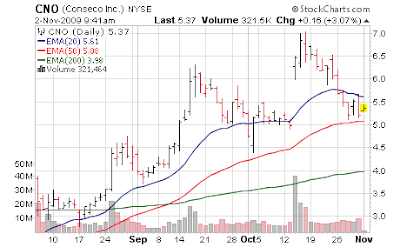

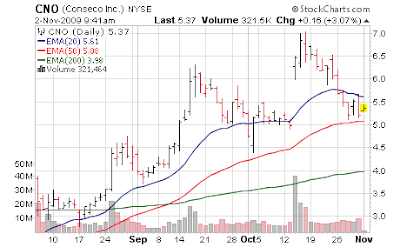

I have been following insurer, Conseco (CNO) for a good 4 months as I looked over potential "home run" plays (or on the other hand, a strike out) and was surprised to see hedge fund megastar John Paulson swoop in for a 9.9% stake about 3 weeks ago. I've been watching the name since, and it has given back all of the huge gain it experienced when news of the Paulson investment broke. (filled the gap) There is a nice entry point here, right above a key moving average - however the company reports Wednesday which will provide the normal hectic volatility so we're most likely going to sit and wait.

But as I look for new ideas this is high on my list, and now that the lemmings have been chased out of the stock - you can get it for the same price as before the Paulson news. With nearly a dollar of potential earnings, a return to "normalized" valuation once bankruptcy is thought to be completely off the table could offer some great returns - then again some of the future steps to continue to offset bankruptcy might include more dilution!

Conseco, Inc., through its subsidiaries, engages in the development, marketing, and administration of supplemental health insurance, annuity, individual life insurance, and other insurance products for senior and middle-income markets in the United States. The company operates in three segments: Bankers Life, Colonial Penn, and Conseco Insurance Group.

Here is an article from the day the news broke and why it is an important development to keep the company out of bankruptcy.

Aug 12, 2009: John Paulson Makes Bank of America 2nd Largest Holding after Gold]

No position but watching closely

Trader Mark

http://www.fundmymutualfund.com/

But as I look for new ideas this is high on my list, and now that the lemmings have been chased out of the stock - you can get it for the same price as before the Paulson news. With nearly a dollar of potential earnings, a return to "normalized" valuation once bankruptcy is thought to be completely off the table could offer some great returns - then again some of the future steps to continue to offset bankruptcy might include more dilution!

Conseco, Inc., through its subsidiaries, engages in the development, marketing, and administration of supplemental health insurance, annuity, individual life insurance, and other insurance products for senior and middle-income markets in the United States. The company operates in three segments: Bankers Life, Colonial Penn, and Conseco Insurance Group.

Here is an article from the day the news broke and why it is an important development to keep the company out of bankruptcy.

- Shares of insurer Conseco Inc. soared to a 12-month high Wednesday after it announced measures to significantly strengthen its balance sheet, including an $77.9 million investment from prominent hedge fund Paulson & Co.

- While the moves will dilute existing shareholders they will allow Conseco to retire debt and could help offset credit losses, FBR Capital Markets analyst Randy Binner said in a note to investors Wednesday. He upgraded Conseco to "outperform" from "market price" and raised his target price to $9 from $4.

- Analysts had said Conseco needed to find a solution to its $293 million in debt due in Sept. 2010, with one saying in April that the company might have to seek bankruptcy protection if unable to do so.

- "The vote of confidence by a widely known and well-regarded firm -- here in the form of a long-term equity investment -- should send a positive message," wrote Fox-Pitt Kelton analyst Paul Sarran in a research note Wednesday.

- On Tuesday night, Conseco announced a three-part plan to shore up its capital base.

- sell Paulson 16.4 million common shares and warrants to purchase 5 million additional shares for $77.9 million. That give Paulson a 9.9 percent stake in Conseco.

- sell $293 million in senior convertible debentures due 2016. The debt will be eligible to be converted into common stock after June 30, 2013.[b] Paulson will buy up to $200 million of the debentures. This debt will be used to purchase existing debt.

- plan a potential stock offering that would net Conseco about $200 million.

Aug 12, 2009: John Paulson Makes Bank of America 2nd Largest Holding after Gold]

No position but watching closely

Trader Mark

http://www.fundmymutualfund.com/