The Causeway International Value (Trades, Portfolio) Fund has revealed its portfolio for the first quarter of 2021. Major trades include reductions in the fund's Volkswagen AG (XTER:VOW3, Financial), Baidu Inc. (BIDU, Financial), Infineon Technologies AG (XTER:IFX, Financial) and ABB Ltd. (XSWX:ABBN, Financial) holdings alongside a new buy into Unilever PLC (LSE:ULVR, Financial).

The fund was started in 2001 and operates under Causeway Capital Management. The Fund seeks long-term growth of capital and income by investing companies which generally have market capitalizations greater than $750 million. The managers operate with an investment philosophy that is value-driven with a fundamentally based, bottom-up approach to stock selection.

Portfolio overview

At the end of the quarter, the portfolio contained 58 stocks, with three new holdings. It was valued at $5.52 billion and has seen a turnover rate of 12%. Top holdings include Samsung Electronics Co. Ltd. (XKRX:005930), Rolls-Royce Holdings PLC (LSE:RR), Novartis AG (XSWX:NOVN), UniCredit SpA (MIL:UCG) and Sanofi SA (XPAR:SAN).

By weight, the top three sectors represented are financial services (21.35%), industrials (21.02%) and technology (15.18%).

Volkswagen

The first quarter saw managers of the fund slash the Volkswagen (XTER:VOW3, Financial) holding by 81.74% with the sale of 1.02 million shares. During the quarter, the shares traded at an average price of 177.21 Euros ($216.14). Overall, the sale had a -3.41% impact on the portfolio and GuruFocus estimates the total gain of the holding at 0.75%.

Volkswagen is one of the world's largest automotive manufacturers. Automotive brands include Volkswagen passenger cars, Audi, Bentley, Bugatti, Lamborghini, Porsche, SEAT, and Skoda. Commercial vehicle brands include MAN, Scania, and Volkswagen. The company's financial services group provides dealer financing to support floor plans, consumer financing for vehicle purchases, and other financial services.

On May 27, the stock was trading at €221 per share with a market cap of €128.61 billion. According to the GF Value Line, the shares are trading at a significantly overvalued rating.

GuruFocus gives the company a financial strength rating of 4 out of 10, a profitability rank of 4 out of 10 and a valuation rank of 5 out of 10. There are currently three severe warning signs issued for a declining gross margin percentage, declining revenue per share and an Altman Z-Score of 1.11 placing the company in the distress column. The company currently has an operating margin of -0.82% which ranks it worse than competitors in the auto industry, but is well above the company's 10-year low of -11.04%.

Unilever

One of three new buys in the fund's portfolio was Unilever (LSE:ULVR, Financial). The managers purchased 1.87 million shares to establish the holding for the first time in the fund's history. Throughout the quarter the shares were purchased at an average price of 41.09 Pounds sterling ($58.36). GuruFocus estimates the total gain of the holding at 4.73% and the purchase had an impact of 1.90% on the portfolio overall.

Unilever is a diversified personal product (42% of 2020 sales by value), home care (20%), and packaged-food (38%) company. The firm's brands include Knorr soups and sauces, Hellmann's mayonnaise, Lipton teas, Axe and Dove skin products, and the TRESemme hair-care brand. The firm has been acquisitive in recent years, and high-profile purchases include the mail-order men's grooming business Dollar Shave Club and Seventh Generation cleaning and personal-care products.

As of May 27, the stock was trading at £43.04 per share with a market cap of £112.80 billion. The GF Value Line shows the stock trading at a fair value rating.

GuruFocus gives the company a financial strength rating of 5 out of 10, a profitability rank of 8 out of 10 and a valuation rank of 4 out of 10. There is currently one severe warning sign issued for assets growing faster than revenue. The strong profitability rank is propped up by a return on invested capital that easily supports the weighted average cost of capital.

Baidu

The first quarter saw managers take a chunk out of the fund's Baidu (BIDU, Financial) holding for the fifth quarter in a row. The holding shrank by 78.21% with the sale of 318,255 shares. During the quarter, the shares traded at an average price of $261.90. The sale had a -1.22% impact on the portfolio overall and GuruFocus estimates the total gain of the holding at 1.37%.

Baidu is the largest Internet search engine in China with mid-70s mobile traffic share in the search market. The firm generates 86% of revenue from online marketing services and the rest from other segments. Baidu is a technology-driven company and has been investing in AI technology, such as autonomously driven cars.

The stock was trading at $195.14 per share with a market cap of $67.72 billion on May 27. The shares are trading at a modestly overvalued rating according to the GF Value Line.

GuruFocus gives the company a financial strength rating of 6 out of 10 and a profitability rank of 8 out of 10. There are currently three severe warning signs issued for assets growing faster than revenue, a declining gross margin percentage and a declining operating margin percentage. The company's cash-to-debt ratio ranks it worse than 68.42% of the industry.

Infineon Technologies

The fund's Infineon Technologies (XTER:IFX, Financial) holding was cut by 54.94% during the first quarter. The 1.7 million shares sold traded at an average price of €34.26 during the quarter. The fund has gained a respectable 61.68% on the holding and the sale had a -1.16% impact on the portfolio overall.

Infineon was spun off from German industrial conglomerate Siemens in 2000 and today is one of Europe's largest chipmakers. The company is a leader in the automotive and industrial chip markets and has also focused on ID cards and security solutions that include semiconductor content. Infineon has divested itself of some less profitable businesses in recent years, most notably the sale of its wireless chip division to Intel in 2010.

On May 27, the stock was trading at €32.16 per share with a market cap of €41.85 billion. According to the GF Value Line, the shares are trading at a significantly overvalued rating.

GuruFocus gives the company a financial strength rating of 5 out of 10, a profitability rank of 8 out of 10 and a valuation rank of 2 out of 10. There are currently five severe warning signs issued for the company including a declining operating margin and a Sloan Ratio indicating poor quality of earnings. Revenue has continued to increase steadily for the company, but net income fell off in 2020.

ABB

Rounding out the fund's top five trades was a reduction in its ABB (XSWX:ABBN, Financial) holding. Managers sold 2.32 million shares to cut the holding by 49.97%. The shares traded at an average price of 27.12 Swiss francs during the quarter. Overall, the sale had a -1.16% impact on the portfolio and GuruFocus estimates the total gain of the holding at 8.58%.

ABB is a global supplier of electrical equipment and automation products. Founded in the late 19th century, the company was created out of the merger of two old industrial companies, ASEA and BBC, and is now called Asea Brown Boveri Group, or ABB. The company is the number-one or number-two supplier in all of its core markets and the number-two robotic arm supplier globally. In automation, it offers a full suite of products for both discrete and process automation as well as robotics.

As of May 27, the stock was trading at CHF30.15 per share with a market cap of CHF61.03 billion. The shares are significantly overvalued according to the GF Value Line.

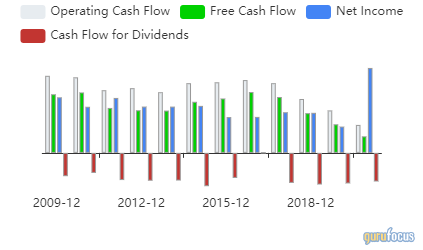

GuruFocus gives the company a financial strength rating of 5 out of 10, a profitability rank of 6 out of 10 and a valuation rank of 3 out of 10. There are currently two severe warning signs issued for a declining operating margin and declining revenue per share. Cash flows have been in decline for several years but the company's net income saw a large spike last year.

Disclosure: Author owns no stocks mentioned.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.