Investors looking for stocks that could potentially outperform are encouraged to consider the GF Score at the top of each summary page.

The GF Score is a ranking system that is closely correlated to the long-term performance of stocks stretching back 16 years. Profitability, growth, financial strength, valuation and momentum are the factors that determine a stock’s GF Score.

Stocks with higher GF Scores tend to produce higher returns than those with a lower GF Scores.

This discussion will examine three stocks that meet the following criteria:

- A GF Score of at least 90 out of 100.

- A dividend yield of at least 1%.

- A rating of modestly undervalued by GuruFocus.

Abbott Laboratories

First up is Abbott Laboratories (ABT, Financial), a leading medical device and equipment health care company. The company spun off its biotech segment, AbbVie Inc. (ABBV, Financial), in 2013. Currently, Abbott Laboratories is composed of four business units, including Diagnostic Products, Nutrition Products, Medical Devices and Established Pharmaceuticals. The company is valued at $191 billion and generates annual revenue of $43 billion.

Abbott Laboratories has a very strong GF Score of 93 out of 100. The company scores well in all categories that are used to determine the GF Score, led by a 9 out of 10 for both profitability and growth ranks. Profitability metrics are better than the majority of the health care industry and close to Abbott Laboratories’ best for the last decade. Growth was powered by revenue and earnings growth without nonrecurring items.

The company has raised its dividend for 50 consecutive years, qualifying Abbott Laboratories as a Dividend King, of which there are less than 50 names with the required five decades of dividend growth. The dividend has a compound annual growth rate of nearly 16% since the company spun off AbbVie. The company raised its dividend 4.4% for the Feb. 15 payment date. This follows the prior year’s increase of 25%. Shares yield 1.7%, which matches the five-year average yield exactly, according to Value Line.

Abbott Laboratories is trading below its intrinsic value according to the GF Value chart.

Abbott Laboratories closed Friday’s trading session at $109.26. The stock has a GF Value of $128.88, giving it a price-to-GF Value ratio of 0.85. Reaching the GF Value would result in a share price gain of 18%. The stock’s yield could push total returns towards the 20% level. Abbott Laboratories is rated as modestly undervalued by GuruFocus.

Allstate

Next up is Allstate Corp. (ALL, Financial), which has become a top name in insurance through its segments such as Allstate Life and Allstate Protection. The company ranks as the number two provider of property and casualty insurance and is one of the largest names in life insurance. It writes insurance policies that cover auto, homeowners,and personal lines. The company’s brands include Allstate, Esurance and Encompass. The $36 billion company has annual revenue of $42 billion.

Allstate’s GF Score is 93 out of 100. The company’s weakest area is financial strength, where it receives just a 5 out of 10. Everywhere else the company has high marks. Allstate’s growth rank is a perfect 10 out of 10 due to outranking the majority of peers on revenue, Ebitda and earnings per share without NRI growth. Momentum is 9 out of 10, profitability is 8 out of 10 and GF Value is a 7 out of 10.

Allstate has a dividend growth streak of 10 years, including a 4.9% increase for the April 1 distribution. This followed a 50% increase in the prior year. The company’s dividend has a CAGR of 11.8% since 2012. Shares of Allstate yield 2.6%, solidly ahead of both the stock’s five-year average yield of 2% and the average yield for the market index.

Shares are trading at a solid discount to the GF Value.

Allstate has a recent price of $130.87 and a GF Value of $147.53, giving the stock a price-to-GF Value ratio of 0.89. Reaching the GF Value would result in a 12.7% gain in the share price. With the dividend, total returns could push into the mid-teens range. Allstate is rated as modestly undervalued.

Cisco

The next stock for consideration is Cisco Systems Inc. (CSCO, Financial), one of the largest providers of internet-based networking and data transportation solutions. The company supplies the routers and switches that allow networks around the globe to connect to each other. In addition, Cisco’s product line includes data centers, cloud, applications and security products. The company is valued at $180 billion and produced revenue of close to $50 billion in its most recent fiscal year.

Cisco has a GF Score of 93 out of 100. The company’s weakest score is in the area of momentum, where it has a 5 out of 10. Cisco does well in most other areas, led by a perfect 10 out of 10 in profitability. Here the company is ahead of most of its peers in almost every category. Cisco also scores well against its own history. The company earns a 9 out of 10 on growth and a 7 out of 10 on both financial strength and GF Value.

