On May 30, 2024, Elastic NV (ESTC, Financial) released its 8-K filing detailing the financial results for its fourth quarter and full fiscal year ended April 30, 2024. Elastic, a software company based in Mountain View, California, focuses on search-adjacent products, enabling enterprises to process and glean insights from both structured and unstructured data. The company's primary focus areas include enterprise search, observability, and security.

Q4 and FY24 Financial Highlights

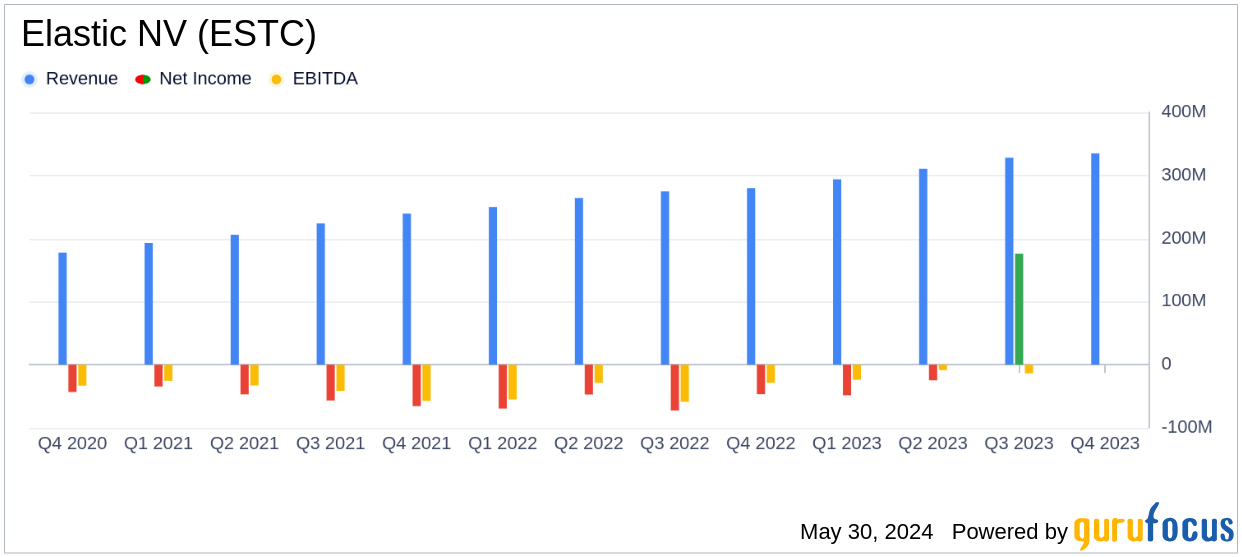

Elastic NV reported a total revenue of $335 million for Q4 FY24, marking a 20% year-over-year increase, surpassing the analyst estimate of $329.48 million. Elastic Cloud revenue was particularly strong, reaching $148 million, a 32% year-over-year increase. For the full fiscal year, total revenue was $1.267 billion, up 19% year-over-year.

Despite the revenue growth, the company reported a GAAP operating loss of $46 million for Q4, with a GAAP operating margin of -14%. However, on a non-GAAP basis, the company achieved an operating income of $29 million, translating to a non-GAAP operating margin of 9%. The GAAP net loss per share was $0.41, while the non-GAAP diluted earnings per share stood at $0.21.

Key Metrics and Achievements

Elastic NV's financial achievements are significant in the software industry, where scalability and innovation are crucial. The company's operating cash flow for Q4 was $61 million, with an adjusted free cash flow of $60 million. As of April 30, 2024, Elastic NV held cash, cash equivalents, and marketable securities totaling $1.084 billion.

Key customer metrics also showed positive trends. The total customer count with Annual Contract Value (ACV) greater than $100,000 increased to over 1,330, up from over 1,160 in Q4 FY23. The total subscription customer count reached approximately 21,000, compared to approximately 20,200 in Q4 FY23. The Net Expansion Rate was approximately 110%.

Product Innovations and Business Highlights

Elastic NV introduced several product innovations, including the Search AI Lake, a cloud-native architecture to scale low latency search with AI capabilities. The company also launched the technical preview of Elastic Cloud Serverless for search, observability, and security workloads. Additionally, Elastic announced Attack Discovery, an AI-driven security analytics solution.

Other notable business highlights include being awarded Google Cloud Partner of the Year for the fourth time and being named one of Fast Company's Most Innovative Companies in the enterprise category for the AI-enabled Elasticsearch Relevance Engine.

Financial Statements Overview

| Metric | Q4 FY24 | Q4 FY23 | FY24 | FY23 |

|---|---|---|---|---|

| Total Revenue | $335 million | $280 million | $1.267 billion | $1.069 billion |

| Elastic Cloud Revenue | $148 million | $112 million | $548 million | $424 million |

| GAAP Operating Loss | $(46) million | $(40) million | $(130) million | $(219) million |

| Non-GAAP Operating Income | $29 million | $N/A | $142 million | $N/A |

| GAAP Net Loss per Share | $(0.41) | $(0.48) | $0.59 | $(2.47) |

| Non-GAAP Diluted EPS | $0.21 | $N/A | $1.19 | $N/A |

Analysis and Outlook

Elastic NV's performance in Q4 and FY24 demonstrates robust growth, particularly in its cloud segment, which is crucial for the company's long-term strategy. The increase in customer count and high Net Expansion Rate indicate strong market adoption and customer retention. However, the GAAP operating losses highlight ongoing challenges in managing operational costs and achieving profitability.

Looking ahead, Elastic NV has provided guidance for Q1 FY25, expecting total revenue between $343 million and $345 million, representing 17% year-over-year growth. The company also anticipates a non-GAAP operating margin between 9.2% and 9.4%, and non-GAAP diluted earnings per share between $0.24 and $0.26.

Overall, Elastic NV's financial results and strategic initiatives position the company well for future growth, particularly in the expanding fields of AI and cloud computing. Investors will be keen to see how the company continues to innovate and manage its operational efficiencies in the coming quarters.

Explore the complete 8-K earnings release (here) from Elastic NV for further details.