On April 23, 2024, JetBlue Airways Corp (JBLU, Financial) disclosed its first-quarter financial results through an 8-K filing, revealing a performance that fell short of analyst expectations on earnings per share but closely aligned with revenue forecasts. The company reported a significant net loss and a decline in operating revenue, reflecting the ongoing pressures in the airline industry and strategic shifts within the company.

JetBlue Airways Corp, a prominent low-cost airline known for its high-quality service and extensive network, operates primarily in the United States, the Caribbean, Latin America, Canada, and England. The airline's focus on cost-effective travel options and customer service has positioned it as a key player in the competitive aviation market.

Financial Performance Overview

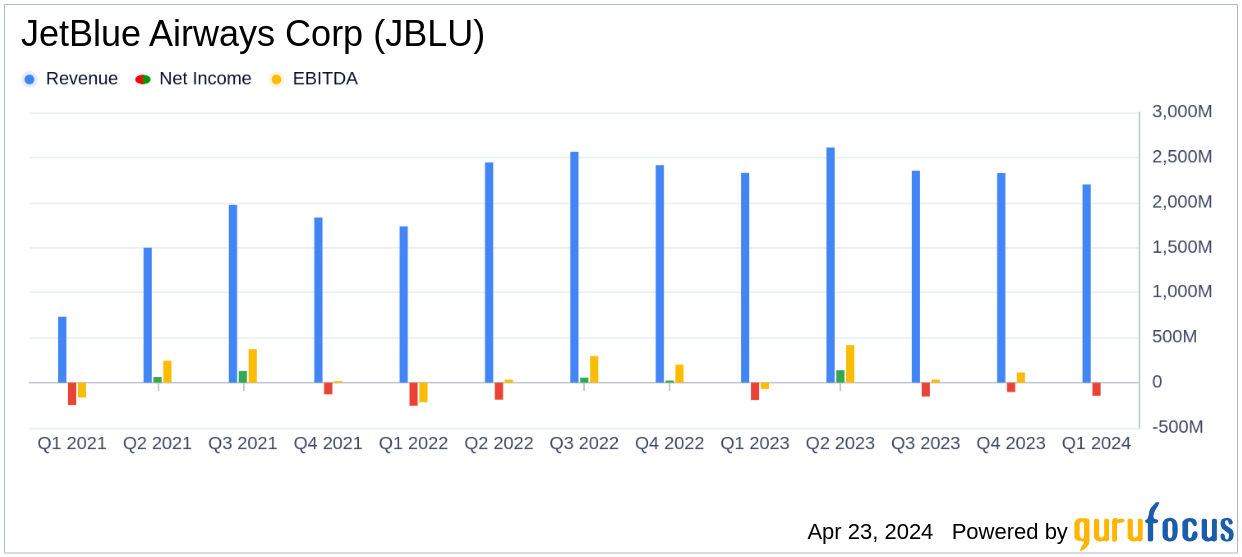

For Q1 2024, JetBlue reported a net loss of $716 million, or $2.11 per share, a substantial decline compared to the previous year. This performance was primarily driven by a 5.1% decrease in operating revenue, totaling $2.2 billion, and a 14.0% increase in operating expenses, amounting to $2.9 billion. The adjusted net loss was $145 million, or $0.43 per share, which was notably worse than the estimated loss of $0.52 per share and net income loss of $169.08 million projected by analysts.

The airline's strategic adjustments, including network optimization and cost-saving measures, have begun to show potential benefits, albeit not sufficient to offset the broader challenges. JetBlue has implemented significant network changes, such as reducing operations at Los Angeles International Airport and exiting unprofitable markets, which are expected to enhance operational efficiency and profitability in the long run.

Operational Highlights and Strategic Initiatives

Despite the financial setbacks, JetBlue has made progress in several areas. The airline has launched new routes, such as non-stop seasonal services to Dublin and Paris, and introduced revenue-enhancing initiatives like preferred seating options. These efforts are part of a broader strategy to focus on high-margin leisure markets and improve the customer experience.

Cost management remains a priority, with JetBlue achieving approximately $100 million in structural cost savings and expecting to reach up to $200 million by year-end. The fleet modernization program also contributed to cost efficiency, replacing older aircraft with new, more cost-effective models.

Challenges and Outlook

Looking ahead, JetBlue faces several challenges, including elevated capacity in its Latin region, which is expected to pressure revenue further. The airline's leadership remains focused on navigating these challenges through strategic adjustments and operational improvements.

For the remainder of 2024, JetBlue anticipates a continuation of revenue challenges but remains committed to its strategic initiatives aimed at returning to profitability. The airline's management is optimistic about the potential for recovery and long-term growth, supported by a disciplined approach to cost control and market positioning.

In conclusion, while JetBlue's Q1 2024 results reflect ongoing industry pressures and strategic transition pains, the airline's focused efforts on operational efficiency and market optimization provide a foundation for future stability and growth. Investors and stakeholders will likely watch closely as JetBlue continues to navigate a challenging market landscape.

Contact Information

For further details, JetBlue's Investor Relations can be reached at +1 718 709 2202 or via email at [email protected]. Corporate Communications is available at +1 718 709 3089 or [email protected].

Explore the complete 8-K earnings release (here) from JetBlue Airways Corp for further details.