Company History and Business: DirecTV (DTV) is in the business of providing digital television entertainment services in the U.S. as well as Latin America. The two segments, DirecTV U.S. and DirecTV Latin America, provide direct-to-home services and partake in acquiring, selling, promoting and of course distributing digital entertainment programming, mostly through satellite to residential and commercial subscribers.

The company also owns and operates multiple regional sports networks. DTV also currently owns a 60% interest in Game Show Network LLC, which is a cable television network for game-related programming as well as Internet interactive game playing.

Key Historical Dates:

1990: Founded.

1994: Officially launched satellite service, and within four months was available nationwide.

1995: The company obtained its one millionth customer.

1999: The company acquired former rival Primestar for about $1.82 billion, adding roughly 2.3 million additional subscribers. In this same year, DIRECTV also acquired another satellite television company that was a leading proponent for the development of direct-broadcast satellite service in the U.S., the United States Satellite Broadcasting Company Inc. USSB was purchased for about $1.3 billion.

2001: The company obtained its 10 millionth customer.

2003: News Corp acquired a 34% interest in DirecTV for $6.6 billion in stock and cash.

2005: DirecTV reached its 15 millionth customer.

2006: Several mergers and acquisitions took place resulting in 100% ownership of DirecTV Latin America.

2007: DirecTV purchased the majority of the assets of ReplayTV, a competing DVR specialist.

2008: Liberty Media acquired 41% of DirecTV, consuming New Corp’s ownership. In the same year, DirecTV Latin America reached 5 million customers.

2009: DirecTV acquired Connect Television Inc., a home services provider, increasing the company’s workforce by more than 1,000 employees.

June 2013: DirecTV acquired LifeShield, a Pennsylvania-based maker of wireless home security systems with the intent to market the systems to the company’s (DTV’s) subscriber base starting in 2014.

Several companies have been trying to purchase the streaming video company Hulu for some time now, and DirecTV is one of them. Last month, DirecTV placed its final bid for the company, which was reportedly over $1 billion. DirecTV’s bid was supposedly the highest of all of the companies attempting to purchase the company, but at the last minute Hulu decided to remain a private company.

Financial Strength

DirecTV has an average revenue growth of 23.2% over the last 10 years and a free cash flow growth of 20.1% over the last five years.

The company’s Latin America segment’s growth is able to be funded by the strong free cash flow generated from the company’s U.S. segment. DTV Latin America accounted for 37% of EBITDA growth in 2012. The company has been aggressively investing in this market. This can be seen through its 11.9% increase in capex for the Latin America segment from 2011 to 2012, compared to the 0.3% capex increase in the U.S. segment. DTV Latin America appears to be booming. From 2011 to 2012, the segment experienced a 31.2% increase in its total number of subscribers, compared to a 1.0% increase for DTV U.S. Revenue is also growing at a much faster rate in the Latin America segment.

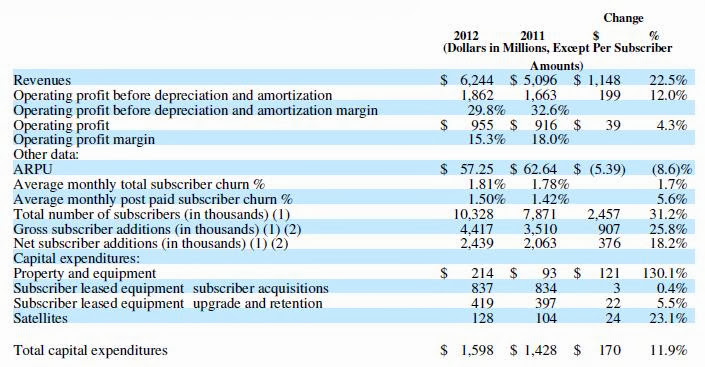

The below image displays the operating results and a summary of key subscriber data for the consolidated DirecTV Latin America operations.

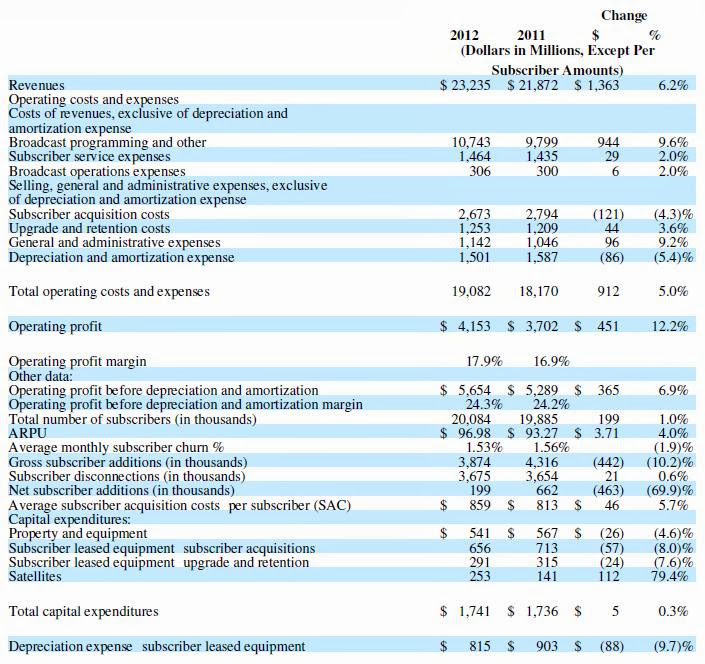

Those numbers are pretty impressive. The market in Latin America appears to be explosive. Here is the operating results and a summary of key subscriber data for the DirecTV U.S. segment:

