Matterport Inc (MTTR, Financial), a pioneering firm in the software industry, has recently witnessed a significant upsurge in its stock price. Over the past week alone, the company's shares have climbed by 2.85%, and over the last three months, they have skyrocketed by an impressive 83.41%. Currently, the market capitalization stands at $1.35 billion with a stock price of $4.29. According to the GF Value, which is pegged at $4.04, Matterport is considered fairly valued. This valuation suggests that the stock price is aligned with the company's intrinsic value, calculated based on historical multiples, past performance adjustments, and future business estimates.

Company Overview

Matterport Inc specializes in spatial data, offering a comprehensive platform that enables the creation of digital twins of physical spaces. These digital twins are utilized across various sectors for design, construction, operation, promotion, and analysis purposes. The majority of Matterport's revenue stems from subscription fees, which customers pay to access its innovative platform. This business model has positioned Matterport as a key player in the digital transformation of physical spaces.

Assessing Profitability

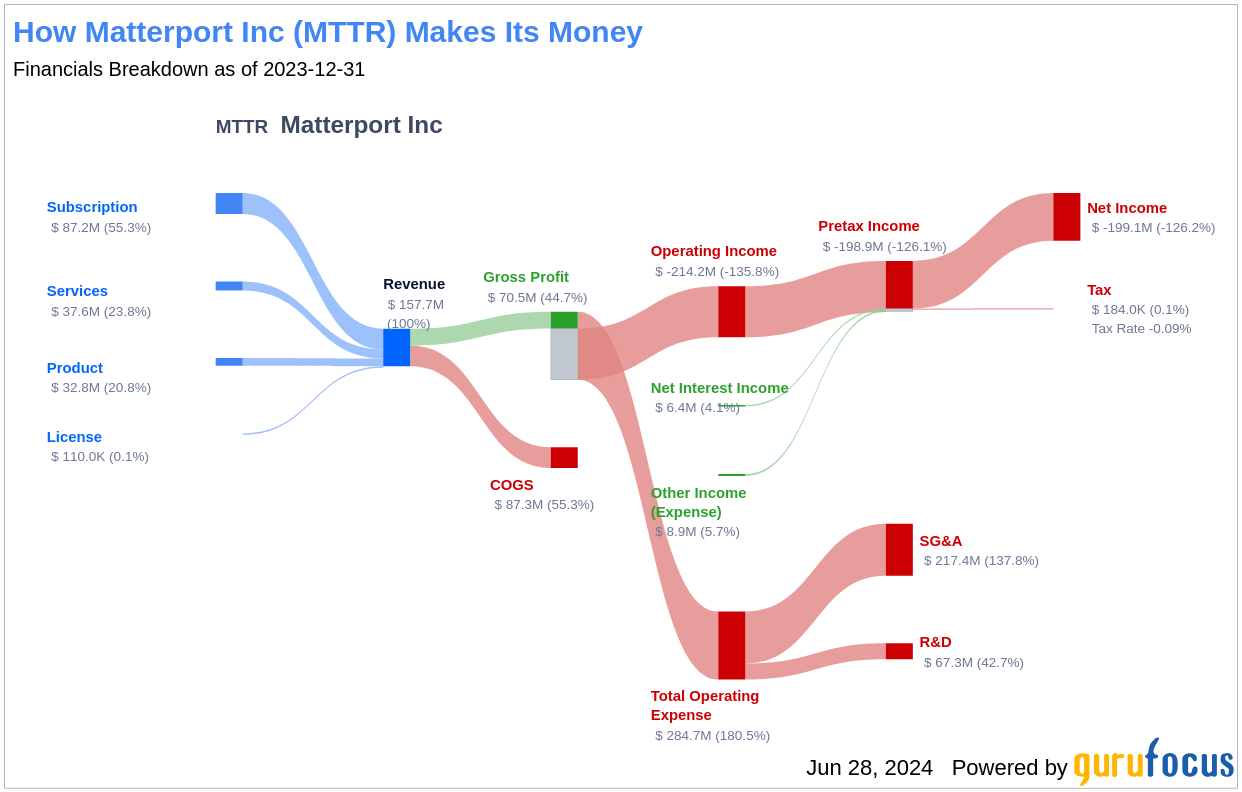

Despite its innovative product offerings, Matterport's financial health, as indicated by its Profitability Rank, remains low at 2 out of 10. The company's Operating Margin is currently at -124.18%, which, although better than 8.83% of its peers, highlights significant losses relative to its revenues. Furthermore, its Return on Equity (ROE) and Return on Assets (ROA) stand at -33.41% and -30.60% respectively, indicating that the firm is not generating positive returns on shareholder equity or assets. The Return on Invested Capital (ROIC) is also deeply negative at -106.43%. These figures suggest that while Matterport is growing, it is doing so at a costly rate to its profitability.

Growth Trajectory

In terms of growth, Matterport demonstrates more promising figures. The company's 3-Year Revenue Growth Rate per Share is 13.90%, which is better than 61.59% of its industry counterparts. Looking ahead, the Total Revenue Growth Rate (Future 3Y to 5Y Est) is projected at 12.16%, suggesting that revenue growth is expected to continue. However, the 3-Year EPS without NRI Growth Rate is -56.00%, indicating challenges in achieving profitability despite revenue increases.

Notable Investors

Several prominent investors have taken positions in Matterport, reflecting confidence in its potential. Steven Cohen (Trades, Portfolio) holds 571,965 shares, representing 0.18% of the company, while Jim Simons and Louis Moore Bacon (Trades, Portfolio) hold smaller stakes. These investments by well-known figures in the financial world may offer some reassurance to other investors about the company's future prospects.

Competitive Landscape

Matterport operates in a competitive environment with firms like Cerence Inc (CRNC, Financial), PubMatic Inc (PUBM, Financial), and Riskified Ltd (RSKD, Financial) also vying for market share. These companies, with market caps ranging from $119.898 million to $1.1 billion, represent significant competition but also highlight the diverse range of companies thriving in the software industry.

Conclusion

While Matterport Inc has shown impressive stock price gains and solid revenue growth prospects, its profitability metrics pose a challenge. The company's ability to improve its bottom line, coupled with its innovative technology and strategic investor backing, will be crucial in maintaining its competitive edge and ensuring long-term growth. As it stands, Matterport offers a unique investment opportunity within the tech space, particularly for those who believe in the potential of digital spatial data.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.