With high flying growth stocks taking it on the chin in 2022, searching for deep value, cyclical stocks has led me to Gannett Co Inc. (GCI, Financial), a U.S.-based newspaper and digital media and marketing company that provides local media and marketing solutions.

Gannett's portfolio includes local media organizations in 46 states in the U.S. Its brands include USA TODAY and over 250 daily newspapers, as well as digital marketing services companies. The company also produces more than 350 annual events, including themed expos, and owns digital marketing services companies ReachLocal, UpCurve and WordStream. It operates the largest media-owned events business in the U.S., USA TODAY Network Ventures.

In addition to its operations in the United States, Gannett also has a presence in the United Kingdom through its media company Newsquest, which offers over 150 local media brands. Gannett's extensive network of brands and capabilities positions the company to preserve the future of local journalism. The company is working to transform its business model to create a more agile and dynamic organization that can sustain local journalism, employees and shareholders.

Rising costs and growth initiatives

Gannett's recent performance has been disappointing due to ongoing challenges in the newspaper sector and increased costs, including inflation in newsprint, paper, delivery and wages, which added $50 million in the first half of the year. To improve the company's transformation, management is implementing a cost reduction program, which aims to remove a significant portion of fixed costs and generate more than $200 million in annual savings. This program is expected to be completed in the fourth quarter.

Despite these challenges, Gannett's growth initiatives, including digital subscriptions and digital market solutions, are still on track and are expected to eventually help the company return to growth. In the meantime, the cost reduction plan is expected to improve profitability and management plans to continue to aggressively reduce debt.

Over the past three years, Gannett has paid off nearly $600 million in debt and has already reduced debt by $130 million year-to-date. Through ongoing asset sales, the company is expected to maintain debt reduction, which should unlock equity value in the long term.

Below is the liability and equity side of the balance sheet over the last three years. Note the considerable decrease in long-term debt.

The chart below shows the breakdown of debt and maturities.

Valuation

The market currently values Gannett's shares below normalized Ebitda and free cash flow, which reflects concerns about secular challenges and the potential impact of a recession in 2023. However, the company's transformation plan, cost reduction program, debt reduction and extensive asset base provide a margin of safety in the near term. With the share price not very far from all-time lows, there is a significant price-to-value gap, and I predict long-term upside potential will be multiples of the current price. Gannett is the largest newspaper chain in the U.S.

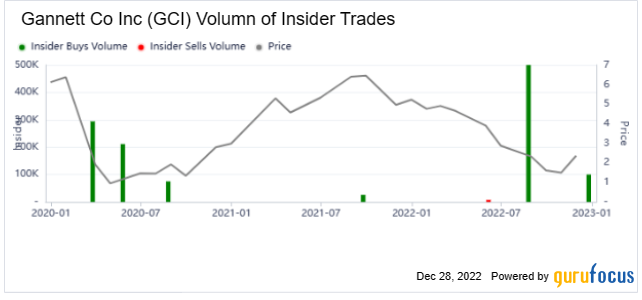

Moreover, the CEO has been buying shares, as have several directors. CEO Michael Reed spent $1.2 million buying company stock on Aug. 8, according to GuruFocus' insider trades data for the stock. The significant insider purchases on the open market could show conviction.

It is now over three years since private equity group New Media Investment Group acquired Gannett on Nov. 19, 2019 and formed the largest newspaper company in the U.S., retaining the Gannett company name. Since then, the stock has lost 72% of its market capitalization.

The share price has dropped from about $6.50 to $2.00 since the acqusition in spite of solid improvement in the company's digital transition and capital structure. In my opinion, this presents a value opportunity. Gannett has made significant progress in its transformation from a traditional print media company into a subscription-led and digitally focused media and marketing solutions company, which is not being recognized by the stock market. My price target for this stock is between $4 to $8.

The GuruFocus valuation box shows the stock could be worth $4.31 based on GF Value, $5.98 based on projected free cash flow value or $8.42 based on earnings power value.

On a price-sales justified basis, Gannett looks considerably undervalued as the price-sales justified value is north of $10.

Digital gains make up for print losses

Gannett has a shrinking print newspaper business. The print business is shrinking by approximately 10% to 15% every year. However, it is doing a good job growing its digital news business. Digital subscribers grew by 28.5% on a year over year basis in the third quarter of 2022. Currently the digital business is about a third of the print business by revenue. Most of the company's future value comes from the digital business, though, as the print business will likely disappear in the next five years or so.

The company also has a digital marketing solutions business, which it grew by about 5% from last year. This represents another avenue of growth that could rebound with advertising spending.

Once Gannett's digital transformation is complete in the next three to five years, I expect the market to assign a much higher valuation to the stock. Gannett's enterprise-value-to-Ebitda multiple is currently around 7, while the New York Times (NYT, Financial) has an enterprise-value-to-Ebitda multiple of about 15. New York Times is much further along in its digital journey.

Thus, I believe that a combination of debt repayment and multiple expansion could deliver a multi-bagger for shareholders. It is also possible that the digital marketing solutions business could be spun off or sold. Currently it does not appear that the business is being fairly valued with Gannett.

However, with a widely expected slowdown or a recession in 2023 in the U.S., the ride is likely to be bumpy. Advertising supported businesses such as Gannett are among the first to be hit when the economy slows, though on the flipside, they recover fast as well. I think at such a reasonable stock price, a lot of these worries are already baked in.