The more I look into this company, the more irritated I become. This is a follow-up to last week's post.

Here is the thing. I start reading the annual reports and proxy statements and I keep getting stuck on the removal of “stock compensation” from GAAP earnings so the company can report positive EPS under “non-GAAP” earnings. This was removed in FY 2011 as GAAP EPS fell 25%; the change enabled them to say “non-GAAP” EPS fell only 7%. In FY 2012 they will lose money under GAAP earnings. This means EPS has actually fallen from $0.63 to $0.47 to ($0.02) since FY 2010. Meanwhile, “non-GAAP” or “earnings without all the expenses in them” will still fall, but they will at least show a “pretend” profit.

The argument comes down to whether or not stock comp is actually an expense. It is. Do not let anyone tell you different. Because of the stock comp, shares outstanding have risen from 128 million to 145 million in FY 2012. That is a 17 million or 13% increase in shares outstanding at a time when EPS has cratered. That means existing shareholder have been diluted 13% over the past two years due to stock given to execs/employees.

To wit, the company says (10k pg.39):

Now, what have the folks done with these shares? Are they holding them? Are they increasing their holdings in a bet on the future of the company? No, they are dumping them as fast as they get them. How does it affect you?

Lets say there are 1 million shares out there and the company earns $1M in 2012 (they won’t, they’ll lose money but play along w/me). That means their EPS is $1. slap a 50X earnings on that (insane multiple but again, play along) and you get a stock price of $50. Now same earnings but add in the 13% dilution from the stock grants insiders are dumping onto the market. Now we have 1.13 million shares and 1 million in earnings for an EPS of $88 a share. Same 50X insane multiple and you get a share price of $44. Get it now? Note: SalesForce will have a PE when FY 2012 is done of NM or “not measurable.” That is because there will be no “E” to divide into the “P.”

So, now that we have the effect, lets look under some rocks at SalesForce (CRM, Financial).

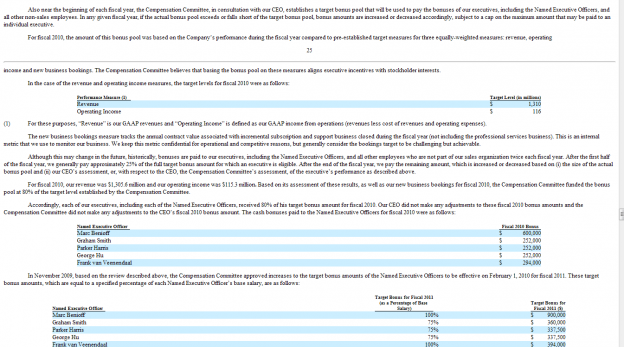

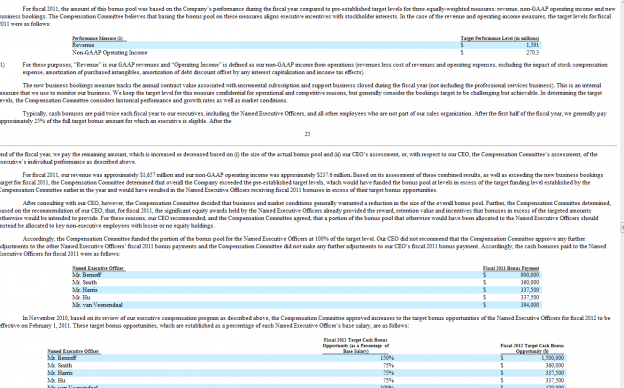

Here is some data on the cash bonuses doled out to execs (click to enlarge):

This is from the 2010 Proxy statement regarding exec. comp:

Here is the applicable wording:

The applicable wording here is (emphasis mine):

Oh … I see, the reason must be because operating income dropped from 2010s $115 million to $97 million in 2011, according to the recent 10K. Under the old bonus system, there would have been NO BONUS for that portion of the determination.

