Recent movements in the stock market have shown a notable decline in the share price of Electronic Arts Inc (EA, Financial), with a daily loss of 3.84% and a three-month downturn of 9.74%. Despite these fluctuations, Electronic Arts reports an Earnings Per Share (EPS) of 4.68. This analysis seeks to determine whether Electronic Arts is modestly undervalued, and if so, what this means for potential investors.

Company Overview

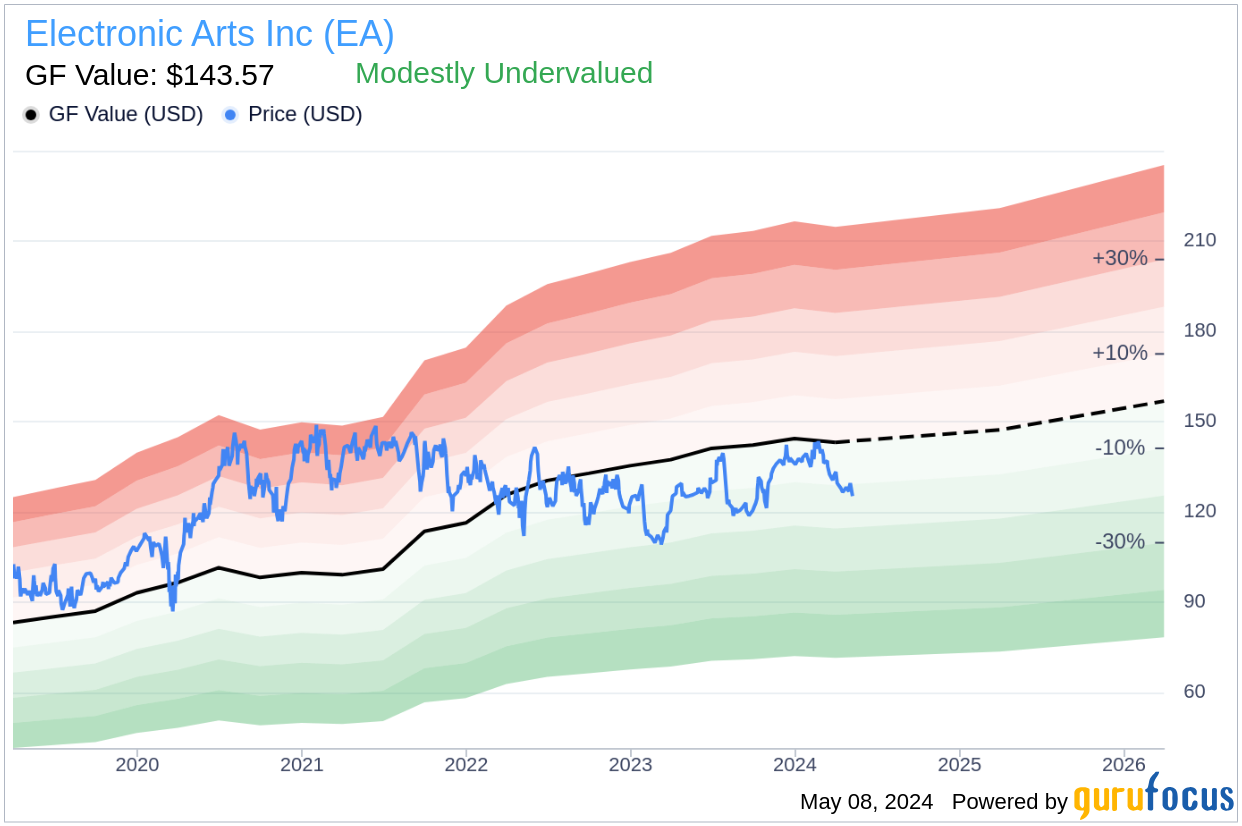

Electronic Arts Inc (EA, Financial) stands as a titan in the video game industry, transitioning from a console-based publisher to a dominant force across consoles, PC, and mobile platforms. The company boasts an impressive portfolio of franchises including Madden, EA Sports FC (formerly FIFA), Battlefield, and Apex Legends. With a current stock price of $125.24, Electronic Arts holds a market cap of $33.50 billion, juxtaposed against a GF Value of $143.57, suggesting a potential undervaluation.

Understanding GF Value

The GF Value is a proprietary measure reflecting the true intrinsic value of a stock, calculated through historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. For Electronic Arts, the GF Value suggests the stock is modestly undervalued. This valuation indicates that the stock's market price is below what it should be, considering the company's financials and market position, potentially signaling a lucrative buying opportunity for investors.

