Overview of Invesco Ltd. (Trades, Portfolio)'s Recent Trade

In a notable move within the investment community, Invesco Ltd. (Trades, Portfolio) has recently adjusted its holdings in Nu Skin Enterprises Inc. (NUS, Financial) by reducing its position. On September 30, 2024, the firm executed a sale of 458,627 shares, resulting in a new total of 84,815 shares held. This transaction, carried out at a price of $7.37 per share, reflects a strategic decision by Invesco, although it had a minimal immediate impact on the firm's portfolio, maintaining a 0.20% position.

Insight into Invesco Ltd. (Trades, Portfolio)

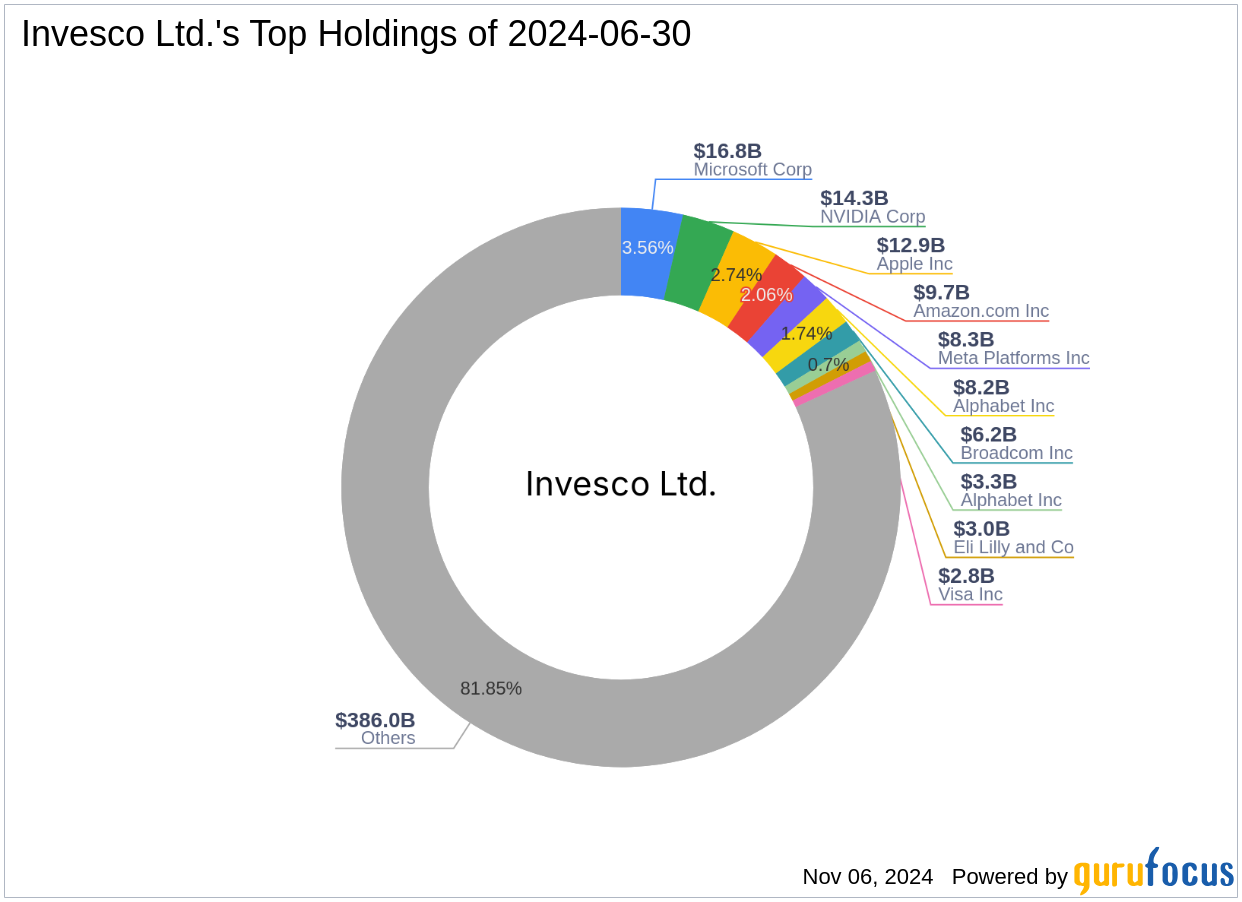

Founded in 1935 and evolving through a series of global expansions and acquisitions, Invesco Ltd. (Trades, Portfolio) has established itself as a major player in the investment management industry. With a diverse range of products including mutual funds and ETFs under brands like Powershares, Invesco manages assets worldwide. The firm's investment philosophy focuses on delivering high-quality, long-term returns to its investors. As of now, Invesco holds a substantial equity of $471.65 billion, predominantly in the technology and financial services sectors, with top holdings in major corporations such as Apple Inc and Microsoft Corp.

Nu Skin Enterprises Inc. at a Glance

Nu Skin Enterprises, based in the USA, operates as a direct-selling company focused on beauty and wellness products. Since its IPO in 1996, the company has expanded its reach to over 50 countries. Despite its broad international presence, Nu Skin's financial metrics indicate challenges, with a current market capitalization of $315.11 million and a concerning GF Value suggesting a potential value trap. The stock's performance has been underwhelming, with significant declines in its year-to-date and since-IPO valuations.

Market Context and Trade Impact

The timing of Invesco's reduction in Nu Skin shares coincides with a period of volatility for Nu Skin, marked by a 13.98% decrease in stock price since the transaction. This move by Invesco could be interpreted as a response to the ongoing financial struggles and market performance of Nu Skin, aligning with a more cautious investment strategy amidst uncertain market conditions.

Comparative Analysis with Other Major Investors

While Invesco has reduced its stake, other significant investors like Hotchkis & Wiley Capital Management LLC and Barrow, Hanley, Mewhinney & Strauss maintain their positions in Nu Skin. This divergence in strategy highlights differing investor confidence and market outlooks regarding Nu Skin's future.

Future Outlook and Strategic Implications

The future of Nu Skin remains uncertain with its current financial health and market trends pointing towards continued challenges. For value investors, Invesco’s decision to reduce its stake might serve as a critical indicator of the need for cautious assessment regarding Nu Skin’s viability as a profitable investment. Investors are advised to closely monitor Nu Skin’s performance and potential strategic adjustments that might influence its market position.

In conclusion, Invesco Ltd. (Trades, Portfolio)'s recent transaction involving Nu Skin shares reflects a strategic repositioning that could influence investor perceptions and decisions in the broader market. As market conditions evolve, the implications of such moves will be critical for shaping investment strategies in the consumer packaged goods sector.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.