Understanding the Dividend Dynamics of Reckitt Benckiser Group PLC

Reckitt Benckiser Group PLC (RBGLY, Financial) recently announced a dividend of $0.29 per share, payable on 2024-06-03, with the ex-dividend date set for 2024-04-11. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Reckitt Benckiser Group PLC's dividend performance and assess its sustainability.

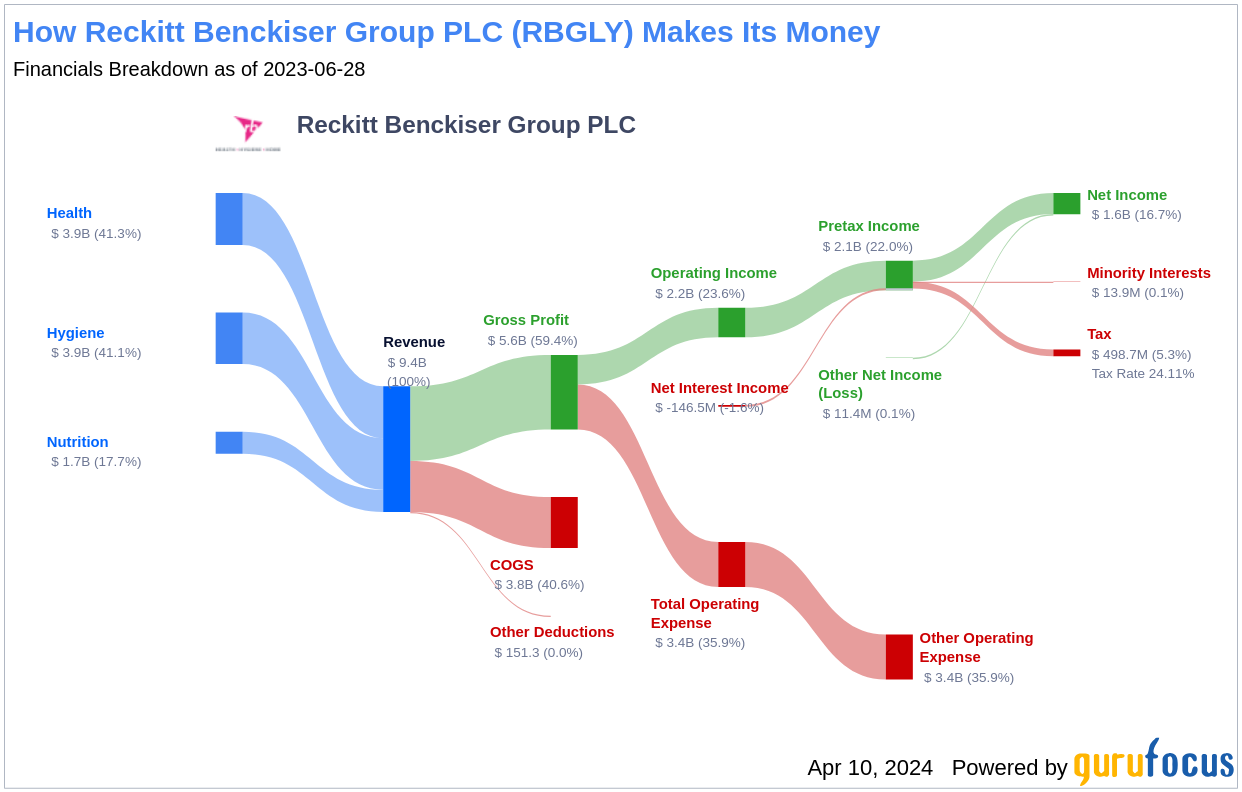

What Does Reckitt Benckiser Group PLC Do?

Reckitt Benckiser, formed in 1999 through a merger, has rebranded itself as Reckitt and boasts a robust portfolio of household and consumer health brands, including Lysol, Finish, Durex, and Mucinex. With a strong global presence, Reckitt has strategically entered the infant formula market through acquisitions and exited the food industry, positioning itself for growth in over 200 markets worldwide.

