Squarespace Inc (SQSP, Financial) released its 8-K filing on February 28, 2024, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its subscription-based website-building software and hosting services, has achieved a significant milestone by surpassing $1 billion in annual revenue for the first time in its 20-year history.

Financial Performance and Strategic Developments

Squarespace's revenue growth was driven by new customer acquisitions across markets and strong retention rates, highlighting the appeal of its comprehensive product offerings. The company's strategic moves, including the acquisition of Google Domains and the launch of Squarespace Payments, have broadened its ecosystem and accessibility to entrepreneurs at various stages of their business journey.

Despite the impressive revenue growth, Squarespace faced challenges, including a competitive market and the need to continuously innovate to retain and grow its customer base. The company's ability to turn a net loss in the previous year into a net income this year is a testament to its resilience and strategic focus.

Financial Highlights and Importance

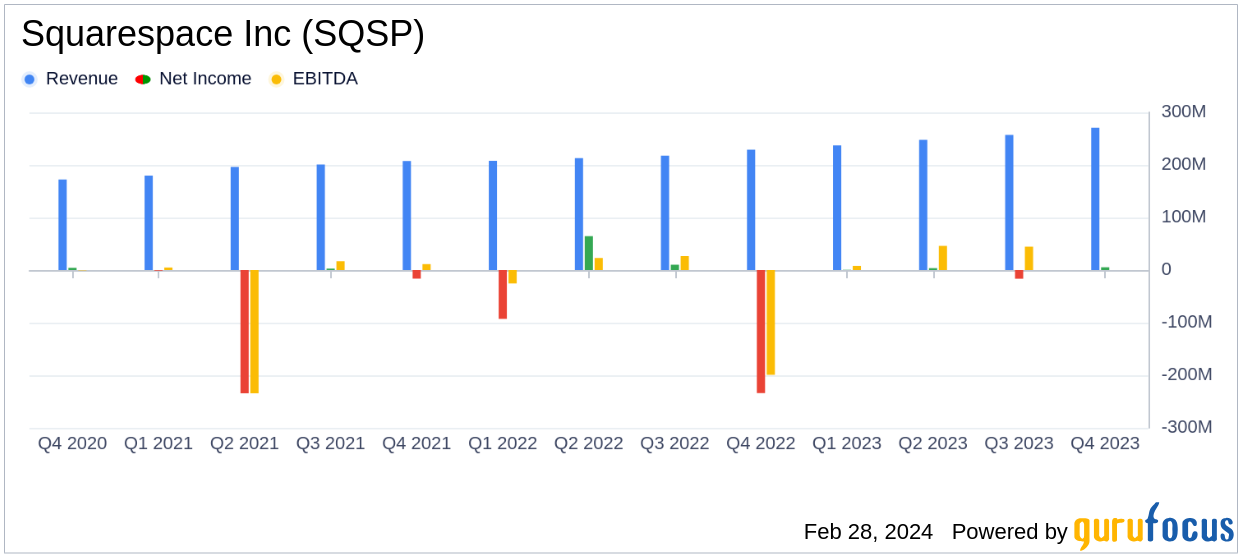

The 18% year-over-year revenue growth in Q4 and the 17% increase for the full year are particularly noteworthy for a company in the software industry, where consistent revenue growth is critical for long-term sustainability. The net income of $5.3 million in Q4, compared to a significant net loss in the same quarter of the previous year, indicates a strong turnaround in profitability, especially when considering the $225.2 million non-cash goodwill impairment charge included in the 2022 results.

The announcement of a $500 million share repurchase program signals management's confidence in the company's financial health and future prospects. This move is expected to deliver value to shareholders and reflects the company's commitment to prudent capital allocation.

Key Financial Metrics and Their Importance

Operating cash flow and unlevered free cash flow are critical indicators of a company's ability to generate cash from its core business operations. The significant increases in these metrics demonstrate Squarespace's improving operational efficiency and financial discipline. Adjusted EBITDA, another important measure of profitability, also showed a positive trend, indicating healthy underlying business performance.

The growth in unique subscriptions and the increase in ARPUS are vital metrics for Squarespace, as they reflect the company's success in expanding its customer base and its ability to monetize its services effectively. These metrics are crucial for assessing the company's market penetration and revenue potential.

Conclusion and Outlook

Overall, Squarespace's financial results reflect a company that is successfully navigating the challenges of a dynamic industry. With a focus on product innovation, strategic acquisitions, and a robust marketing strategy, Squarespace is well-positioned for continued growth. The company's guidance for the first quarter of fiscal year 2024 projects revenue growth of 16% to 17%, with non-GAAP unlevered free cash flow expected to be between $83 million and $86 million.

For value investors and potential GuruFocus.com members, Squarespace's latest earnings report suggests a company on the rise, with solid financials and strategic initiatives that could yield long-term benefits. As Squarespace continues to innovate and expand its offerings, it remains a company to watch in the software and online services sector.

Explore the complete 8-K earnings release (here) from Squarespace Inc for further details.