Assessing the sustainability, growth, and future prospects of Linde PLC's dividends

Linde PLC (LIN, Financial) recently announced a dividend of $1.28 per share, payable on September 19, 2023, with the ex-dividend date set for September 1, 2023. As investors anticipate this upcoming payment, it's crucial to examine the company's dividend history, yield, and growth rates. Using data from GuruFocus, we delve into Linde PLC's dividend performance and evaluate its sustainability.

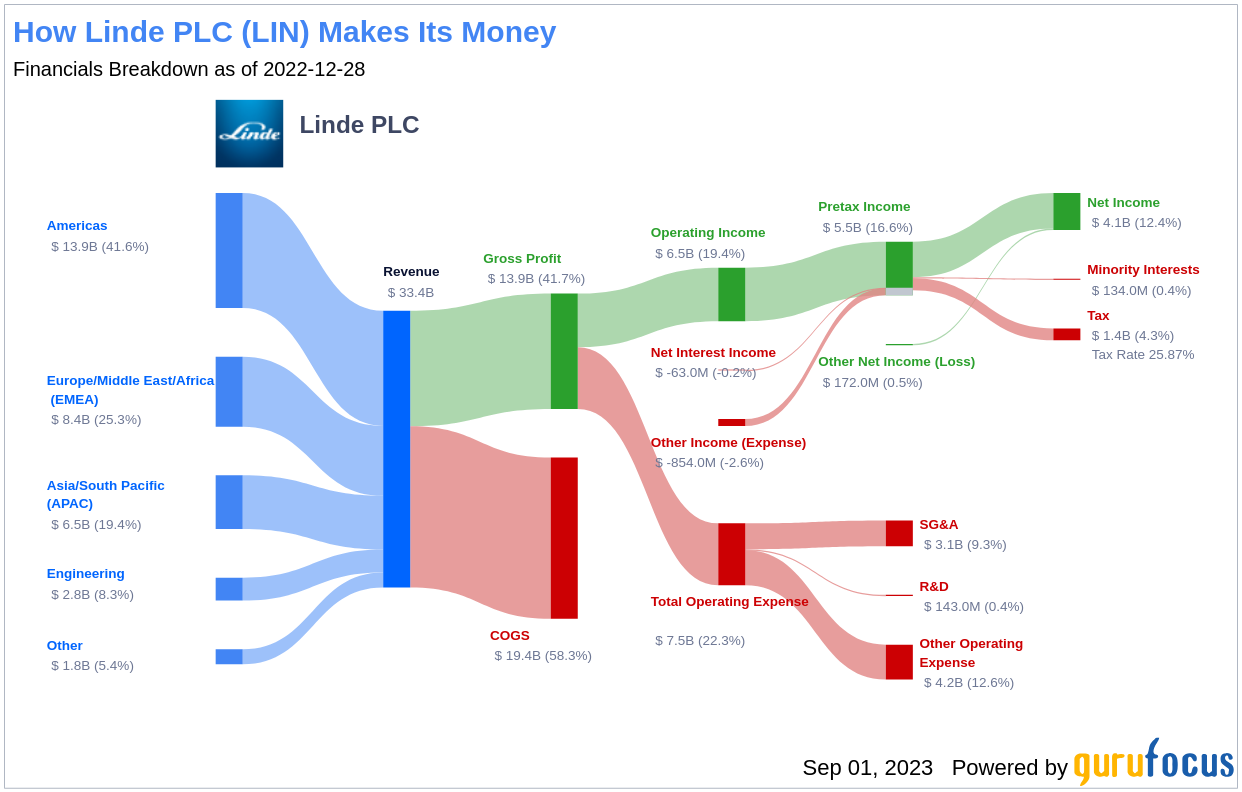

Understanding Linde PLC's Business Model

Linde is the world's largest industrial gas supplier, operating in over 100 countries. The company's primary products include atmospheric gases (like oxygen, nitrogen, and argon) and process gases (such as hydrogen, carbon dioxide, and helium), along with equipment used in industrial gas production. Linde serves a wide range of sectors, including chemicals, manufacturing, healthcare, and steelmaking. In 2022, Linde generated approximately $33 billion in revenue and $5.4 billion in GAAP operating profit.

A Look at Linde PLC's Dividend History

Linde PLC has maintained a consistent dividend payment record since 1992, with dividends currently distributed quarterly. The company has increased its dividend each year since 1996, earning it the status of a dividend aristocrat—an honor given to companies that have increased their dividend each year for at least the past 27 years.

