RB Global Inc (RBA, Financial) has experienced a notable uptick in its stock performance over the recent months. With a current market capitalization of $13.63 billion, the company's stock price stands at $74.83. Despite a minor setback of -1.11% over the past week, RB Global has seen an impressive gain of 10.97% over the past three months. According to the GF Value, the stock is currently modestly undervalued at a GF Value of $91.92, up slightly from the past GF Value of $91.71. This valuation suggests that investors may still have an opportunity to invest in the company at a price less than its intrinsic value.

Introduction to RB Global Inc

RB Global Inc operates as the world's premier auctioneer for heavy equipment, catering to a diverse range of sectors with a significant global footprint. The company's evolution from a traditional live auctioneer to a powerhouse in the sale of industrial, construction, agricultural, oilfield, and transportation equipment has been remarkable. RB Global's expansive network includes over 40 live auction sites across more than 12 countries, complemented by online platforms such as IronPlanet, Marketplace-E, and GovPlanet. With a focus on both large-scale and smaller, more localized auctions, RB Global conducts over 300 auctions annually, moving approximately $6 billion worth of equipment.

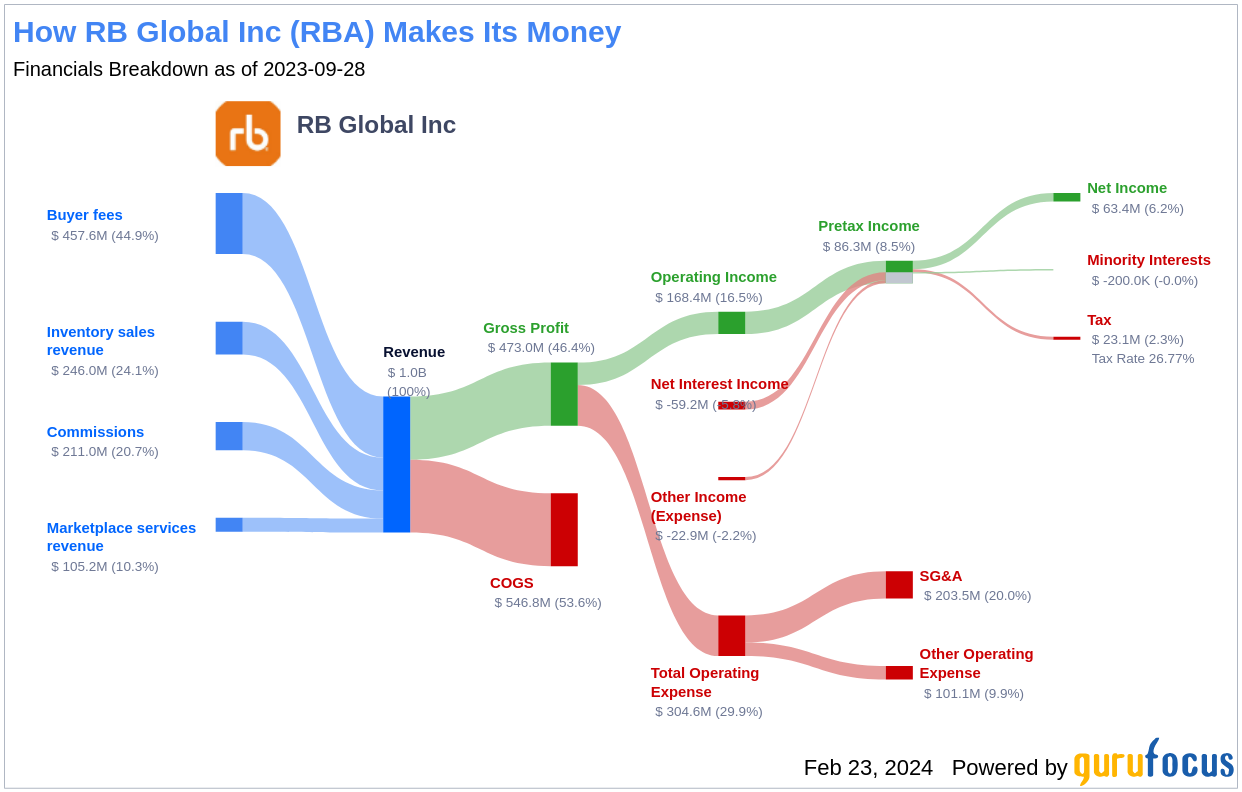

Assessing Profitability

RB Global's financial health is robust, as indicated by its high Profitability Rank of 9/10. The company's operating margin stands at an impressive 18.79%, outperforming 84.39% of 1070 companies in the industry. Its Return on Equity (ROE) is 4.45%, surpassing 35.82% of its peers, while the Return on Assets (ROA) at 2.00% is better than 38.74% of competitors. Furthermore, RB Global's Return on Invested Capital (ROIC) of 6.14% is higher than 51.1% of similar companies. These figures are a testament to the company's consistent profitability over the past decade, a feat achieved by less than 1% of companies in the sector.

