From Professor Damodaran's blog:

The Twitter IPO: Thoughts on the IPO End Game

The Twitter IPO moved into its final phase, with the announcement last week of the preliminary pricing estimates per share and details of the offering. The company surprised many investors by setting an offering price of $17 to $20 per share, at the low end of market expectations, and pairing it with a plan to sell 70 million shares. Having posted on my estimate of Twitter’s price when the IPO was first announced and following up with my estimate of value, when the company filed its prospectus (S-1) with Twitter, I thought it would make sense to both update my valuation, with the new information that has emerged since, and to try to make sense of the pricing game that Twitter and its bankers are playing.

Updated valuation

In my original valuation of Twitter, just over a month ago, I used the Twitter's initial S-1 filing which contained information through the first two quarters of 2013 (ending June 30, 2013) and the rough details of what investors expected the IPO proceeds to be. Since then, Twitter has released three amended filings with the most recent one containing third quarter operating details and share numbers that reflect changes since June 30. Incorporating the information in this filing as well as the offering details contained in the report leads me to a (mostly minor) reassessment of my estimate of Twitter’s value.

Operating Results: Twitter’s third quarter report contained both good news and bad news. The good news was that revenue growth continued to accelerate, with revenues more than doubling relative to revenues in the same quarter in 2012, but it was accompanied by losses, which also surged. The table below compares the trailing 12-month values of key operating metrics from June 2013 (that I used in my prior valuation) with the updated values using the September 2013 reports:

As with prior periods, the R&D expense was a major reason for the reported losses and capitalizing that value does make the company very mildly profitable. Note that while the numbers have shifted significantly, there is little in the report that would lead me to reassess my narrative for the company: it remains a young company with significant growth potential in a competitive market. Consequently, my targeted revenues in 2023 ($11.2 billion) and the operating margin estimates (25%) for the company remain close to my initial estimates (October 5).

IPO proceeds: In the most recent filing, the company announced its intent to issue 70 million shares, with the option to increase that number by 10.5 million shares. In conjunction with the price range of $17-$20 that is also specified, that implies that the proceeds from the offering will range anywhere from $1.19 billion (70 million shares at $17/share) at the low end to $1.61 billion (80.5 million shares at $20/share) at the high end. In my valuation, I will assume that the offering will happen at the mid-range price ($18.50) and that the option to expand the offering will not be utilized, leading to an expected proceeds of $1.295 billion.

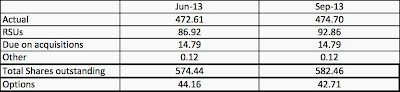

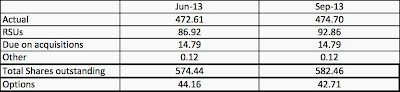

Share number: As with most young companies, the share number is a moving target as options get exercised and new shares are issued to employees and to fund acquisitions. In the table below, I compare the share numbers (actual, RSU and options) from the first S-1 filing with those in the most recent filing:

The share count has increased by about 8.02 million shares, since the last filing, while there has been a slight drop off in options outstanding. (Note: The most recent filing also references 80.3 million shares for future issuance to cover equity incentive & ESOP plans that I have not counted.)

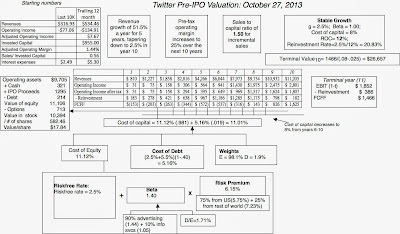

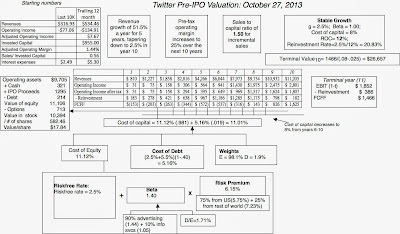

The final valuation is contained in this spreadsheet, but it has changed little from my original estimate, with the value per share increasing to $17.84/share from my original estimate of $17.36/share. The picture is below:

Reading the pricing tea leaves

Now that the company (and its bankers) have announced a price range ($17-$20) that is close to my estimate of value, my ego, of course, wants me to believe that this is a testimonial to my valuation skills but I know better. There is a fairy tale scenario, where my value is right, Goldman Sachs has come up with a value very close to mine and the market price happens to reflect that value. It is a fantasy for a simple reason. As I noted in my price versus value post, the IPO process has little to do with value and everything to do with price, and given how the market is pricing other social media companies, I find it difficult to believe that price and value have magically converged, with Twitter.