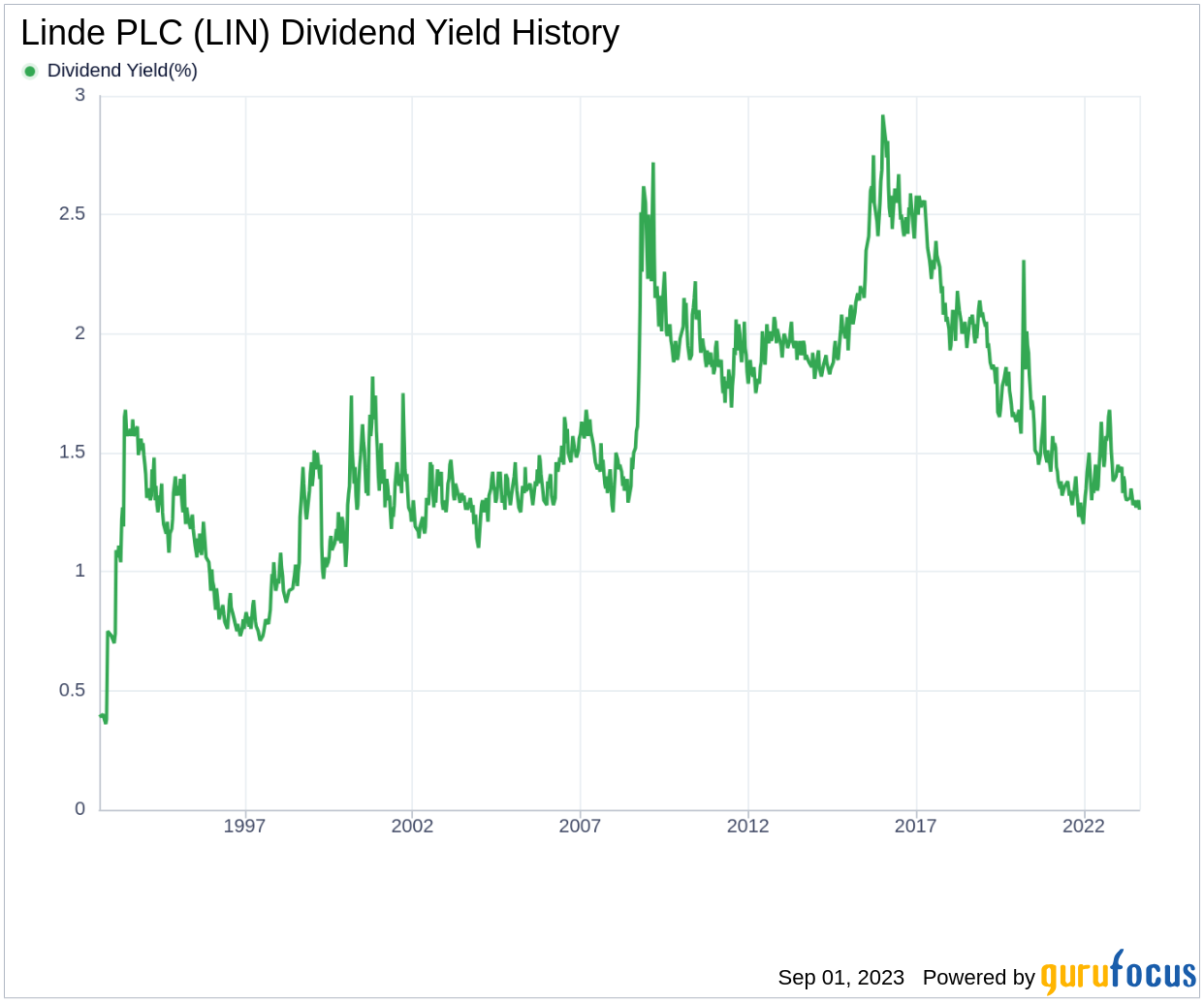

Breaking Down Linde PLC's Dividend Yield and Growth

Linde PLC currently has a 12-month trailing dividend yield of 1.25% and a 12-month forward dividend yield of 1.31%, indicating an expectation of increased dividend payments over the next 12 months. However, Linde PLC's dividend yield is near a 10-year low and underperforms 63.72% of global competitors in the Chemicals industry, suggesting that the company's dividend yield may not be a compelling proposition for income investors.

Over the past three years, Linde PLC's annual dividend growth rate was 10.20%, which decreased to 8.40% per year over a five-year horizon. Over the past decade, Linde PLC's annual dividends per share growth rate stands at 7.30%. Based on Linde PLC's dividend yield and five-year growth rate, the 5-year yield on cost of Linde PLC stock as of today is approximately 1.87%.

Evaluating Dividend Sustainability: Payout Ratio and Profitability

To assess the sustainability of the dividend, it's essential to evaluate the company's payout ratio. The dividend payout ratio offers insights into the portion of earnings the company distributes as dividends. A lower ratio suggests that the company retains a significant part of its earnings, thereby ensuring the availability of funds for future growth and unexpected downturns. As of June 30, 2023, Linde PLC's dividend payout ratio is 0.43. Linde PLC's profitability rank of 8 out of 10 suggests good profitability prospects. The company has reported positive net income for each year over the past decade, further solidifying its high profitability.

Assessing Growth Metrics: The Future Outlook

Linde PLC's growth rank of 8 out of 10 indicates a strong growth trajectory relative to its competitors. The company's revenue per share and 3-year revenue growth rate suggest a robust revenue model, although it underperforms approximately 52.82% of global competitors. Linde PLC's 3-year EPS growth rate of 27.20% per year on average underperforms approximately 34.25% of global competitors. Lastly, the company's 5-year EBITDA growth rate of 5.00% underperforms approximately 63.33% of global competitors.

Concluding Thoughts

In conclusion, Linde PLC has demonstrated a strong track record of consistent dividend payments and growth. However, its dividend yield is currently near a 10-year low, potentially making it less attractive to income investors. The company's payout ratio and profitability rank suggest a robust financial health that could sustain future dividends. Despite some underperformance in growth metrics compared to global competitors, Linde PLC shows promising prospects with its solid revenue model and EPS growth rate. As always, investors should conduct thorough research and consider multiple factors before making investment decisions.

GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.