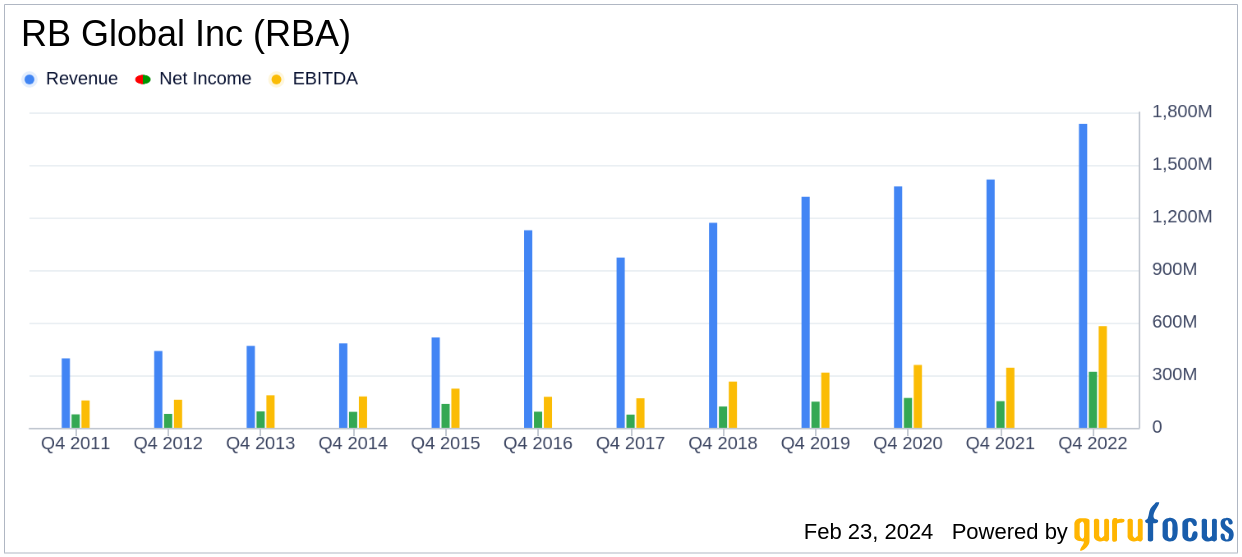

Growth Trajectory of RB Global

RB Global's growth metrics are equally impressive, with a perfect Growth Rank of 10/10. The company has maintained a 3-Year Revenue Growth Rate per Share of 10.00%, outpacing 65.61% of 974 companies in the industry. Its 5-Year Revenue Growth Rate per Share is even higher at 10.30%, surpassing 72.53% of 859 companies. Looking ahead, the estimated Total Revenue Growth Rate for the next 3 to 5 years is 6.22%, which is more favorable than 50.3% of 165 companies. The 3-Year EPS without NRI Growth Rate stands at 16.10%, and the 5-Year EPS without NRI Growth Rate is an impressive 24.00%, both indicating strong future prospects for the company.

Key Shareholders in RB Global

RB Global's shareholder base includes notable investors such as Steven Cohen (Trades, Portfolio), who holds 834,735 shares, representing 0.46% of the company. Chuck Royce (Trades, Portfolio) comes in second with 532,693 shares, accounting for 0.29%, followed by Murray Stahl (Trades, Portfolio) with 92,529 shares, making up 0.05% of the company. The involvement of these significant shareholders underscores the confidence in RB Global's market position and growth potential.

Competitive Landscape

When compared to its competitors, RB Global stands out with a substantial market capitalization of $13.63 billion. Its closest competitors in the Business Services industry include GDI Integrated Facility Services Inc (TSX:GDI, Financial) with a market cap of $671.964 million, Calian Group Ltd (TSX:CGY, Financial) at $518.532 million, and Information Services Corp (TSX:ISV, Financial) with $308.855 million. RB Global's dominant market cap reflects its leading position and competitive advantage in the sector.

Conclusion

In summary, RB Global Inc's recent stock performance, with an 11% gain over the past quarter, is underpinned by its strong profitability and growth prospects. The company's valuation suggests it is modestly undervalued, presenting a potential opportunity for investors. RB Global's significant market cap compared to its competitors, along with the confidence shown by its key shareholders, positions the company favorably for continued success. As the world's largest auctioneer for heavy equipment, RB Global's expansive operations and strategic online presence are likely to drive its performance in the foreseeable future.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.