DTV has also been putting up some pretty impressive buyback numbers. In February of this year they announced an additional $4 billion worth of buybacks, which is about 13.5% of the company’s market cap. Ever since 2006, the board of directors has allowed DTV to aggressively repurchase shares. According to the company’s latest 10-K, the company anticipates “additional borrowings in the future in order to achieve a ratio of outstanding long-term debt equal to approximately 2.5 times operating profit before depreciation and amortization” (pp. 52). Here is a chart of what it has been doing since 2006:

Management

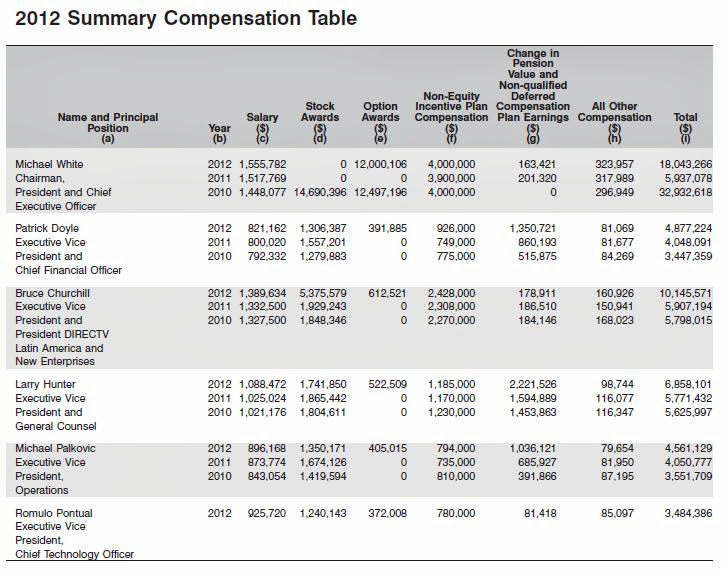

Chairman, President and CEO Michael White has been in his position since 2010. He has also served on the board of directors and vice chairman of PepsiCo, and as chairman and chief executive officer of PepsiCo International. Earlier in the century, White served as president and chief executive officer of Frito Lay’s Europe/Africa/Middle East division. He has also had several other major roles in big-time companies dating back to 1990.

Below is the summary of management's compensation:

Valuation

Using a conventional P/E valuation method we can subtract the $2.365 billion in cash from DTV’s $33.9 billion market cap, which means the company can technically be purchased for $31.535 billion. We can then divide by the net income (TTM) of $2.857 billion which shows us that DTV is currently trading at a P/E of 11.04.

We can also look at the Peter Lynch value of the stock which is currently valued at $120.55 according to GuruFocus.com, and viewing the Peter Lynch chart confirms that the stock is undervalued.

By taking advantage of the company’s aggressive stock buybacks, DTV has lowered its share count from 1.395 billion in 2005 to what will most likely be around 578 million by then end of 2013 with the newly approved additional $4 billion allowance for more buybacks. This displays an annualized rate of 10.4%. Pretty impressive.

Over the last four years DTV has generated free cash flow amounts between $2 billion and $2.8 billion. If we play the safe side and assume that the company will once again produce somewhere between $2 billion and $2.8 billion for 2013, that would result in a free cash flow per share of anywhere from $3.46 to $4.84 as opposed to the 2012 FCF per share of $3.55. At today’s prices, this would account for a free cash flow yield of 5.6% - 7.8%.

Competitors

DTV’s largest competitors are Comcast Corporation (CMCSA), DISH Network (DISH) and privately held Time Warner. Comcast is the largest, with a market cap of $115.42 billion compared to DISH’s $21.79 billion and DirecTV’s $33.91 billion. One of the most outstanding statistics in my eyes is the fact that the TTM revenue for Comcast (the company with a market cap 3.4x larger than DTV) was only $64 billion compared to DirecTV’s almost $31 billion.

End Notes

Disclosure: No current position held at the time of writing.

Disclaimer: The opinions and ideas in this article are for informational and educational purposes only. They are not a recommendation to buy or sell any stock at any given time. As always, it is imperative for each individual investor to do their own due diligence and perform their own research on any and all stocks before making an investment decision.

The company also owns and operates multiple regional sports networks. DTV also currently owns a 60% interest in Game Show Network LLC, which is a cable television network for game-related programming as well as Internet interactive game playing.

Key Historical Dates:

1990: Founded.

1994: Officially launched satellite service, and within four months was available nationwide.

1995: The company obtained its one millionth customer.