Link: These companies may deliver higher future returns at reduced risk.

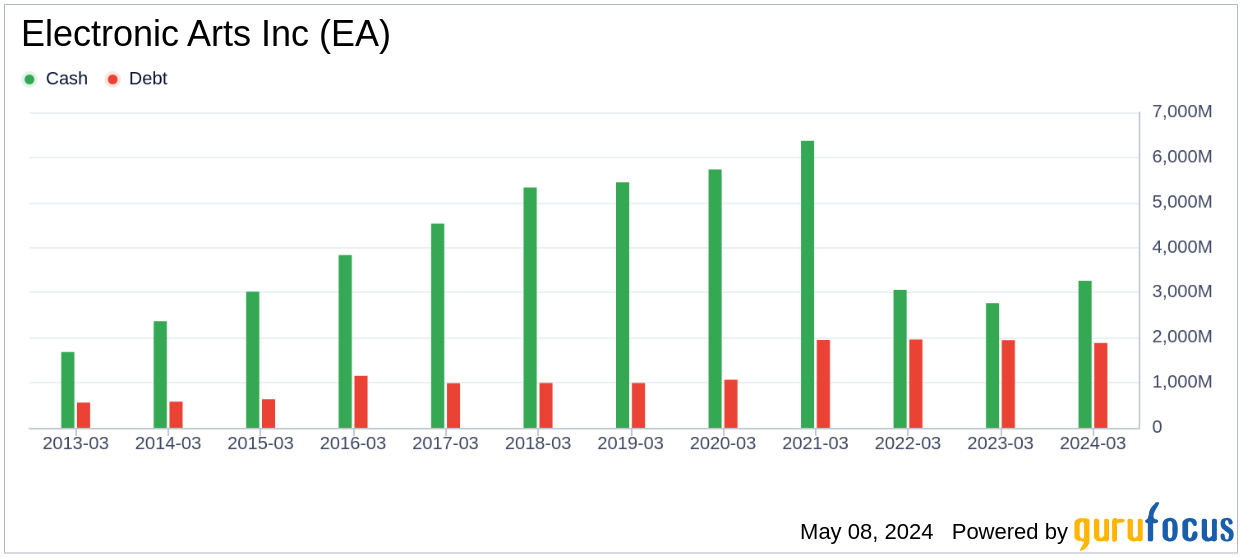

Financial Strength and Stability

Investing in companies with robust financial health reduces the risk of capital loss. Electronic Arts' financial strength is commendable, with a cash-to-debt ratio of 1.59, although this is lower than 65.59% of peers in the Interactive Media industry. The company's overall financial strength has been rated 8 out of 10 by GuruFocus, indicating a strong financial position.