The company has increased its dividend for 12 consecutive years. Cisco’s dividend CAGR is robust at 20% since 2012, but dividend growth has slowed greatly in the near term. The dividend has been raised just 1 cent or 2 cents per share per quarter over the last four years. Helping to compensate for this low growth rate is the current yield of 3.5%, which is more than twice the yield of the S&P 500 Index. It is also better than the yield of 3.1% that Cisco has averaged since 2017.

The stock looks attractively priced looking at the GF Value chart.

Cisco closed the trading week at $43.39. Shares have a GF Value of $50.37, equating to a price-to-GF Value ratio of 0.86. It could return 16.1% if it reached its GF Value. Total returns could approach the high-teens when including the stock’s dividend. The company earns a rating of modestly undervalued.

CSX

The final name for consideration is CSX Corp. (CSX, Financial), the largest railroad in the eastern portion of the United States. The company began with just 13 miles of track in 1827, but now has approximately 21,000 route miles that connect 23 states in the Northeast, Midwest and Southeast U.S. as well as to two Canadian provinces. The $63 billion company generated revenue of $12.5 billion in 2021.

CSX’s GF Score is 91 out of 100. Financial strength is its weakest area at 5 out of 10, but the Piotroski F-score of 7 out of 9 shows a financially strong company. Profitability rank is a 9 out of 10 as CSX easily tops most competitors in the transportation industry. Rounding out the other areas that contribute to the GF Score, momentum is a perfect 10 out of 10, GF Value is a 9 out of 10 and growth is 8 out of 10.

CSX has rewarded shareholders with a dividend increase for 17 consecutive years, including a 7.2% increase for the March15 payment date. The latest increase was close to the company's dividend CAGR of 8.3% since 2012 and not too far off the prior year’s raise of 7.7%. Shares offer a yield of 1.4%, in line with the five-year average.

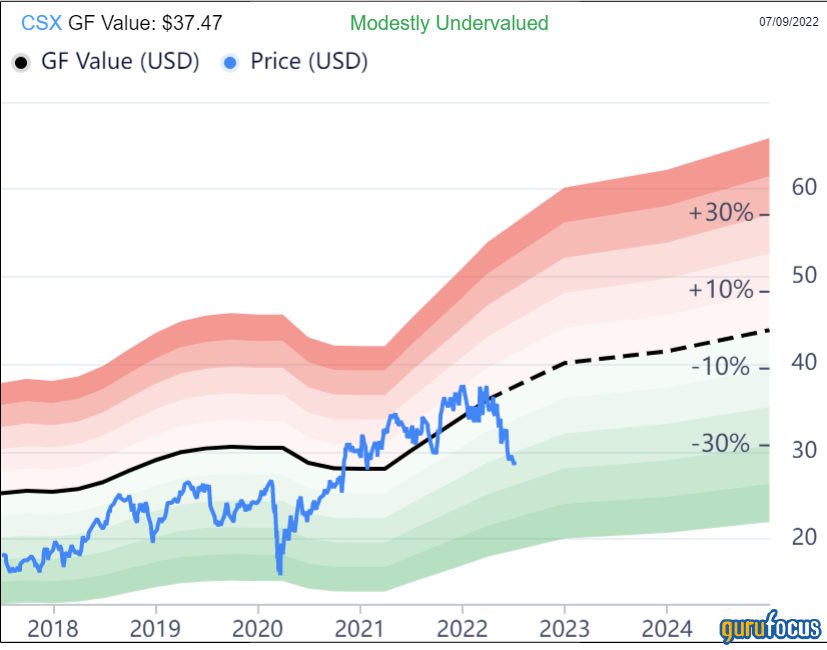

The stock looks cheaply priced according to the GF Value chart.

CSX closed Friday at $28.99. The stock has a GF Value of $37.47, giving it a price-to-GF Value ratio of 0.77. Shares could see a return of 29%. The dividend could push total returns into the low-30% range. CSX is rated as modestly undervalued.

Final thoughts

Identifying companies that tend to outperform might have gotten easier thanks to the GF Score ranking system. Using a variety of key components to rank stocks allows the investor to create a watchlist of high-quality companies from a single source.

Abbott Laboratories, Allstate, Cisco,and CSX are four stocks that have a GF Score of at least 91 out of 100. All four names rank highly in most individual categories. Each also has a least a decade of dividend growth and trades with a double-digit discount to their respect intrinsic values.

These companies could be excellent investment options for those looking for a combination of high returns, income and value.