With a daily price dip of -1.36%, a 3-month loss of -8.41%, and an Earnings Per Share (EPS) of 17.65, investors may wonder if Caterpillar Inc (CAT, Financial) is currently undervalued. Delving into the company's valuation, this article aims to provide a clear analysis for investors considering Caterpillar's stock. The following sections will explore the stock's intrinsic value through the lens of GuruFocus' proprietary GF Value, offering insights into whether Caterpillar presents a promising investment opportunity.

Company Introduction

Caterpillar Inc (CAT, Financial), the world's leading manufacturer of heavy equipment, power solutions, and locomotives, commands a significant presence in the industry with a 13% market share as of 2021. The company's diverse portfolio is managed through four main segments: construction industries, resource industries, energy and transportation, and Caterpillar Financial Services. Not only does Caterpillar boast a robust product lineup, but its extensive dealer network with approximately 2,700 branches across the globe ensures comprehensive market coverage. Additionally, Caterpillar Financial Services enhances customer accessibility to the company's offerings. A key metric in evaluating Caterpillar's stock is the comparison between its current price and the GF Value, which serves as an estimate of the stock's fair value. This comparison sets the stage for an in-depth analysis of Caterpillar's market valuation.

Summarize GF Value

The GF Value is a unique metric that determines the intrinsic value of a stock based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line provides investors with a visual representation of the stock's fair trading value. When the stock price of Caterpillar (CAT, Financial) hovers significantly above this line, it may suggest overvaluation and potentially lower future returns. Conversely, a price below the GF Value Line could indicate undervaluation and the prospect of higher future returns. At its current price of $246.01, with a market cap of $125.20 billion, Caterpillar appears modestly undervalued according to the GF Value. This suggests that the stock may offer a favorable long-term return compared to its business growth.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength

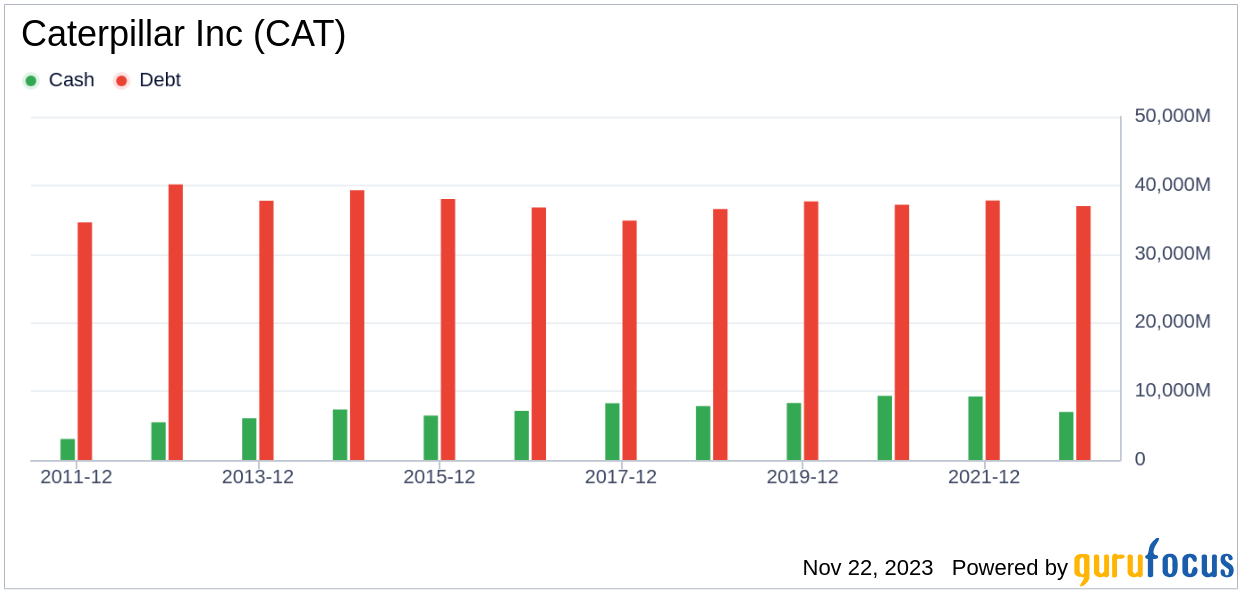

Investing in companies with solid financial strength is crucial to minimize the risk of capital loss. Key indicators such as the cash-to-debt ratio and interest coverage provide valuable insights into a company's financial resilience. Caterpillar's cash-to-debt ratio stands at 0.18, which, while lower than many of its peers, still reflects fair financial health with a GuruFocus ranking of 6 out of 10.

Profitability and Growth

Profitability is a crucial aspect of a company's investment profile, with high profit margins typically indicating a safer investment. Caterpillar has demonstrated consistent profitability over the past decade, with a remarkable operating margin of 18.68%, ranking it above the majority of its industry counterparts. The company's profitability rank stands at 7 out of 10, signaling a solid financial footing.

Growth is another key valuation component, as it is closely tied to long-term stock performance. Caterpillar's average annual revenue growth is 5.7%, reflecting an average performance within its industry. However, its 3-year average EBITDA growth rate of 4.2% suggests there is room for improvement when compared to industry peers.

ROIC vs WACC

Comparing Return on Invested Capital (ROIC) to the Weighted Average Cost of Capital (WACC) is another method to assess a company's value creation. Caterpillar's ROIC of 15.28% surpasses its WACC of 10.2%, indicating the company's efficiency in generating cash flow relative to the capital invested.

Conclusion

In summary, Caterpillar (CAT, Financial) presents itself as a modestly undervalued investment opportunity. The company exhibits fair financial strength and profitability, with growth metrics that have room for improvement. To gain a deeper understanding of Caterpillar's financial health and potential, interested investors can review its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, consider exploring the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.