There are many purchases in life that are optional, such as upgrading a perfectly good car for a flashier new model or splurging on building a pool in the backyard. Yet, there are also products that people will continue buying for their day-to-day lives regardless of economic conditions, such as food, a daily cup of coffee or toilet paper. These day-to-day products, also known as consumer staples, are known for being remarkably stable investments, even if their returns may not be particularly noteworthy compared to successful tech giants and the like.

Since millions of other people have their daily "must-haves," the companies that manufacture these staples stand a good chance of continuing to profit even during times of economic turmoil. Even though these companies could be impacted by supply chain disruptions, shortages and inflation, consumer defensive value stocks could still be a hedge to protect wealth during market volatility.

Here are my five favorite consumer defensive stocks that I believe could hold up well even if we experience a recession. Four of them are individual companies, and one is an exchange-traded fund for diversity.

Walmart

The world’s largest company by revenue, Walmart (WMT, Financial) is where millions of Americans buy everything from their weekly groceries to tires for their cars. Walmart is mounting a challenge to Amazon (AMZN, Financial) in online shopping and to Costco (COST, Financial) with the members-only warehouse store Sam’s Club. Walmart has a GF Score of 83 out of 100 and a price-earnings ratio of 26.80.

Target

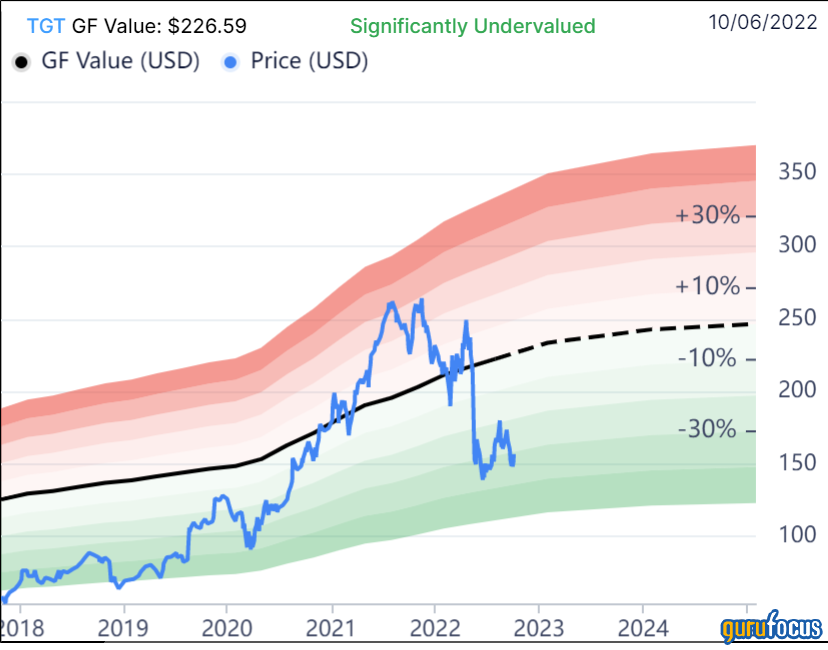

Smaller and more stylish than Walmart, Target (TGT, Financial) has nearly 2,000 U.S. stores and about 400,000 employees. While Target’s clothing and home furnishings get great reviews for style, quality and price, plenty of shoppers also pick up weekly staples such as snacks, breakfast items, pet food, milk and bread. The GF Value chart rates Target as significantly undervalued.

Proctor & Gamble

One of the world’s best-known consumer products companies, Proctor & Gamble (PG, Financial) owns brands including Crest, Pampers, Gillette and Tide. Proctor & Gamble has a GF score of 86 out of 100 and a price-earnings ratio of 22.41. Wall Street analysts rank Proctor & Gamble as a buy.

Enjoying a soft drink may not be essential to life, and yet it is one of those things people tend to do no matter what the stock market is doing. Coca-Cola includes its flagship soft drinks Coke, Diet Coke and Coke Zero as well as other beverages including bottled water and sports drinks. With a price-earnings ratio of 25.81, Coca-Cola's price may be a little overvalued compared to its historical levels, as shown by the Peter Lynch chart.

Consumer Staples Select Sector SPDR Fund (XLP, Financial)

If you want to add exposure to several consumer defensive stocks to your portfolio without having to pick and choose, a good option is the Consumer Staples Select Sector SPDR Fund (XLP, Financial). This exchange-traded fund includes stocks such as Proctor & Gamble, Coca-Cola, Walmart, Colgate-Palmolive (CL, Financial), Costco and PepsiCo (PEP, Financial), among others. This fund showed growth of more than 26% over the past five years. The Consumer Staples Select Sector SPDR Fund has a price-earnings ratio of 20.40.