We also would be remiss if we did not note here that not only did we change the metric used to determine the granting of the bonus or not to one were would achieve, but we also increases to amount of the bonus by 50% (from 100% of salary to 150%). Given CEO Benioff’s salary for FY 2012, that means he is eligible for a cool 66% increase in his cash bonus for the year.

Anyone here wish they had a job they could change their bonus metrics around to make them a slam dunk no matter what the business conditions?? Yeah, yeah I know the CEO does not set the plan but do not kid yourself folks…he is the Chairman of the Board that selects the comp committee.

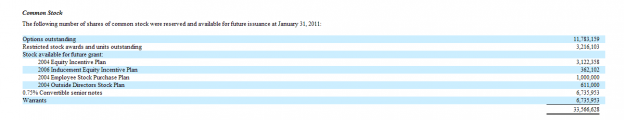

We should also talk about the Convertible notes the company issued. Why? Well in 2015 shareholders will get another 6.7million shares dumped on them as these bonds convert to shares:

Let’s get back to the stock options. Just how much is out there? According to the 10,000, 33,000,000 shares (note it can be increased at anytime by the Board as it has in the past):

That means shareholders still have a roughly 22% dilution coming from upcoming options (assuming no more increases which will not happen, there will be more and offset by any forfeitures). If we go back to our example from the beginning we find that our 1.13 million shares has now grown to 1.36 million shares and our EPS is now $.73 or 27% lower and out share price drops to $36.50 from the original $50. If we look at it another way, the company has to increase earnings 27% just to break even on an EPS level due to the dilution.

Do I begrudge SalesForce's execs for making money? Heck no. What I begrudge is the way they are doing it. It doesn’t pass the smell test. When you decide to report and highlight “non-GAAP” earnings rather than “GAAP” because the stock grants/options you have been heaping on people the past few years are coming due, and it is cratering your actual EPS, it doesn’t pass the smell test. When you in conjunction with that decide to alter execs bonus structure to make sure the fact EPS that is falling off a cliff does not interfere with their bonus, it doesn’t pass the smell test. When you then go on TV and do a victory lap while patting yourself on the back for a “great year” while EPS fell 25% and 2012 looks worse. were I a shareholder I would wonder what the heck Benioff was looking at.

Hanging your hat on being the “first to $2 billion in revenue” while operating earnings tank is a bit delusional. Think about it: $2 million in revenue for $97 million in operating income?

That means $0.05 of every dollar they bring in drops to operating earnings (that is before interest, taxes etc.). If that isn’t bad enough, $0.07 of every dollar still manages to find its way to stock comp. But it doesn’t really cost anything, does it.

Here is the thing. I start reading the annual reports and proxy statements and I keep getting stuck on the removal of “stock compensation” from GAAP earnings so the company can report positive EPS under “non-GAAP” earnings. This was removed in FY 2011 as GAAP EPS fell 25%; the change enabled them to say “non-GAAP” EPS fell only 7%. In FY 2012 they will lose money under GAAP earnings. This means EPS has actually fallen from $0.63 to $0.47 to ($0.02) since FY 2010. Meanwhile, “non-GAAP” or “earnings without all the expenses in them” will still fall, but they will at least show a “pretend” profit.

The argument comes down to whether or not stock comp is actually an expense. It is. Do not let anyone tell you different. Because of the stock comp, shares outstanding have risen from 128 million to 145 million in FY 2012. That is a 17 million or 13% increase in shares outstanding at a time when EPS has cratered. That means existing shareholder have been diluted 13% over the past two years due to stock given to execs/employees.

To wit, the company says (10k pg.39):

We recognized stock-based expense of $120.4 million, or 7 percent of revenue, during fiscal 2011. The requirement to expense stock-based awards will continue to materially reduce our reported results of operations. As of January 31, 2011, we had an aggregate of $559.8 million of stock compensation remaining to be amortized to expense over the remaining requisite service period of the underlying awards. We currently expect this stock compensation balance to be amortized as follows: $195.1 million during fiscal 2012; $157.9 million during fiscal 2013; $129.6 million during fiscal 2014; $76.8 million during fiscal 2015 and $0.4 million during fiscal 2016. These amounts reflect only outstanding stock awards as of January 31, 2011 and assume no forfeiture activity. We expect to continue to issue share-based awards to our employees in future periods, which will increase the stock compensation amortization in such future periods.So, they know it is an expense, it is just when they want to report earnings, they want to pretend it isn’t.

