On Monday, Hertz Global Holdings Inc. (HTZZ, Financial) saw share prices on the rise with its announcement that it will be ordering 100,000 Tesla Inc. (TSLA, Financial) cars to build out one of the world’s largest electric vehicle fleets.

The order is expected to be fulfilled through the end of 2022 and Hertz expects EVs to make up approximately 20% of its fleet by that time. The new vehicles will have access to Tesla’s 3,000 supercharger locations across the U.S. and Europe. Hertz also plans to build out its own infrastructure with a combination of Level 2 and DC fast-charging stations across 65 markets in the same time frame. By the end of 2023, the company hopes the network will cover more than 100 different markets.

Hertz has plans for the vehicles as a “premium and differentiated” rental experience compared to the rest of its fleet. Digitized guidance is expected to be included with the Tesla rentals, which will help educate customers about the vehicles and expedite the rental process through Hertz’s app.

The press release also highlighted a fresh media campaign championed by Superbowl legend Tom Brady. Two ads are slated to debut featuring Brady and his signature “Let’s Go” cry in combination with Hertz.

Hertz’s statements also included a word of caution that expectations for deliveries could be affected by forces outside of its control, including the ongoing chip shortage that has so far plagued the auto industry. Hertz has been short on vehicles throughout the last several months after culling its fleet during bankruptcy and facing shortages from manufacturers.

Hertz (HTZZ, Financial) shares were up 9.56% at $27.05 per share with a market cap of $12.96 billion on Oct. 25. Share prices have rebounded for the company as travel demand continues to increase.

On the other side of the deal, Tesla is set to take in approximately $4.2 billion in revenue according to Bloomberg. The same article also stated that the order will be the single-largest purchase of EVs, putting the company once again at the forefront of the emerging industry.

Hertz is also reportedly opting in for “well-appointed” vehicles rather than purchasing base models that lack features. These vehicles paint a higher-end picture of Tesla with the potential for some of its fancier tech, like autopilot self-driving features, to make it into the hands of consumers.

Tesla, while seemingly immune to chip shortage delays, has been plagued by recent complaints of extended delivery windows. The deal with Hertz takes Tesla vehicles and makes them directly available to any potential customers for a quick rental. Anyone who may have been on the fence about buying a Tesla could easily rent one for a few days before finalizing their decision.

Tesla shares, freshly off record-setting days of trading, jumped over $1,000 dollars per share and landed the company at a market cap of $1 trillion dollars. Reaching the milestone landed the company amongst some of the most well-known names in the market, including Apple Inc. (AAPL, Financial), Amazon.com Inc. (AMZN, Financial) and Microsoft Corp. (MSFT, Financial).

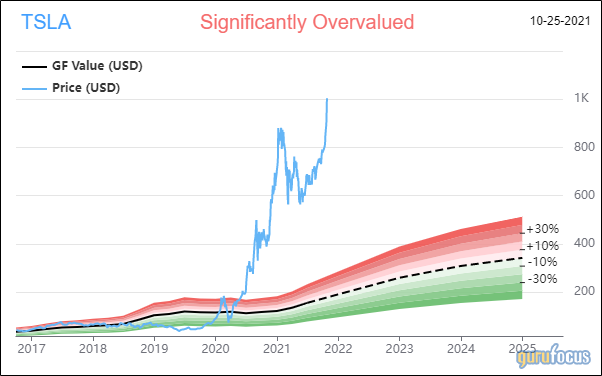

By mid-afternoon on Oct. 25, Tesla was trading at $1,038.06 per share with a market cap of $1.03 trillion. According to the GF Value Line, the stock is trading at a significantly overvalued rating.

Top guru shareholders invested in Tesla (TSLA, Financial) include Baillie Gifford (Trades, Portfolio), Ron Baron (Trades, Portfolio), Catherine Wood (Trades, Portfolio), Primecap Management and Spiros Segalas (Trades, Portfolio).