Taking a snapshot of the recent market performance for Pioneer Natural Resources Co (PXD, Financial), we observe a daily loss of 1.74%, and a slight decline of 2.67% over the past three months. Despite these fluctuations, the company boasts a robust Earnings Per Share (EPS) of 20.94. Investors are often left pondering whether these figures indicate an overvalued stock. The following analysis dives into Pioneer Natural Resources Co (PXD)'s valuation to uncover whether its current market price justifies the intrinsic value of the company.

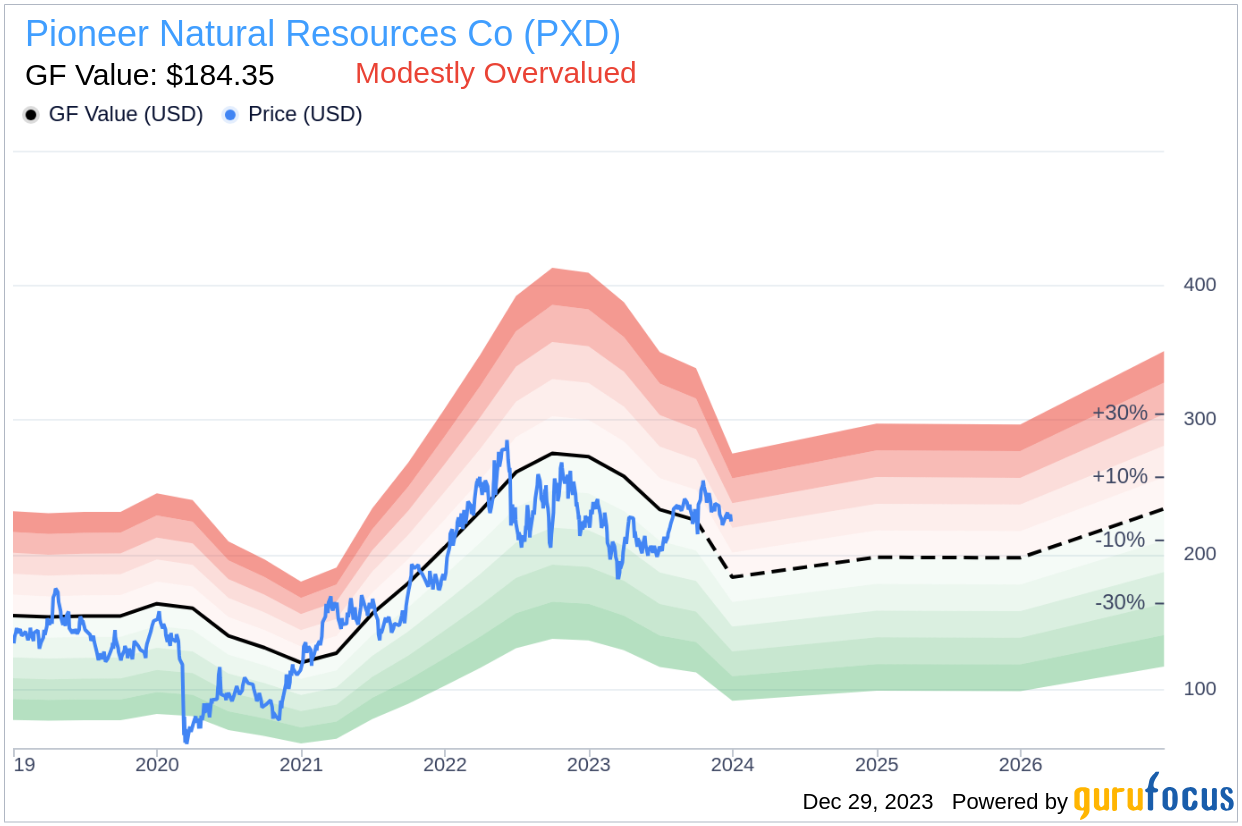

Based in Irving, Texas, Pioneer Natural Resources Co is a leading independent oil and gas exploration and production company with a focus on the Permian Basin in Texas. With proven reserves of 2.4 billion barrels of oil equivalent and a substantial daily production rate, the company represents a significant player in the industry. Our valuation begins by comparing the current stock price of $224.85 to the GF Value of $184.35, a measure of fair value that considers multiple financial indicators. This comparison sets the stage for a deeper exploration of the company's market valuation.

Understanding GF Value

The GF Value is a unique valuation metric that encapsulates the true worth of a stock by considering historical trading multiples, a GuruFocus adjustment factor based on the company's past performance, and projected future business outcomes. Pioneer Natural Resources Co (PXD, Financial) currently appears modestly overvalued when assessed against the GF Value Line. This suggests that the stock price may experience limited upside potential, as it trades above the calculated fair value.

Because Pioneer Natural Resources Co is relatively overvalued, there is a possibility that the long-term return of its stock might lag behind the company's business growth. This assessment is crucial for investors seeking to align their expectations with the stock's future performance.

Discover other investment opportunities: High Quality & Low Capex companies.

Financial Strength Analysis

Investing in companies with robust financial strength minimizes the risk of capital loss. Pioneer Natural Resources Co's financial health is indicated by a cash-to-debt ratio of 0.05, which is low compared to industry peers. Despite this, the company's overall financial strength is rated as fair, with a GuruFocus ranking of 7 out of 10. This suggests a stable financial position that can support the company's operations and growth strategies.

Profitability and Growth Prospects

Profitability is a key indicator of a company's financial health. Pioneer Natural Resources Co has demonstrated consistent profitability, with a high operating margin of 35.79% that surpasses many competitors in the Oil & Gas industry. This level of profitability, coupled with a strong profitability rank of 8 out of 10, underlines the company's efficiency in generating profits.

When it comes to growth, Pioneer Natural Resources Co has shown impressive revenue and EBITDA growth rates, outperforming a significant portion of its industry counterparts. Such growth is a critical component of shareholder value creation, especially when it is achieved profitably.

ROIC vs. WACC: Measuring Value Creation

The comparison between a company's Return on Invested Capital (ROIC) and its Weighted Average Cost of Capital (WACC) provides insight into its value creation efficiency. Pioneer Natural Resources Co's ROIC of 16.27% significantly exceeds its WACC of 6.97%, indicating the company's effectiveness in generating returns on investment above its capital costs.

Concluding Remarks

In conclusion, Pioneer Natural Resources Co (PXD, Financial) appears modestly overvalued based on its current market pricing relative to GF Value. Despite this, the company's financial condition is fair, and its profitability is robust. With growth rates that outshine many of its industry peers, Pioneer Natural Resources Co remains an intriguing prospect for investors. To delve deeper into the company's financials, interested parties can review Pioneer Natural Resources Co's 30-Year Financials here.

For those seeking high-quality investment options with potentially above-average returns, the GuruFocus High Quality Low Capex Screener is an excellent resource to explore.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.