Now, what have the folks done with these shares? Are they holding them? Are they increasing their holdings in a bet on the future of the company? No, they are dumping them as fast as they get them. How does it affect you?

Lets say there are 1 million shares out there and the company earns $1M in 2012 (they won’t, they’ll lose money but play along w/me). That means their EPS is $1. slap a 50X earnings on that (insane multiple but again, play along) and you get a stock price of $50. Now same earnings but add in the 13% dilution from the stock grants insiders are dumping onto the market. Now we have 1.13 million shares and 1 million in earnings for an EPS of $88 a share. Same 50X insane multiple and you get a share price of $44. Get it now? Note: SalesForce will have a PE when FY 2012 is done of NM or “not measurable.” That is because there will be no “E” to divide into the “P.”

So, now that we have the effect, lets look under some rocks at SalesForce (CRM, Financial).

Here is some data on the cash bonuses doled out to execs (click to enlarge):

This is from the 2010 Proxy statement regarding exec. comp:

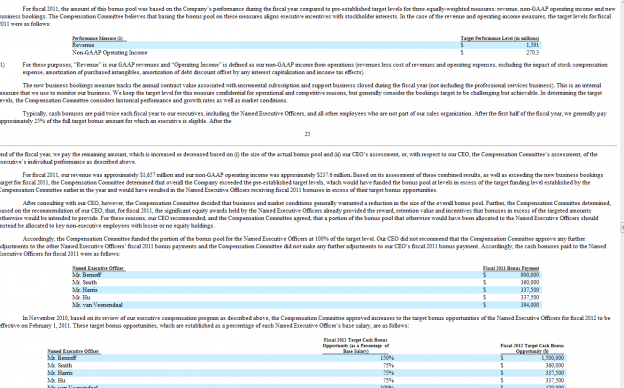

Here is the applicable wording:

For these purposes, “Revenue” is our GAAP revenues and “Operating Income” is defined as our GAAP income from operations (revenues less cost of revenues and operating expenses).Now lets flash forward just a year to the recently filed Proxy?

The applicable wording here is (emphasis mine):

For these purposes, “Revenue” is our GAAP revenues and “Operating Income” is defined as our non-GAAP income from operations (revenues less cost of revenues and operating expenses, excluding the impact of stock compensation expense, amortization of purchased intangibles, amortization of debt discount offset by any interest capitalization and income tax effects).Geez, I wonder why we switched from GAAP operating income to “non-GAAP” from 2010 to 2011?

Oh … I see, the reason must be because operating income dropped from 2010s $115 million to $97 million in 2011, according to the recent 10K. Under the old bonus system, there would have been NO BONUS for that portion of the determination.

We also would be remiss if we did not note here that not only did we change the metric used to determine the granting of the bonus or not to one were would achieve, but we also increases to amount of the bonus by 50% (from 100% of salary to 150%). Given CEO Benioff’s salary for FY 2012, that means he is eligible for a cool 66% increase in his cash bonus for the year.

Anyone here wish they had a job they could change their bonus metrics around to make them a slam dunk no matter what the business conditions?? Yeah, yeah I know the CEO does not set the plan but do not kid yourself folks…he is the Chairman of the Board that selects the comp committee.

We should also talk about the Convertible notes the company issued. Why? Well in 2015 shareholders will get another 6.7million shares dumped on them as these bonds convert to shares:

In January 2010, the Company issued at par value $575.0 million of 0.75% convertible senior notes due January 15, 2015 (the “Notes”). Interest is payable semi-annually in arrears on January 15 and July 15 of each year, commencing July 15, 2010.Now, lets look at how they account for the transaction (10K pg 75):

The Notes are governed by an Indenture dated as of January 19, 2010, between the Company, as issuer, and U.S. Bank National Association, as trustee. The Notes do not contain any financial covenants or any restrictions on the payment of dividends, the incurrence of senior debt or other indebtedness, or the issuance or repurchase of securities by the Company.

