Canam (TSE: CAM) has dropped some 15% in the last few days, as the company reported a loss in its first quarter earnings results last week. However, Canam has been discussed on this site as a stock idea with long-term potential for gains due to its stable operating model and growing backlog. As a result, temporary pullbacks in the form of revenue timing issues appear to offer long-term investors an excellent buying opportunity.

While the market appears focused on the fact that revenue dropped from $180M to $105M in the first quarter (a large drop by any standard), it's important for long-term investors to look behind the numbers to understand the long-term implications. As a company that designs and builds large-ticket construction products that require long lead times, recessions will hit this company later than it will most. As a result, the slowdown in the economy that occurred in 2009 has only hit the company now. The important indicators for forward-looking shareholders, however, are the company's booking rates.

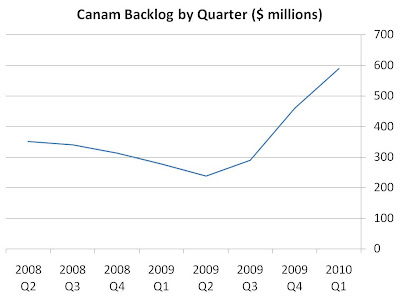

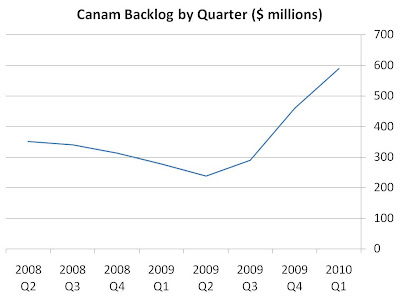

For Canam, booking rates have been out-pacing revenue, as the company's backlog is now at a record level, though the company has been in existence for 50 years! The company's backlog over the last several quarters is shown below:

There are two main reasons for the large backlog. First, the company has been building roofing installations for two large stadiums (BC Place in Vancouver and Marlins' Stadium in Miami), but isn't scheduled to start deliveryof those structures until the second quarter. (In this case, revenue cannot be booked until delivery has taken place.) These contracts alone are worth $180M; compare that to the company's first quarter revenue of $105M. In essence, revenue from the first quarter was simply pushed to revenues in future quarters, making first quarter revenue look poorer than it was, but making future quarters look better than they should.

Second, with prices depressed among competitors and complementary businesses, Canam has been at work acquiring companies, including Tennessee-based FabSouth, which added another $100M+ to the company's backlog. Since FabSouth was not fully consolidated in Canam's results until most of the first quarter was complete, these revenue numbers don't show the full impact of Canam's full business. But as the company works through its record backlog (and it expects to deliver all of its current backlog within a year), those revenue numbers will see strong sequential growth.

Investors focused only on quarterly earnings are sure to make poor decisions when it comes to making purchase decisions for the long-term. For companies dealing in large-ticket items, revenue timing issues can play a significant role in any one quarter's results. As such, it's important that investors think about the company's business from a long-term perspective to put themselves in a position to properly value a company's stock.

Disclosure: Author has a long position in shares of CAM

Saj Karsan

http://www.barelkarsan.com

Saj Karsan

http://www.barelkarsan.com