Evolent Health Inc (EVH, Financial) has recently caught the attention of investors with its notable stock performance. The company's market capitalization stands at a robust $3.88 billion, with the current stock price at $34.07. Over the past week, Evolent Health has seen a significant gain of 10.08%, and this upward trend extends over the past three months with a 15.30% increase. According to GuruFocus's valuation metrics, the stock is currently modestly undervalued with a GF Value of $39.74, up from a past GF Value of $37.38. This marks a positive shift from the previous valuation, which suggested investors should think twice as it was considered a possible value trap.

Introduction to Evolent Health Inc

Evolent Health Inc operates within the Healthcare Providers & Services industry, focusing on the transformation of healthcare delivery and payment. The company's primary aim is to assist health systems and physician organizations in transitioning to value-based care and population health management. Evolent Health operates through two main segments: EHS and Clinical Solutions. The EHS segment offers a comprehensive administrative and clinical platform for health plan administration and infrastructure for value-based business, while the Clinical Solutions segment caters to a wide range of clinical needs, including specialty care management in oncology, cardiology, and musculoskeletal markets. The majority of the company's revenue is generated from the Clinical Solutions segment, indicating its significant role in Evolent Health's business model.

Assessing Profitability

When it comes to profitability, Evolent Health Inc has a Profitability Rank of 4/10 as of September 30, 2023. The company's Operating Margin is currently at -1.74%, which is better than 34.36% of 649 companies in the same industry. Its ROE stands at -8.75%, surpassing 27.8% of its peers, while the ROA is at -3.96%, outperforming 33.78% of competitors. The ROIC is -0.84%, which is better than 37.41% of other companies in the industry. Over the past decade, Evolent Health has managed to achieve profitability in 2 years, which is more favorable than 19.08% of companies within the sector.

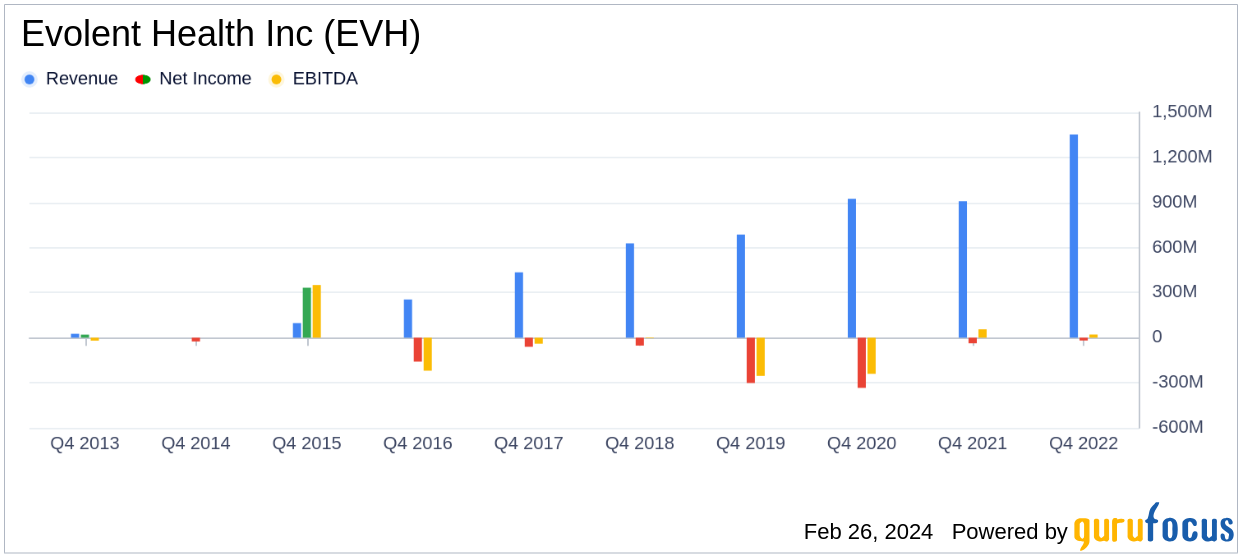

Exploring Growth Potential

Evolent Health's Growth Rank is impressive at 9/10. The company's 3-Year Revenue Growth Rate per Share is 20.00%, which is better than 74.41% of 555 companies in the industry. The 5-Year Revenue Growth Rate per Share is also strong at 14.90%, outperforming 74.42% of its peers. Looking ahead, the Total Revenue Growth Rate (Future 3Y To 5Y Est) is projected at an impressive 26.57%, surpassing 92.91% of the industry. The 3-Year EPS without NRI Growth Rate is at 41.80%, better than 85.07% of competitors, and the 5-Year EPS without NRI Growth Rate is at 32.90%, exceeding 82.65% of similar companies.

Investor Holdings

Notable investors have taken significant positions in Evolent Health. The Vanguard Health Care Fund (Trades, Portfolio) holds 3,351,619 shares, accounting for 2.92% of the share percentage. Steven Cohen (Trades, Portfolio) follows closely with 2,675,000 shares, representing 2.33% of the company's shares. Ray Dalio (Trades, Portfolio) also has a stake in Evolent Health, with 204,377 shares, making up 0.18% of the share percentage. These holdings by prominent investors underscore the confidence in Evolent Health's market position and future prospects.

Competitive Landscape

In comparison to its competitors, Evolent Health stands out with its market cap of $3.88 billion. Teladoc Health Inc (TDOC, Financial) has a market cap of $2.42 billion, Progyny Inc (PGNY, Financial) is valued at $3.71 billion, and Privia Health Group Inc (PRVA, Financial) comes in at $2.3 billion. These figures highlight Evolent Health's strong position within the Healthcare Providers & Services industry.

Conclusion

In summary, Evolent Health Inc's stock performance has been robust, with a 15.30% gain over the past three months and a current valuation that suggests the stock is modestly undervalued. The company's profitability metrics, while not stellar, are competitive within the industry, and its growth prospects are particularly strong, as evidenced by its high Growth Rank and projected revenue growth rates. The positions held by major investors like the Vanguard Health Care Fund (Trades, Portfolio), Steven Cohen (Trades, Portfolio), and Ray Dalio (Trades, Portfolio) further validate the company's potential. When compared to its key competitors, Evolent Health's market cap indicates a solid standing in the market. Value investors may find Evolent Health an attractive option, considering its growth trajectory and current market valuation.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: