On November 12, 2024, Greenoaks Capital Partners LLC (Trades, Portfolio) made a significant addition to its investment portfolio by acquiring 2,250,199 shares of Coupang Inc (CPNG, Financial), South Korea's largest e-commerce platform. This transaction increased Greenoaks' total holdings in the company to 52,994,063 shares, marking a substantial endorsement of Coupang’s market position and business model.

Insight into Greenoaks Capital Partners LLC (Trades, Portfolio)

Based in San Francisco, Greenoaks Capital Partners LLC (Trades, Portfolio) is renowned for its strategic investments primarily in the technology and consumer cyclical sectors. With a portfolio that includes top holdings such as Carvana Co (CVNA, Financial) and Sea Ltd (SE, Financial), the firm manages an equity portfolio valued at approximately $1.49 billion. Greenoaks’ investment philosophy focuses on long-term growth and innovation-driven companies, making its increased stake in Coupang a fitting addition to its investment strategy.

Overview of Coupang Inc

Coupang Inc, listed under the symbol CPNG, operates South Korea's premier e-commerce platform. Since its IPO on March 11, 2021, the company has expanded its services beyond traditional e-commerce to include logistics, online grocery delivery, and even luxury goods. Despite its broad operational base, Coupang is headquartered in the USA and has a market capitalization of $44.09 billion as of the latest data.

Financial and Market Performance of Coupang Inc

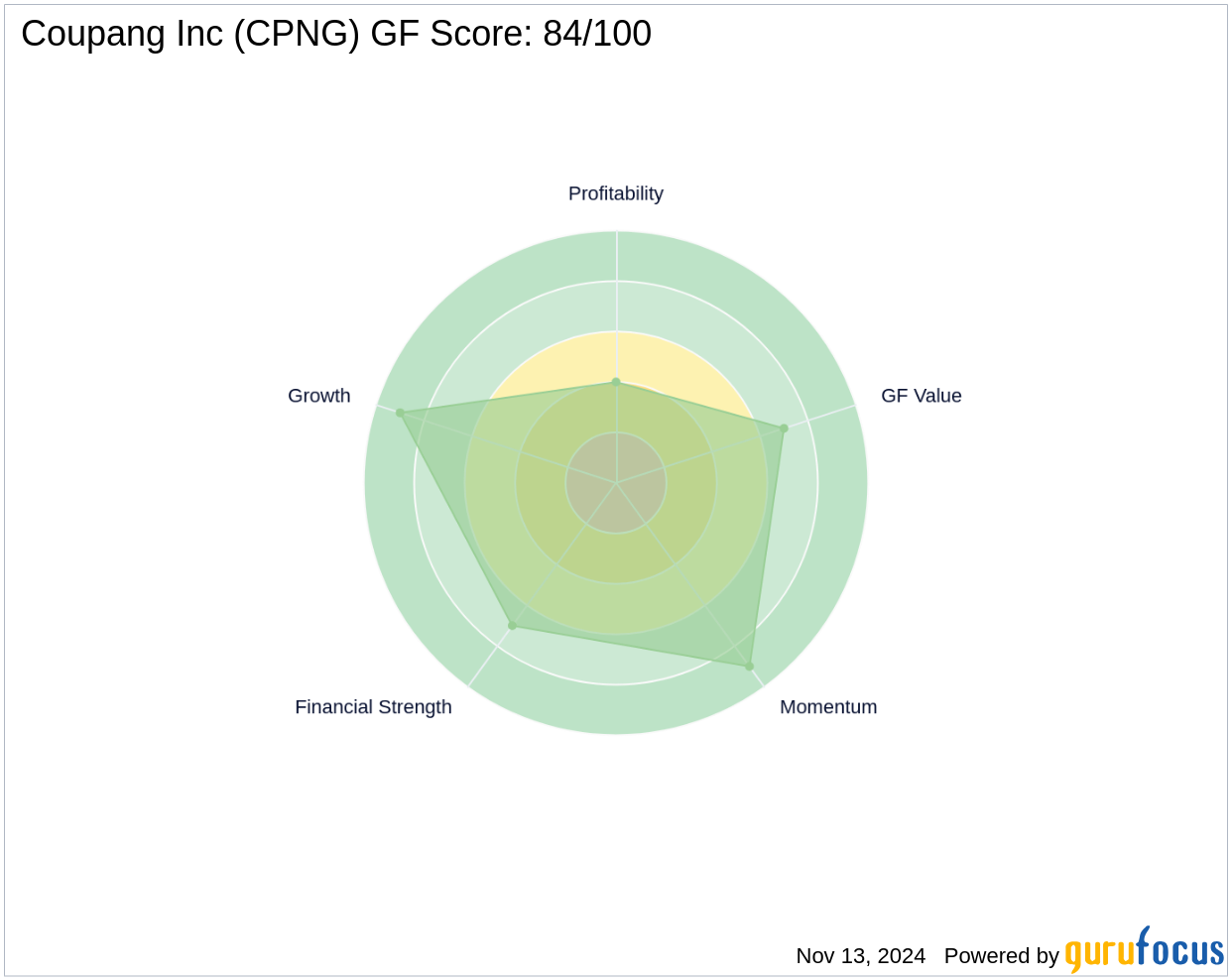

Coupang's stock is currently priced at $24.51, closely aligning with its GF Value of $23.12, indicating the stock is fairly valued. The company holds a GF Score of 84/100, suggesting a strong potential for future performance. Despite a challenging past with a price decline of 61.4% since its IPO, Coupang has shown a remarkable year-to-date increase of 55.82% in its stock price.

Strategic Impact of the Transaction on Greenoaks' Portfolio

The recent acquisition has significantly impacted Greenoaks' portfolio, with Coupang now constituting 83.57% of its total investments. This move not only underscores Greenoaks' confidence in Coupang but also highlights the strategic importance of e-commerce and technology within its investment focus. The firm's position in Coupang has increased to 2.95%, reflecting a deeper commitment to the company's growth trajectory.

Comparative Analysis with Other Major Investors

Greenoaks is not alone in its bullish outlook on Coupang. Other notable investors include Dodge & Cox, Bill Gates (Trades, Portfolio), and Ron Baron (Trades, Portfolio), each maintaining significant stakes in the company. This collective confidence from top investors further validates the potential seen in Coupang’s business model and market strategy.

Future Outlook and Market Potential

Looking ahead, Coupang's innovative approach to e-commerce and expansion into new service areas like luxury goods and international markets positions it well for sustained growth. Analysts remain optimistic about its ability to navigate market challenges and capitalize on increasing digital sales trends in South Korea and beyond.

Conclusion

In conclusion, Greenoaks Capital Partners LLC (Trades, Portfolio)'s recent investment in Coupang Inc reflects a strategic alignment with the firm's long-term growth objectives, particularly in the technology and consumer sectors. This transaction not only enhances Greenoaks' portfolio but also supports Coupang’s continuing expansion and innovation in the e-commerce industry. As the market evolves, this partnership is poised to reap significant benefits, underscoring the potential for substantial returns on investment.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.