1999: The company acquired former rival Primestar for about $1.82 billion, adding roughly 2.3 million additional subscribers. In this same year, DIRECTV also acquired another satellite television company that was a leading proponent for the development of direct-broadcast satellite service in the U.S., the United States Satellite Broadcasting Company Inc. USSB was purchased for about $1.3 billion.

2001: The company obtained its 10 millionth customer.

2003: News Corp acquired a 34% interest in DirecTV for $6.6 billion in stock and cash.

2005: DirecTV reached its 15 millionth customer.

2006: Several mergers and acquisitions took place resulting in 100% ownership of DirecTV Latin America.

2007: DirecTV purchased the majority of the assets of ReplayTV, a competing DVR specialist.

2008: Liberty Media acquired 41% of DirecTV, consuming New Corp’s ownership. In the same year, DirecTV Latin America reached 5 million customers.

2009: DirecTV acquired Connect Television Inc., a home services provider, increasing the company’s workforce by more than 1,000 employees.

June 2013: DirecTV acquired LifeShield, a Pennsylvania-based maker of wireless home security systems with the intent to market the systems to the company’s (DTV’s) subscriber base starting in 2014.

Several companies have been trying to purchase the streaming video company Hulu for some time now, and DirecTV is one of them. Last month, DirecTV placed its final bid for the company, which was reportedly over $1 billion. DirecTV’s bid was supposedly the highest of all of the companies attempting to purchase the company, but at the last minute Hulu decided to remain a private company.

Financial Strength

DirecTV has an average revenue growth of 23.2% over the last 10 years and a free cash flow growth of 20.1% over the last five years.

The company’s Latin America segment’s growth is able to be funded by the strong free cash flow generated from the company’s U.S. segment. DTV Latin America accounted for 37% of EBITDA growth in 2012. The company has been aggressively investing in this market. This can be seen through its 11.9% increase in capex for the Latin America segment from 2011 to 2012, compared to the 0.3% capex increase in the U.S. segment. DTV Latin America appears to be booming. From 2011 to 2012, the segment experienced a 31.2% increase in its total number of subscribers, compared to a 1.0% increase for DTV U.S. Revenue is also growing at a much faster rate in the Latin America segment.

The below image displays the operating results and a summary of key subscriber data for the consolidated DirecTV Latin America operations.

Those numbers are pretty impressive. The market in Latin America appears to be explosive. Here is the operating results and a summary of key subscriber data for the DirecTV U.S. segment:

DTV has also been putting up some pretty impressive buyback numbers. In February of this year they announced an additional $4 billion worth of buybacks, which is about 13.5% of the company’s market cap. Ever since 2006, the board of directors has allowed DTV to aggressively repurchase shares. According to the company’s latest 10-K, the company anticipates “additional borrowings in the future in order to achieve a ratio of outstanding long-term debt equal to approximately 2.5 times operating profit before depreciation and amortization” (pp. 52). Here is a chart of what it has been doing since 2006:

Management

Chairman, President and CEO Michael White has been in his position since 2010. He has also served on the board of directors and vice chairman of PepsiCo, and as chairman and chief executive officer of PepsiCo International. Earlier in the century, White served as president and chief executive officer of Frito Lay’s Europe/Africa/Middle East division. He has also had several other major roles in big-time companies dating back to 1990.

Below is the summary of management's compensation:

Valuation

Using a conventional P/E valuation method we can subtract the $2.365 billion in cash from DTV’s $33.9 billion market cap, which means the company can technically be purchased for $31.535 billion. We can then divide by the net income (TTM) of $2.857 billion which shows us that DTV is currently trading at a P/E of 11.04.

We can also look at the Peter Lynch value of the stock which is currently valued at $120.55 according to GuruFocus.com, and viewing the Peter Lynch chart confirms that the stock is undervalued.

By taking advantage of the company’s aggressive stock buybacks, DTV has lowered its share count from 1.395 billion in 2005 to what will most likely be around 578 million by then end of 2013 with the newly approved additional $4 billion allowance for more buybacks. This displays an annualized rate of 10.4%. Pretty impressive.

Over the last four years DTV has generated free cash flow amounts between $2 billion and $2.8 billion. If we play the safe side and assume that the company will once again produce somewhere between $2 billion and $2.8 billion for 2013, that would result in a free cash flow per share of anywhere from $3.46 to $4.84 as opposed to the 2012 FCF per share of $3.55. At today’s prices, this would account for a free cash flow yield of 5.6% - 7.8%.

Competitors

DTV’s largest competitors are Comcast Corporation (CMCSA), DISH Network (DISH) and privately held Time Warner. Comcast is the largest, with a market cap of $115.42 billion compared to DISH’s $21.79 billion and DirecTV’s $33.91 billion. One of the most outstanding statistics in my eyes is the fact that the TTM revenue for Comcast (the company with a market cap 3.4x larger than DTV) was only $64 billion compared to DirecTV’s almost $31 billion.

End Notes

Disclosure: No current position held at the time of writing.

Disclaimer: The opinions and ideas in this article are for informational and educational purposes only. They are not a recommendation to buy or sell any stock at any given time. As always, it is imperative for each individual investor to do their own due diligence and perform their own research on any and all stocks before making an investment decision.