A Glimpse at Reckitt Benckiser Group PLC's Dividend History

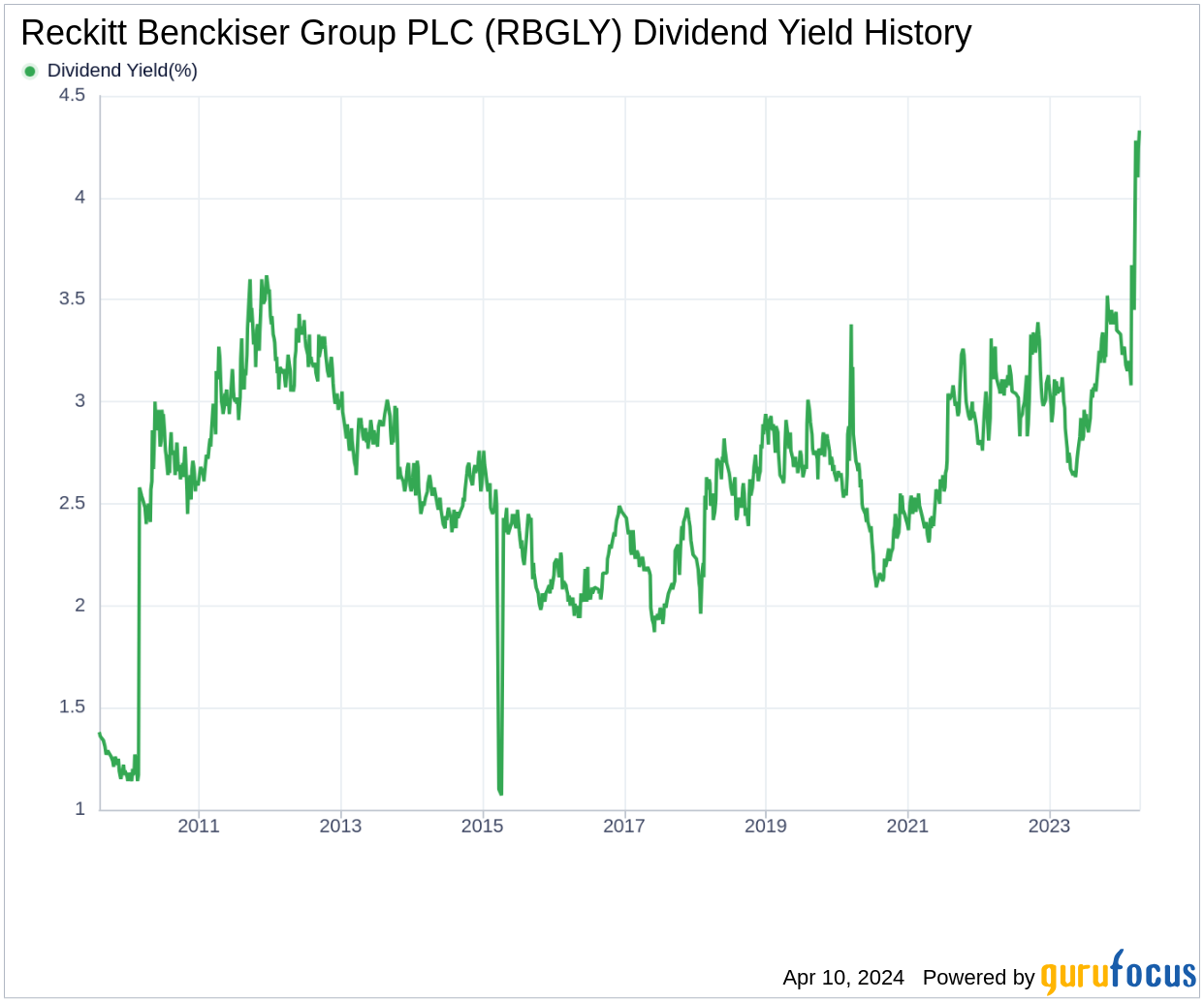

Reckitt Benckiser Group PLC has a history of consistent dividend payments since 2009, with bi-annual distributions. Observe the trend in annual Dividends Per Share to comprehend historical patterns.

Breaking Down Reckitt Benckiser Group PLC's Dividend Yield and Growth

Reckitt Benckiser Group PLC currently boasts a trailing dividend yield of 4.35% and a forward dividend yield of 4.56%, indicating an expected increase in dividend payments over the next year. The company's dividend yield is near a 10-year high and stands out in the Consumer Packaged Goods industry, making it an attractive option for income-focused investors.

Over the past three, five, and ten years, Reckitt Benckiser Group PLC has experienced varying dividend growth rates, with the 5-year yield on cost for the stock at approximately 4.71% as of today.

The Sustainability Question: Payout Ratio and Profitability

The sustainability of Reckitt Benckiser Group PLC's dividends can be gauged by examining the dividend payout ratio, which is currently 0.01, indicating strong potential for sustained dividends. The company's profitability rank further reinforces this view, with a score of 7 out of 10, reflecting good profitability prospects and consistent net profit over the past decade.

Growth Metrics: The Future Outlook

Reckitt Benckiser Group PLC's growth rank of 7 out of 10 signifies a positive growth trajectory. However, the company's revenue per share and 3-year revenue growth rate show mixed performance compared to global competitors. Despite underperformance in some areas, the company's impressive 3-year EPS growth rate and 5-year EBITDA growth rate suggest a capacity for sustaining dividends in the long term.

Concluding Thoughts on Reckitt Benckiser Group PLC's Dividend Profile

In conclusion, Reckitt Benckiser Group PLC presents a compelling dividend profile, with a history of consistent payments, an attractive yield, and a low payout ratio that bodes well for future sustainability. The company's profitability and growth metrics, despite some areas of underperformance, demonstrate a robust financial foundation capable of supporting ongoing dividend distributions. Investors seeking to explore further into high-dividend yield opportunities can leverage the tools available to GuruFocus Premium users, such as the High Dividend Yield Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.