Overview of the Recent Transaction

On September 30, 2024, COWEN AND COMPANY, LLC (Trades, Portfolio) made a significant addition to its investment portfolio by acquiring 517,458 shares of SK Growth Opportunities Corp (SKGR, Financial). This move not only reflects the firm's strategic investment approach but also highlights its confidence in SKGR's potential. The transaction was executed at a price of $11.3357 per share, marking a notable development in the firm's trading activities.

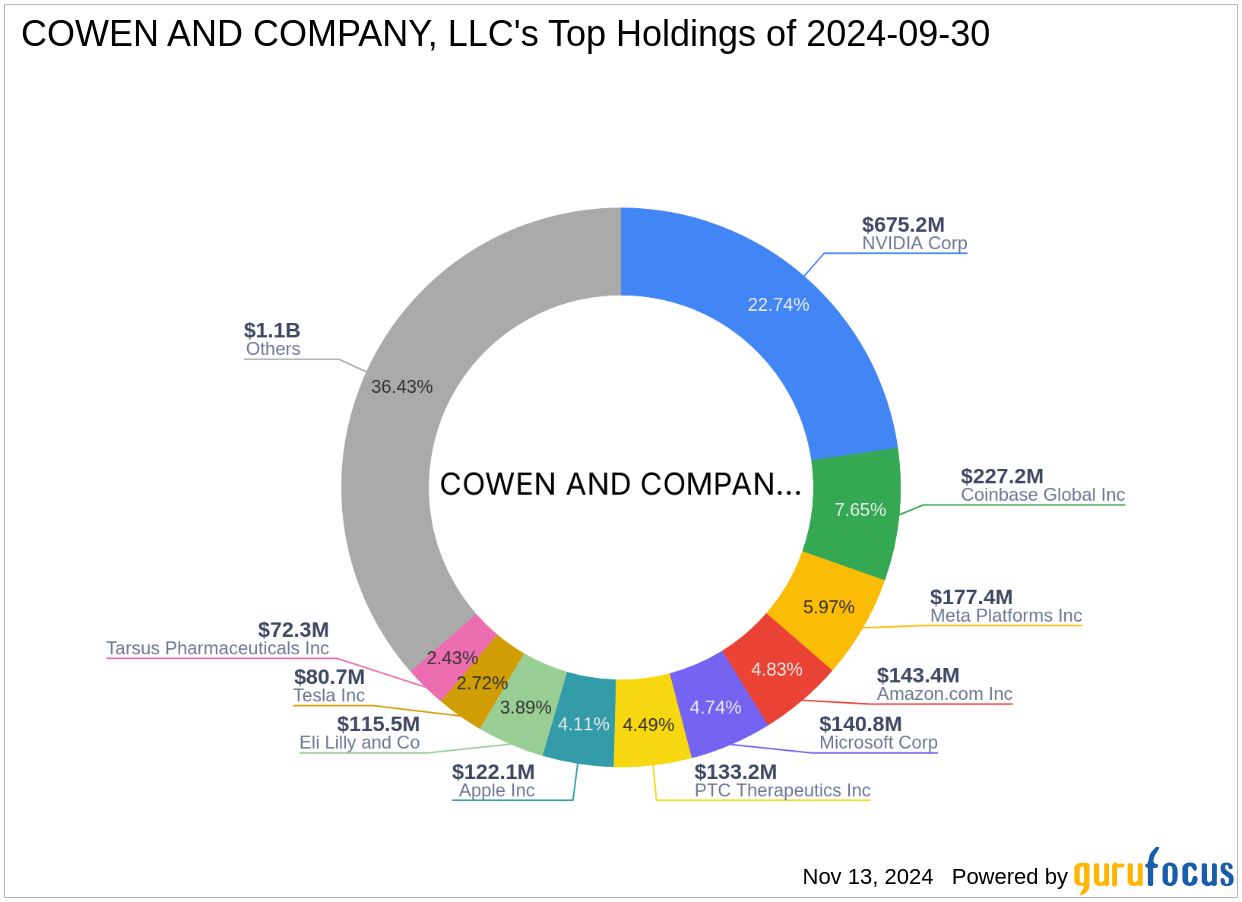

Profile of COWEN AND COMPANY, LLC (Trades, Portfolio)

COWEN AND COMPANY, LLC (Trades, Portfolio), based at 599 Lexington Avenue, New York, NY, is a prominent player in the investment sector, known for its dynamic investment strategies and substantial market influence. With a robust portfolio of $2.97 billion in equity, the firm focuses on technology and financial services sectors, holding major stakes in leading companies like Amazon.com Inc (AMZN, Financial), Meta Platforms Inc (META, Financial), and Microsoft Corp (MSFT, Financial). The firm's investment philosophy is geared towards maximizing returns through strategic market placements and diversified holdings.

Introduction to SK Growth Opportunities Corp

SK Growth Opportunities Corp, a USA-based blank check company, was established with the aim of facilitating mergers, acquisitions, and similar business combinations. Since its IPO on August 15, 2022, SKGR has been actively exploring opportunities to enhance shareholder value. Despite being a relatively new market player, the company has managed to maintain a market capitalization of approximately $176.064 million.

Detailed Analysis of the Trade Action

The recent acquisition by COWEN AND COMPANY, LLC (Trades, Portfolio) involved an increase of 257,352 shares in SKGR, reflecting a 98.94% change in their previous holdings. This strategic move has increased the firm's stake in SKGR to 5.30% of their total portfolio, with a modest trade impact of 0.08%. The firm's decision to bolster its position in SKGR underscores a calculated approach to tapping into the company's growth trajectory.

Market Impact and Stock Performance

Following the transaction, SK Growth Opportunities Corp's stock price saw a slight increase of 1.54%, indicating a positive market reception. The stock has experienced a 16.5% increase since its IPO and a 6.28% rise year-to-date. These metrics suggest a growing investor confidence and a potentially bright future for SKGR in the financial markets.

Financial Health and Growth Metrics

Despite its nascent stage, SKGR shows a ROE of 3.53% and an ROA of 3.20%, placing it at ranks 93 and 72 respectively. However, the company's growth metrics such as the GF Score of 23/100 and a Piotroski F-Score of 2 indicate challenges in profitability and financial stability. The firm's cash to debt ratio stands at a low 0.02, reflecting potential liquidity risks.

Sector and Market Analysis

COWEN AND COMPANY, LLC (Trades, Portfolio)'s focus on technology and financial services sectors aligns with its investment in SKGR, which operates within the diversified financial services industry. These sectors have shown resilience and growth, making them attractive for strategic investments.

Future Outlook and Implications

The acquisition of SKGR shares by COWEN AND COMPANY, LLC (Trades, Portfolio) could signal a bullish outlook on the company's merger and acquisition prospects. For investors, this move might indicate a potential uplift in SKGR's market performance, driven by strategic business combinations and growth initiatives in the coming years.

This analysis not only sheds light on the transaction's implications for both COWEN AND COMPANY, LLC (Trades, Portfolio) and SK Growth Opportunities Corp but also provides investors with critical insights into the evolving market dynamics.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.