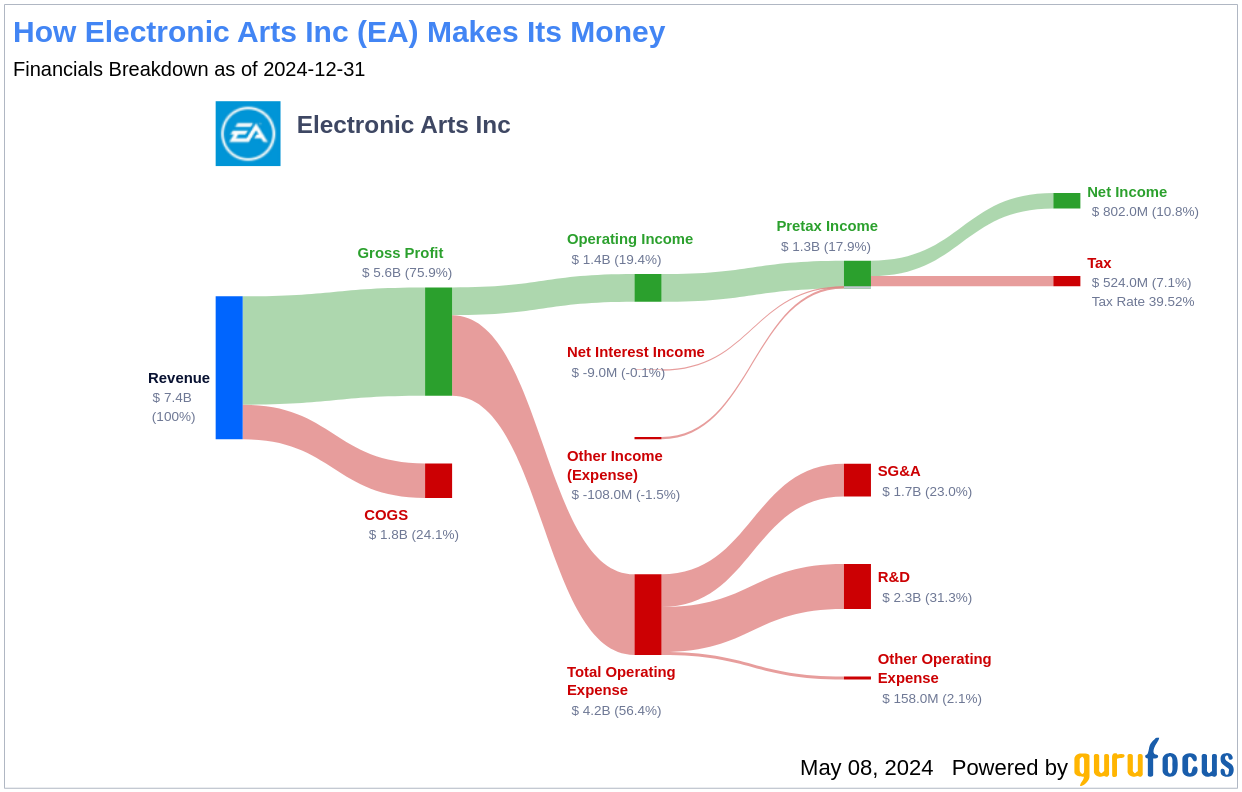

Profitability and Growth Perspectives

Electronic Arts has demonstrated consistent profitability over the past decade, with an impressive operating margin of 20.54%, ranking higher than 83.65% of its industry counterparts. The company's 3-year average annual revenue growth rate stands at 12.5%, showcasing a strong potential for future value creation.

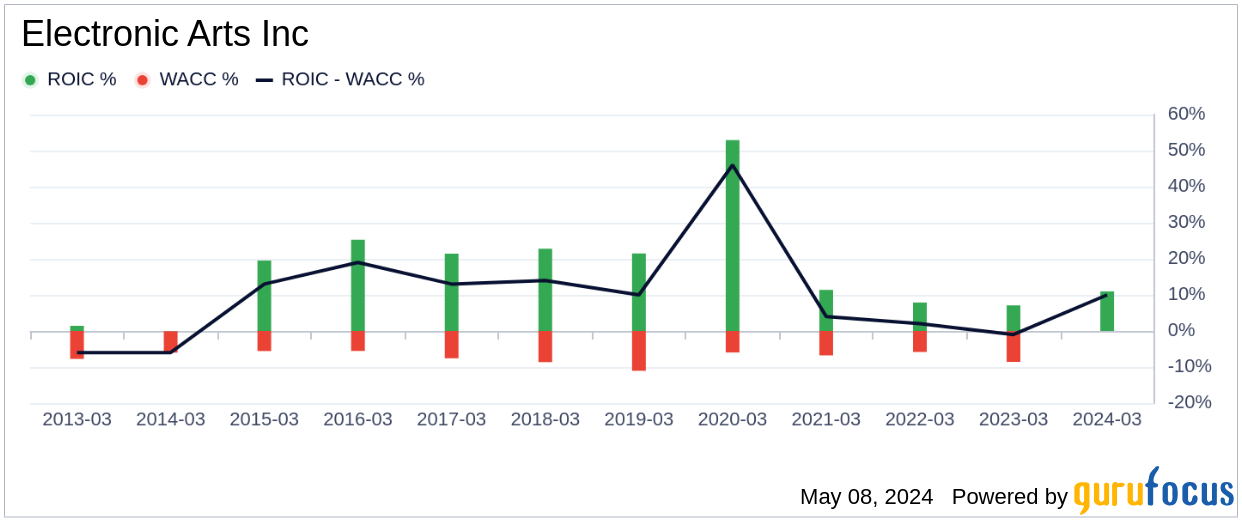

Efficiency in Capital Use

A critical measure of a company's profitability is its efficiency in using capital, indicated by the Return on Invested Capital (ROIC) and compared against the Weighted Average Cost of Capital (WACC). For Electronic Arts, the ROIC is 9.52, slightly higher than its WACC of 9.04, suggesting efficient capital use relative to its cost.

Conclusion

Given its current market valuation, Electronic Arts appears modestly undervalued, offering a potentially attractive opportunity for investors. The company's strong financial foundation and promising growth metrics further bolster this perspective. For more detailed financial insights, interested parties are encouraged to view Electronic Arts' 30-Year Financials here.

To discover other high-quality companies that may deliver above-average returns, please visit the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.