Corpay Inc (CPAY, Financial) recently experienced a daily loss of 6.99%, yet it has seen a modest 3-month gain of 3.79%. With an Earnings Per Share (EPS) of 13.44, the question arises: Is Corpay fairly valued in the current market? This article delves deep into Corpay's valuation, providing insights to inform your investment decisions.

Company Overview

Corpay, a prominent player in the S&P 500, specializes in corporate payment solutions that streamline business expenses related to vehicles, travel, and vendor payments. This not only saves time for its customers but also reduces their expenditure. With a current stock price of $283.22 and a market cap of $20.20 billion, our analysis begins by comparing these figures against the GF Value, an estimated fair value of $306.99, to gauge if Corpay stands as a worthwhile investment.

Understanding GF Value

The GF Value is a unique measure of a stock's intrinsic value, calculated using historical trading multiples, a GuruFocus adjustment factor based on past performance, and future business performance estimates. For Corpay, the GF Value suggests a fair trading benchmark. If a stock trades significantly above this line, it may be overvalued, and thus, potentially offer poorer future returns. Conversely, trading below this line could indicate undervaluation, suggesting a potentially higher return. Currently, Corpay's stock price aligns closely with its GF Value, indicating it is fairly valued.

Financial Strength and Stability

Assessing a company's financial strength is crucial to understanding its ability to withstand economic downturns. Corpay's cash-to-debt ratio stands at 0.19, which is lower than 85.56% of its peers in the Software industry. This indicates a moderate risk, with a financial strength rating of 5 out of 10. Such insights are vital for investors aiming to avoid permanent capital loss.

Profitability and Growth Prospects

Corpay has maintained profitability over the past decade, boasting a robust operating margin of 44.28%, which ranks better than 98.69% of its industry counterparts. With an impressive 3-year average annual revenue growth rate of 22.4%, Corpay not only outperforms 77.29% of its industry peers but also shows promising growth potential.

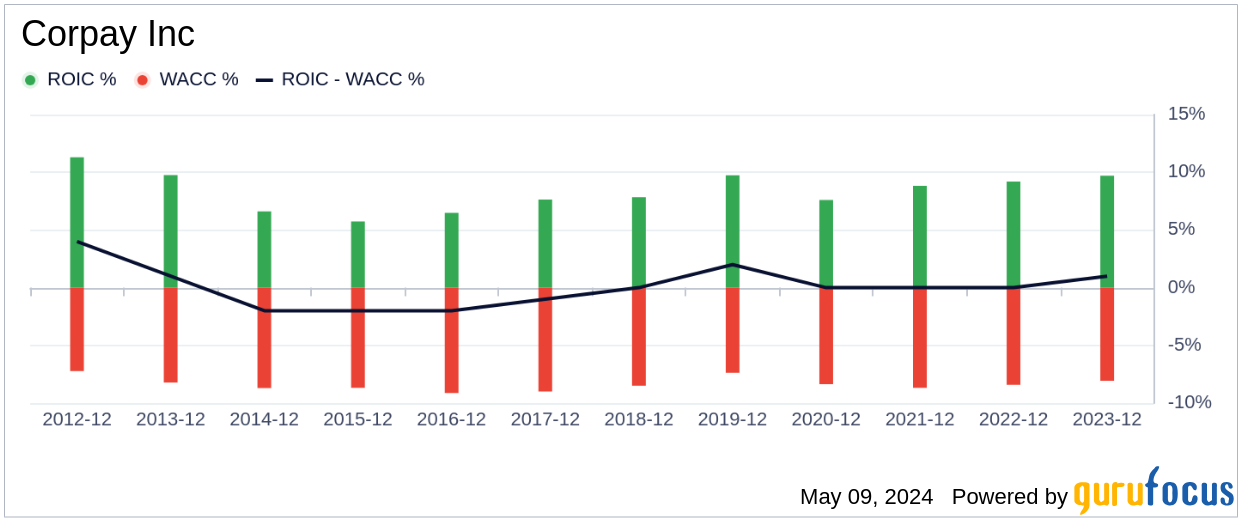

Investment Efficiency: ROIC vs. WACC

The efficiency of Corpay's investments can be gauged by comparing its Return on Invested Capital (ROIC) to its Weighted Average Cost of Capital (WACC). Currently, Corpay's ROIC is 9.8, surpassing its WACC of 8.38, indicating effective capital management that creates value for shareholders.

Conclusion

In summary, Corpay (CPAY, Financial) appears to be fairly valued, with strong financial health and profitability. The company's growth prospects look promising, making it a potentially stable investment. For more detailed financial data on Corpay, you can explore its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, consider using the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.