Continue reading here.

The Twitter IPO: Thoughts on the IPO End Game

The Twitter IPO moved into its final phase, with the announcement last week of the preliminary pricing estimates per share and details of the offering. The company surprised many investors by setting an offering price of $17 to $20 per share, at the low end of market expectations, and pairing it with a plan to sell 70 million shares. Having posted on my estimate of Twitter’s price when the IPO was first announced and following up with my estimate of value, when the company filed its prospectus (S-1) with Twitter, I thought it would make sense to both update my valuation, with the new information that has emerged since, and to try to make sense of the pricing game that Twitter and its bankers are playing.

Updated valuation

In my original valuation of Twitter, just over a month ago, I used the Twitter's initial S-1 filing which contained information through the first two quarters of 2013 (ending June 30, 2013) and the rough details of what investors expected the IPO proceeds to be. Since then, Twitter has released three amended filings with the most recent one containing third quarter operating details and share numbers that reflect changes since June 30. Incorporating the information in this filing as well as the offering details contained in the report leads me to a (mostly minor) reassessment of my estimate of Twitter’s value.

Operating Results: Twitter’s third quarter report contained both good news and bad news. The good news was that revenue growth continued to accelerate, with revenues more than doubling relative to revenues in the same quarter in 2012, but it was accompanied by losses, which also surged. The table below compares the trailing 12-month values of key operating metrics from June 2013 (that I used in my prior valuation) with the updated values using the September 2013 reports:

As with prior periods, the R&D expense was a major reason for the reported losses and capitalizing that value does make the company very mildly profitable. Note that while the numbers have shifted significantly, there is little in the report that would lead me to reassess my narrative for the company: it remains a young company with significant growth potential in a competitive market. Consequently, my targeted revenues in 2023 ($11.2 billion) and the operating margin estimates (25%) for the company remain close to my initial estimates (October 5).

IPO proceeds: In the most recent filing, the company announced its intent to issue 70 million shares, with the option to increase that number by 10.5 million shares. In conjunction with the price range of $17-$20 that is also specified, that implies that the proceeds from the offering will range anywhere from $1.19 billion (70 million shares at $17/share) at the low end to $1.61 billion (80.5 million shares at $20/share) at the high end. In my valuation, I will assume that the offering will happen at the mid-range price ($18.50) and that the option to expand the offering will not be utilized, leading to an expected proceeds of $1.295 billion.

Share number: As with most young companies, the share number is a moving target as options get exercised and new shares are issued to employees and to fund acquisitions. In the table below, I compare the share numbers (actual, RSU and options) from the first S-1 filing with those in the most recent filing:

The share count has increased by about 8.02 million shares, since the last filing, while there has been a slight drop off in options outstanding. (Note: The most recent filing also references 80.3 million shares for future issuance to cover equity incentive & ESOP plans that I have not counted.)

The final valuation is contained in this spreadsheet, but it has changed little from my original estimate, with the value per share increasing to $17.84/share from my original estimate of $17.36/share. The picture is below:

Reading the pricing tea leaves

Now that the company (and its bankers) have announced a price range ($17-$20) that is close to my estimate of value, my ego, of course, wants me to believe that this is a testimonial to my valuation skills but I know better. There is a fairy tale scenario, where my value is right, Goldman Sachs has come up with a value very close to mine and the market price happens to reflect that value. It is a fantasy for a simple reason. As I noted in my price versus value post, the IPO process has little to do with value and everything to do with price, and given how the market is pricing other social media companies, I find it difficult to believe that price and value have magically converged, with Twitter.

Continue reading here.