued at approximately $644.96 billion, the firm focuses on maximizing long-term capital through a mix of growth and value investments.

Agilon Health Inc: Business and Market Challenges

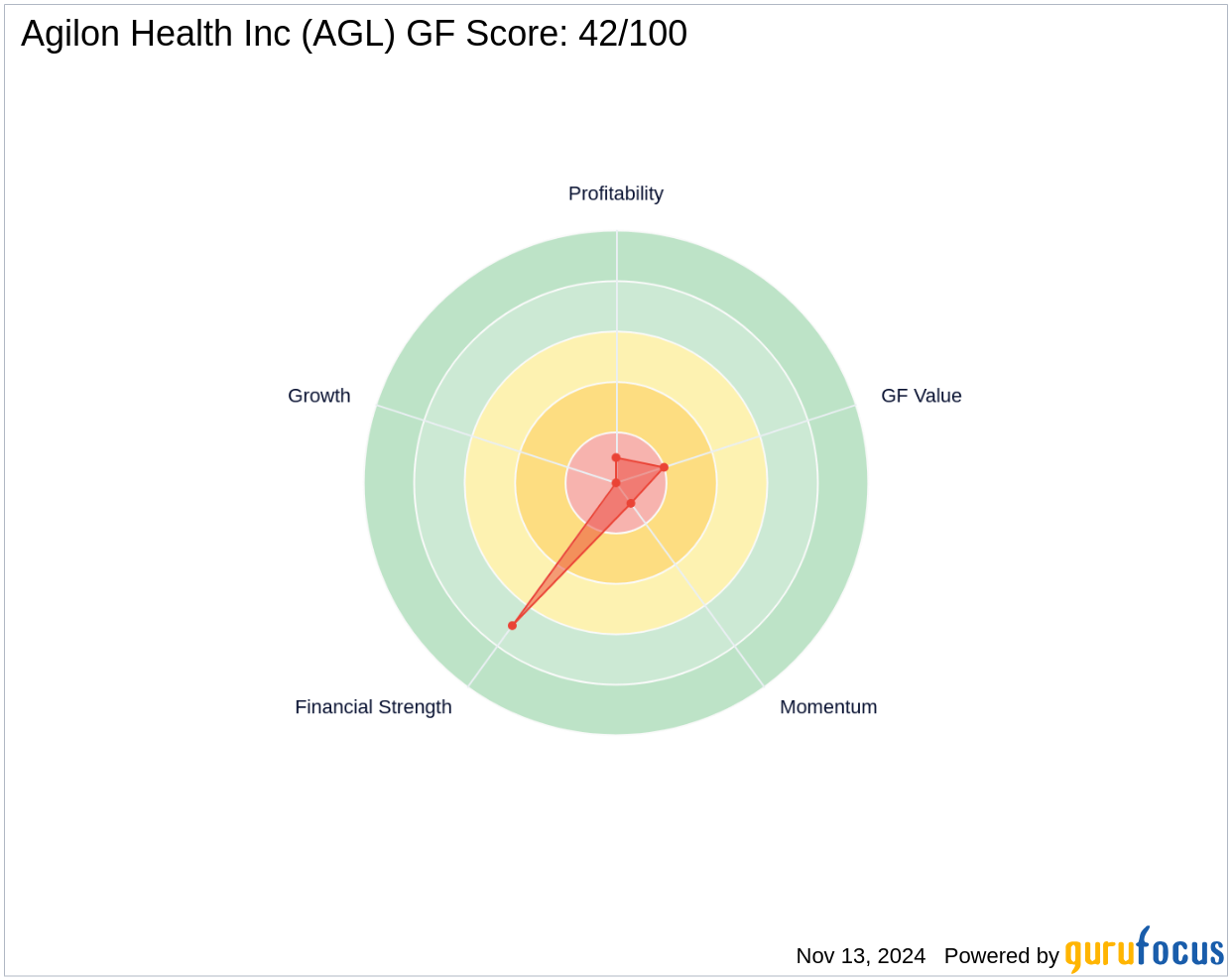

Agilon Health Inc, trading under the symbol AGL, operates within the Healthcare Providers & Services industry, focusing on empowering primary care physicians through Medicare-centric, globally capitated business models. Since its IPO on April 15, 2021, Agilon has faced significant market challenges, reflected in its current stock price of $1.83, a steep decline from its IPO price, indicating a -93.52% change. The company's financial health is concerning, with a GF Score of 42/100, suggesting poor future performance potential.

Impact of the Trade on Capital World Investors (Trades, Portfolio)' Portfolio

The reduction in Agilon Health shares by Capital World Investors (Trades, Portfolio) marks a strategic shift, possibly due to the stock's underperformance and bleak market outlook. Holding 11.80% of its portfolio in Agilon, the firm's decision to reduce its stake could be a move to mitigate risks associated with the stock's declining value and poor financial metrics.Agilon Health's Stock Performance and Financial Health

Agilon Health's performance has been underwhelming with a Year-To-Date price change of -85.85%. The stock's valuation metrics are alarming, with a GF Value of $43.71, suggesting that the stock is currently a possible value trap. This is further compounded by its low profitability and growth ranks, indicating severe underlying issues in its business model and market strategy.Industry and Market Analysis

Within the competitive landscape of Healthcare Providers & Services, Agilon Health struggles to maintain a competitive edge. Its financial strength and profitability are significantly lower than industry standards, which could be a contributing factor to Capital World Investors (Trades, Portfolio)' decision to reduce their investment.Investor Implications

For investors holding or considering an investment in Agilon Health, the recent actions by Capital World Investors (Trades, Portfolio) might serve as a critical indicator of the stock's potential risks. Investors should consider the firm’s trading pattern and the stock's current valuation and performance metrics before making any investment decisions.Conclusion

Capital World Investors (Trades, Portfolio)' recent reduction in Agilon Health Inc shares highlights significant concerns about the company's future performance and market position. This strategic move could have broader implications for the market, signaling caution to other investors about the potential downturns in the Healthcare Providers & Services sector.This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.