Planet 13 Holdings Inc (PLNH, Financial) released its 8-K filing on November 8, 2024, detailing its financial results for the third quarter ended September 30, 2024. The company, a vertically-integrated cannabis operator based in Nevada, focuses on enhancing the cannabis shopping experience and optimizing cultivation efficiencies.

Q3 2024 Financial Highlights

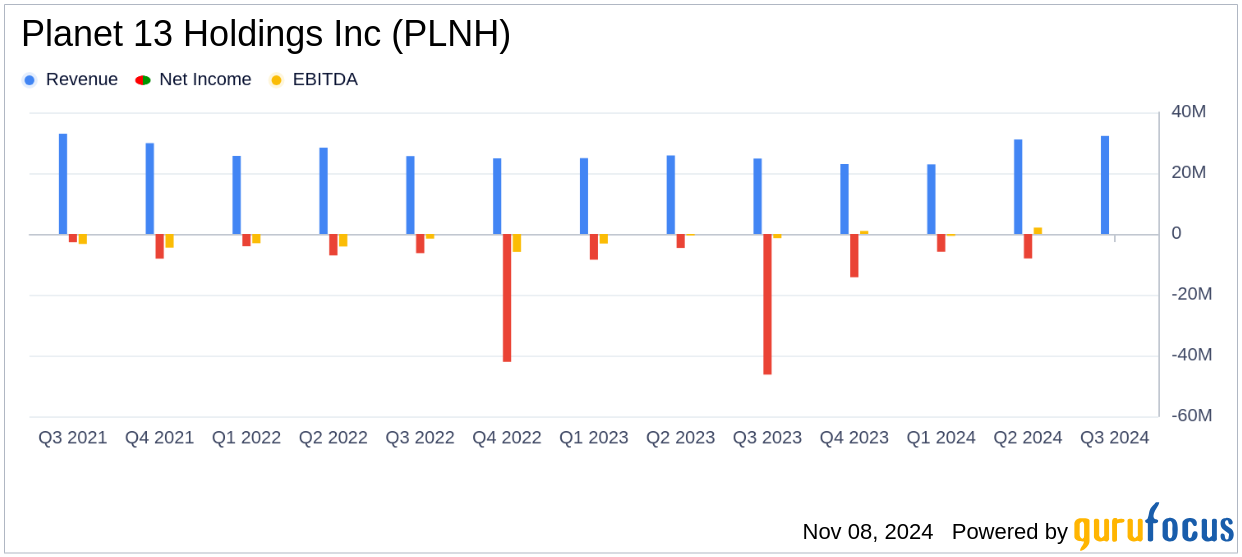

Planet 13 Holdings Inc reported a total revenue of $32.2 million for Q3 2024, marking a 29.7% increase from the $24.8 million reported in the same period last year. This figure falls short of the analyst estimate of $37.46 million. The company's gross profit also saw a significant rise, reaching $16.7 million, up 50.8% from the previous year's $11.1 million, with a gross profit margin of 51.9%.

Operational Challenges and Strategic Focus

Despite facing seasonal headwinds in Florida and ongoing consumer spending pressures, Planet 13 is strategically expanding its store footprint and enhancing cultivation assets. Co-CEO Larry Scheffler emphasized the company's growth initiatives, stating,

Despite Florida not moving forward with adult-use, we see a significant growth runway by expanding our store footprint and enhancing cultivation assets in the state."Co-CEO Bob Groesbeck added,

Our focus remains on delivering a one-of-a-kind shopping experience for the consumer, making thoughtful investments and most importantly, prioritizing cash flow."

Financial Achievements and Industry Context

Planet 13's financial achievements are noteworthy in the context of the cannabis industry, where optimizing operational efficiencies and expanding market presence are crucial. The company's adjusted EBITDA improved significantly to $1.3 million from $0.2 million in the previous year, reflecting a 509.0% increase. This improvement underscores the company's efforts to enhance profitability and operational efficiency.

Income Statement and Balance Sheet Insights

The income statement reveals a net loss of $7.4 million, a substantial improvement from the $46.3 million loss reported in Q3 2023. Operating expenses decreased dramatically by 66.4%, contributing to the improved financial performance. On the balance sheet, total assets increased to $242.96 million from $151.75 million at the end of 2023, with significant growth in intangible assets and goodwill.

| Metric | Q3 2024 | Q3 2023 | % Change |

|---|---|---|---|

| Total Revenue | $32.2 million | $24.8 million | 29.7% |

| Gross Profit | $16.7 million | $11.1 million | 50.8% |

| Net Loss | $(7.4) million | $(46.3) million | -84.0% |

| Adjusted EBITDA | $1.3 million | $0.2 million | 509.0% |

Analysis and Future Outlook

Planet 13 Holdings Inc's Q3 2024 results demonstrate resilience and strategic foresight in a challenging market environment. The company's focus on expanding its retail footprint and enhancing product offerings positions it well for future growth. With a strong balance sheet and multiple growth opportunities, Planet 13 is poised to capitalize on the evolving cannabis market dynamics.

For more detailed financial information, investors are encouraged to review the company's investor relations page.

Explore the complete 8-K earnings release (here) from Planet 13 Holdings Inc for further details.