Assessing the Sustainability and Future Prospects of CEN's Dividend

Center Coast Brookfield MLP & Energy Infrastructure Fund (CEN, Financial) recently announced a dividend of $0.23 per share, payable on 2023-09-26, with the ex-dividend date set for 2023-09-12. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's deep dive into Center Coast Brookfield MLP & Energy Infrastructure Fund's dividend performance and assess its sustainability.

What Does Center Coast Brookfield MLP & Energy Infrastructure Fund Do?

Center Coast Brookfield MLP & Energy Infrastructure Fund is a closed-end management investment company. Its fund's investment objective is to provide a high level of total return with an emphasis on distributions to shareholders. It invests primarily in a portfolio of master limited partnerships (MLPs) and energy infrastructure companies.

A Glimpse at Center Coast Brookfield MLP & Energy Infrastructure Fund's Dividend History

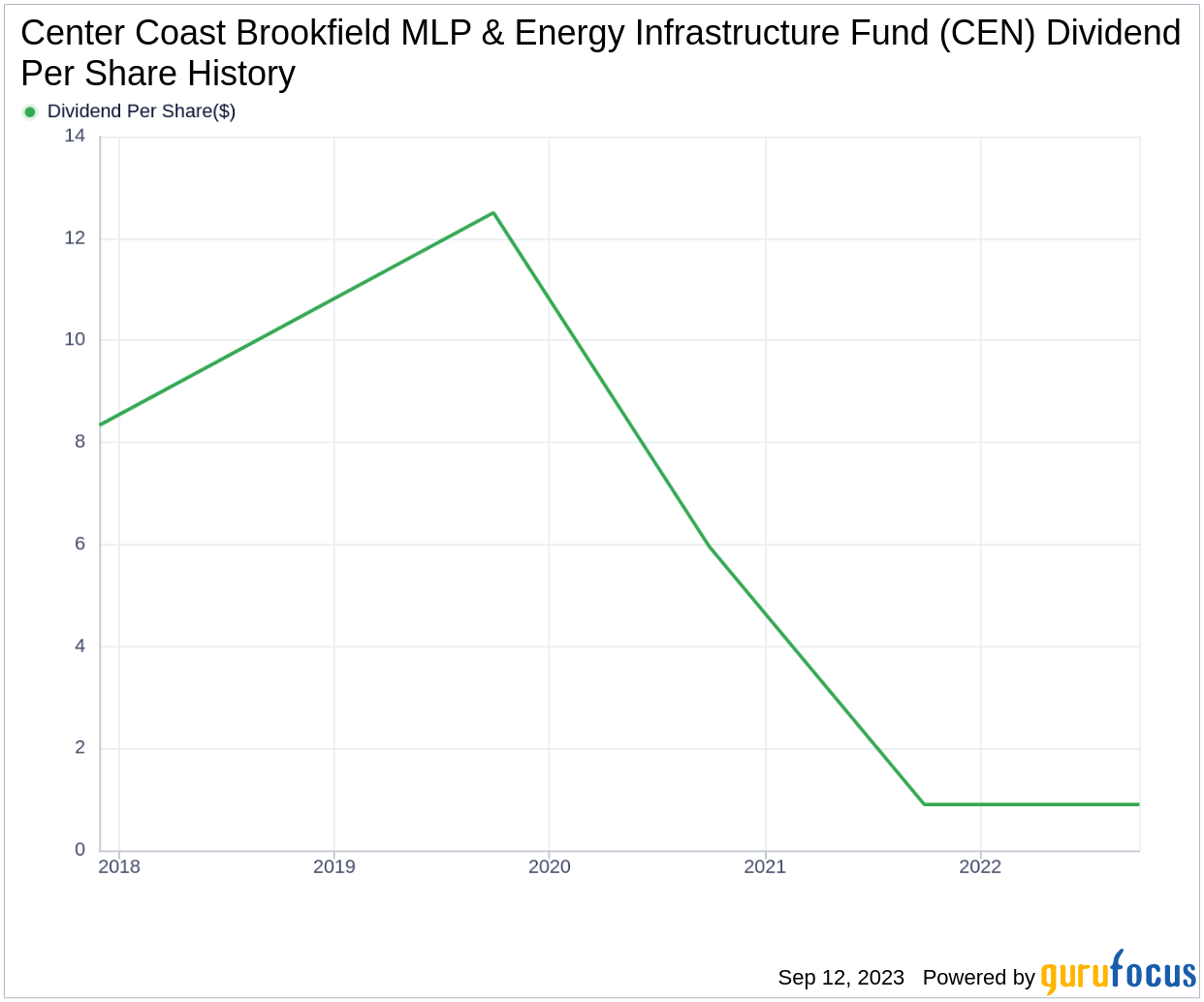

Center Coast Brookfield MLP & Energy Infrastructure Fund has maintained a consistent dividend payment record since 2013. Dividends are currently distributed on a quarterly basis.

Below is a chart showing annual Dividends Per Share for tracking historical trends.

Breaking Down Center Coast Brookfield MLP & Energy Infrastructure Fund's Dividend Yield and Growth

As of today, Center Coast Brookfield MLP & Energy Infrastructure Fund currently has a 12-month trailing dividend yield of 4.28% and a 12-month forward dividend yield of 4.28%. This suggests an expectation of same dividend payments over the next 12 months.

Center Coast Brookfield MLP & Energy Infrastructure Fund's dividend yield of 4.28% is near a 10-year low and underperforms than 67.71 of global competitors in the Asset Management industry, suggesting that the company's dividend yield may not be a compelling proposition for income investors.

Over the past three years, Center Coast Brookfield MLP & Energy Infrastructure Fund's annual dividend growth rate was -58.40%.

Based on Center Coast Brookfield MLP & Energy Infrastructure Fund's dividend yield and five-year growth rate, the 5-year yield on cost of Center Coast Brookfield MLP & Energy Infrastructure Fund stock as of today is approximately 4.28%.

The Sustainability Question: Payout Ratio and Profitability

To assess the sustainability of the dividend, one needs to evaluate the company's payout ratio. The dividend payout ratio provides insights into the portion of earnings the company distributes as dividends. A lower ratio suggests that the company retains a significant part of its earnings, thereby ensuring the availability of funds for future growth and unexpected downturns. As of 2023-03-31, Center Coast Brookfield MLP & Energy Infrastructure Fund's dividend payout ratio is 30.00. This may suggest that the company's dividend may not be sustainable.

Center Coast Brookfield MLP & Energy Infrastructure Fund's profitability rank, offers an understanding of the company's earnings prowess relative to its peers. GuruFocus ranks Center Coast Brookfield MLP & Energy Infrastructure Fund's profitability 2 out of 10 as of 2023-03-31, suggesting the dividend may not be sustainable. The company has reported net profit in 2 years out of past 10 years.

Growth Metrics: The Future Outlook

To ensure the sustainability of dividends, a company must have robust growth metrics. Center Coast Brookfield MLP & Energy Infrastructure Fund's growth rank of 2 out of 10 suggests that the company has poor growth prospects and thus, the dividend may not be sustainable.

Conclusion

While Center Coast Brookfield MLP & Energy Infrastructure Fund has a consistent dividend payment record, its current yield, growth rate, payout ratio, profitability, and growth metrics raise questions about the sustainability of its dividends. Investors should consider these factors carefully before making investment decisions.

GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.