The notes are unsecured and rank senior in right of payment to the company’s future indebtedness that is expressly subordinated in right of payment to the notes and rank equal in right of payment to the company’s existing and future unsecured indebtedness that is not so subordinated and are effectively subordinated in right of payment to any of the company’s cash equal to the principal amount of the Notes, and secured indebtedness to the extent of the value of the assets securing such indebtedness and are structurally subordinated to all existing and future indebtedness and liabilities incurred by our subsidiaries, including trade payables.

If converted, holders will receive cash equal to the principal amount of the notes, and at the company’s election, cash and/or shares of the company’s common stock for any amounts in excess of the principal amounts.

The initial conversion rate is 11.7147 shares of common stock per $1,000 principal amount of cotes, subject to anti-dilution adjustments.

In accounting for the transaction costs related to the Note issuance, the Company allocated the total amount incurred to the liability and equity components. Transaction costs attributable to the liability component are being amortized to expense over the term of the Notes, and transaction costs attributable to the equity component were netted with the equity component in additional paid-in capital. Additionally, the Company recorded a deferred tax liability of $51.1 million in connection with the Notes.All perfectly legit under GAAP rules. But wait, lets look back at the above bonus calculation.

(revenues less cost of revenues and operating expenses, excluding the impact of stock compensation expense, amortization of purchased intangibles, amortization of debt discount ...)See it? They issue convertible debt that will dilute shareholders by another 6.7m shares (minus the net effect of hedging) and account for it properly according to GGAP. But when we account for it for their bonus, we strip the annual cost of the debt out of the determination so they can walk away with their money. So in essence shareholders are paying twice, once for the dilution and twice for cash bonuses they should not be paying. Pretty slick if you ask me.

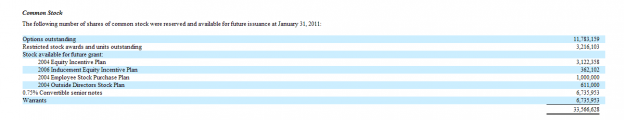

Let’s get back to the stock options. Just how much is out there? According to the 10,000, 33,000,000 shares (note it can be increased at anytime by the Board as it has in the past):

That means shareholders still have a roughly 22% dilution coming from upcoming options (assuming no more increases which will not happen, there will be more and offset by any forfeitures). If we go back to our example from the beginning we find that our 1.13 million shares has now grown to 1.36 million shares and our EPS is now $.73 or 27% lower and out share price drops to $36.50 from the original $50. If we look at it another way, the company has to increase earnings 27% just to break even on an EPS level due to the dilution.

Do I begrudge SalesForce's execs for making money? Heck no. What I begrudge is the way they are doing it. It doesn’t pass the smell test. When you decide to report and highlight “non-GAAP” earnings rather than “GAAP” because the stock grants/options you have been heaping on people the past few years are coming due, and it is cratering your actual EPS, it doesn’t pass the smell test. When you in conjunction with that decide to alter execs bonus structure to make sure the fact EPS that is falling off a cliff does not interfere with their bonus, it doesn’t pass the smell test. When you then go on TV and do a victory lap while patting yourself on the back for a “great year” while EPS fell 25% and 2012 looks worse. were I a shareholder I would wonder what the heck Benioff was looking at.

Hanging your hat on being the “first to $2 billion in revenue” while operating earnings tank is a bit delusional. Think about it: $2 million in revenue for $97 million in operating income?

That means $0.05 of every dollar they bring in drops to operating earnings (that is before interest, taxes etc.). If that isn’t bad enough, $0.07 of every dollar still manages to find its way to stock comp. But it doesn’t really cost anything, does it.