Overview of the Recent Transaction

On September 30, 2024, MMCAP International Inc. SPC (Trades, Portfolio), a notable investment firm, strategically increased its stake in Cardiol Therapeutics Inc. (CRDL, Financial) by purchasing an additional 1,471,500 shares. This transaction, executed at a price of $1.98 per share, has significantly impacted MMCAP's portfolio, raising its total holdings in Cardiol Therapeutics to 2,395,625 shares. This move not only increased the firm's position in the company to 3.34% but also adjusted its portfolio weight to 0.66%.

Profile of MMCAP International Inc. SPC (Trades, Portfolio)

MMCAP International Inc. SPC (Trades, Portfolio) operates from its base in Grand Cayman, focusing on diversified investment strategies. The firm's investment philosophy emphasizes strategic acquisitions across various sectors, with a notable concentration in Energy and Financial Services. Among its top holdings are Uranium Energy Corp (UEC, Financial), Ur-Energy Inc (URG, Financial), and NexGen Energy Ltd (NXE, Financial), highlighting its preference for robust, market-leading companies.

Insight into Cardiol Therapeutics Inc.

Cardiol Therapeutics Inc., based in Canada, is a clinical-stage biopharmaceutical company dedicated to developing innovative therapies for heart diseases. Its flagship product, CardiolRx, is under clinical trials aimed at addressing acute myocarditis and recurrent pericarditis. Despite its pioneering potential, the company's market capitalization stands at approximately $153.33 million, reflecting the high-risk, high-reward nature typical of the biopharmaceutical sector.

Analysis of the Trade's Impact

The recent acquisition by MMCAP International Inc. SPC (Trades, Portfolio) is poised to have a substantial influence on its investment portfolio. By increasing its stake in Cardiol Therapeutics, MMCAP has not only underscored its confidence in Cardiol's future prospects but also strategically positioned itself to benefit from potential market gains following successful clinical outcomes or strategic partnerships that may arise.

Cardiol Therapeutics' Market and Financial Performance

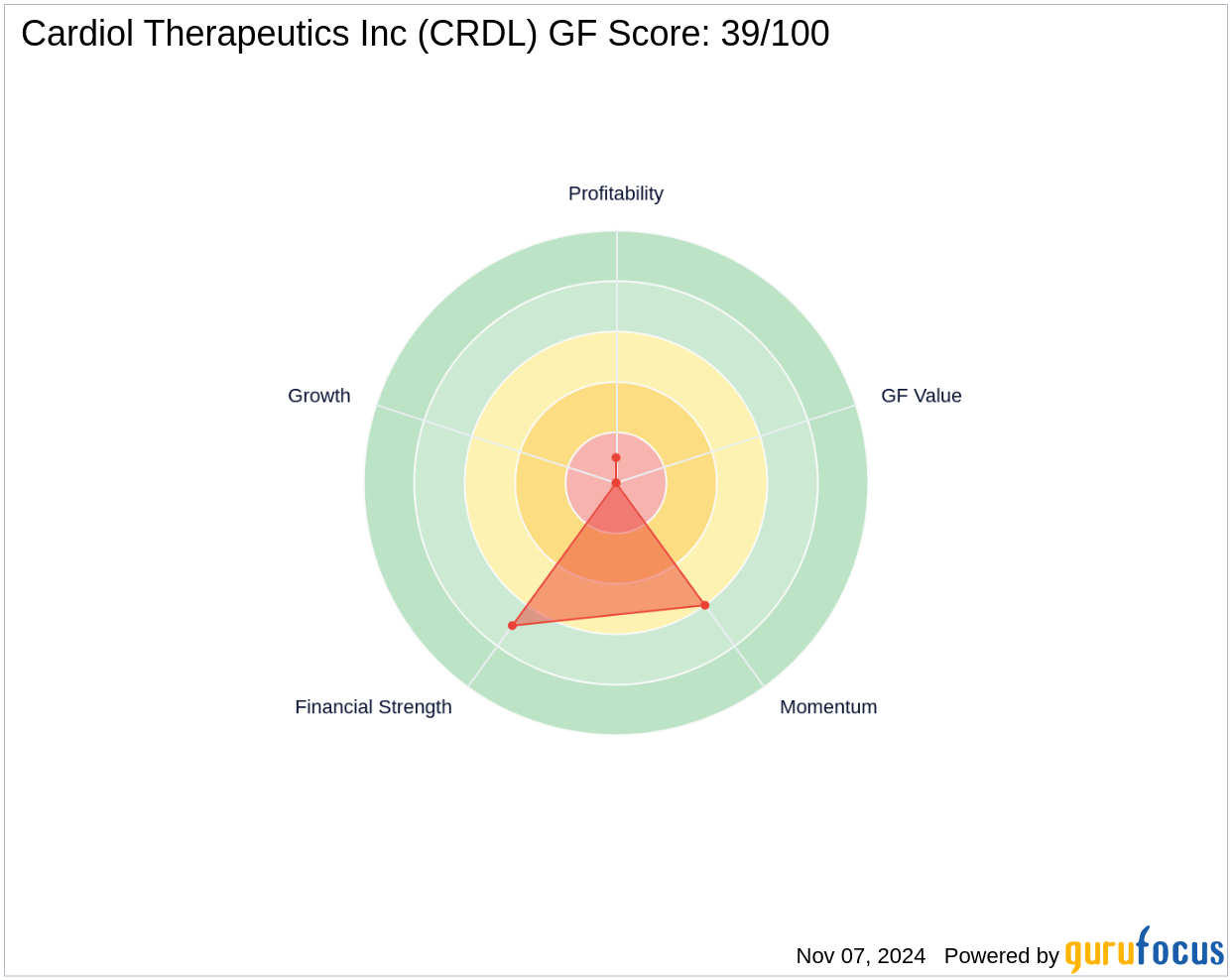

Currently, Cardiol Therapeutics' stock price stands at $1.935, marking a slight decrease since the transaction date. The company's financial health, as indicated by a Financial Strength rank of 7/10, suggests a robust balance sheet, primarily bolstered by a high cash-to-debt ratio of 145.58. However, its profitability remains a concern, with a Profitability Rank of 1/10 and ongoing losses impacting its return metrics.

Strategic Importance of the Transaction

The decision by MMCAP to bolster its position in Cardiol Therapeutics is likely driven by the firm's assessment of Cardiol's unique positioning within the biopharmaceutical industry and its potential to disrupt traditional heart disease treatments. This move could be seen as a strategic play to leverage upcoming market dynamics as Cardiol progresses through its clinical trials.

Sector and Market Analysis

The Drug Manufacturers industry, particularly in the biopharmaceutical sector, is known for its high volatility and substantial growth potential. Cardiol Therapeutics, with its innovative approach to heart disease treatment, represents a typical example within this sector, facing both significant challenges and opportunities.

Future Outlook and Implications

The investment by MMCAP International Inc. SPC (Trades, Portfolio) in Cardiol Therapeutics could yield significant returns, especially if Cardiol's clinical trials prove successful. For MMCAP, this transaction not only diversifies its portfolio but also aligns with its strategy of investing in companies with groundbreaking potential. For the broader market and other investors, this move highlights areas within the biopharmaceutical sector that are ripe for investment, despite inherent risks.

This analysis reflects data accurate as of November 7, 2024, and incorporates all relevant market dynamics and company-specific developments up to this date.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.