TJX Companies (TJX) is the largest international apparel and home decor off-price department store chain in the United States, bringing home over $25 billion in revenue last year. The company operates with four separate segments: Marmaxx, HomeGoods, TJX Canada, and TJX Europe. The company operates its retail locations under the T.J. Maxx, Marshalls, HomeGoods, Winners, HomeSense, T.K. Maxx, and Sierra Trading Post trademarks. TJX Companies also sells products through the website SierraTradingPost.com in the United States.

In early 2011, TJX Companies completed a consolidation of their once operated A.J. Wright Division. This consolidation converted 91 A.J. Wright stores into T.J. Maxx, Marshalls or HomeGoods brands, and closed the remaining 71 stores, as well as A.J. Wright’s two distribution centers and home office.

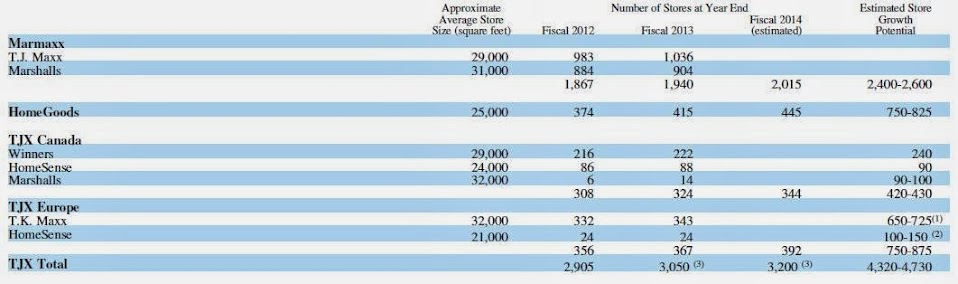

At the end of Februrary, 2013, TJX Companies operated 1,036 T.J. Maxx locations, 904 Marshalls locations, 415 HomeGoods locations, and 4 Sierra Trading Post store in the United States. The company also maintained 222 Winners locations, 88 HomeSense locations, and 14 Marshalls stores in Canada; and 343 T.K. Maxx store, as well as 24 HomeSense store in Europe. In comparison, at the beginning of August, 2013 (5 months later), TJX Companies operated 1,052 T.J. Maxx stores, 914 Marshalls stores, and 430 HomeGoods locations in the United States. The company’s international stores saw the same type of increase as well.

With over 3,000 locations worldwide, TJX Companies has enormous buying power. The company strives to offer prices that are usually 20% to 60% lower than department and specialty store prices, and believes that it offers a competitive advantage by offering a constantly changing assortment of quality brand name and designer merchandise at these prices. TJX takes advantage of over 16,000 vendors worldwide. The company is able to offer these low prices by purchasing their goods during a different buying cycle than most department stores. TJX normally makes purchases for the current season, as opposed to purchasing before the season begins, and takes advantage of closeouts and cancelled orders from other department stores This enables them to purchase at great discounts.

Financial Strength

TJX drives growth primarily by opening new locations worldwide. From fiscal year 2013 through fiscal year 2015, the company is hoping to increase retail square footage by 4-5%. During the same time period, the company is expecting to see a 2% growth in consolidated same-store sales. In fiscal year 2013 alone, total retail square footage increased by roughly 4% with the addition of 147 locations, and consolidated same-store sales rose 7% due to an increase in customer traffic. TJX’s fiscal year ends on the last Saturday in January. TJX Corporation has stated that they believe the current United States market is able to sustain at least 2,400 Marmaxx and 750 HomeGoods locations. The company also believes that there is potential for 240 Winners stores, 90 HomeSense locations, and 90 to 100 Marshalls locations in Canada, as well as roughly 650 T.K. Maxx locations, and 100 to 150 HomeSense stores with their current European markets.

With their business model, TJX locations have to constantly replenish and refresh its stores with exciting merchandise to drive same-store sales. One could consider this a great risk because the company’s entire inventory is essentially liquid, purchasing during current market trends. Quantity, timing, and the basic nature of inventory flowing into the stores on a constant basis can all be viewed as risks, but clearly the company has been doing it and doing it right for quite some time. Check out the consistent growth in their five-year price chart:

TJX Corporation has an impressive operating margin of 12.02% and a net profit margin of 7.47%. Revenue growth over the last 10 years has been 10.8%, with FCF growth of 20.2% over the same time period. The company’s Book Value growth has been 13.8% over the last 10 years as well.

TJX has put up over $26 billion in revenue over the last 12 months. With a cost of goods sold at around $19 billion, the company is raking in over $7 billion of gross profit. The company currently has over $2 billion in cash alone, even after their recent $200 million acquisition. TJX has also seen pretty consistent growth year over year in almost every category.

This consistent year over year growth can also be seen through the company’s U.S. segment with increases in net sales, stores opened, and selling square footage.

TJX has also been authorizing hefty share repurchases. Under the company’s repurchase program, TJX has spent $1.3 billion to repurchase 30.6 million shares in fiscal year 2013, $1.37 billion for 49.7 million shares in fiscal 2012, and $1.201 billion to repurchase 55.1 million shares in fiscal 2011. In February of 2013, the company’s board of directors authorized an additional $1.5 billion in repurchases for fiscal year 2014. The company has stated that they plan to repurchase between $1.3 billion and $1.4 billion throughout the year.

Management

With a Return on Assets of 21.54%, Return on Equity of 55.22%, and a Return on Invested Capital of 33.61%, the company’s management has been pretty effective at reinvesting earnings. In fact, the company’s Return on Equity is greater than 99% of competitors in the Retail Apparel Industry.

Like most companies, Chief Executive Officer Carol Meyrowitz’s pay is based on performance. Looking at the CEO’s pay over the last five year, I’d say they’ve been performing pretty well.

Valuation

Using the conventional P/E method, we can subtract the company’s current $2.09 billion in cash from their $39.75 billion market cap, showing that the company’s actual operations can be bought for $37.66 billion. With [url=http://www.gurufocus.com/stock/TJX]TJX’s net income of $1.999 billion (TTM), the company is technically trading at a P/E of 18.84x as opposed to the current 20.40x.

If we were to use Graham’s calculation of intrinsic value, we can take the TTM EPS of 2.55 multiplied by 8.5 + 2 times the estimated growth rate over the next 7-10 years (I’m using 11% here, which is actually pretty conservative speaking as how the past 10 years they have averaged 17.3% EPS growth). We then multiply this number by 4.4, and divide the total by today’s AAA Corporate Bond Rate (4.93). Here is Graham’s formula:

This brings us to a conservative (in my opinion, due to the discounted growth estimate) intrinsic value of $69.41. Not bad, right?

Catalysts

I believe the biggest catalyst to an increase in growth for the company is their growing opportunity to be able to offer e-commerce options to reach new customers and expand their product offering. By doing this, [uTJX will be able to compliment their in-store sales with their online sales, rather than hurting their brick-and-mortar locations. Ever since the company’s fiscal year 2011, they have been testing off-priced e-commerce sales with its T.K. Maxx brand in the United Kingdom. In fiscal year 2013, the company began the development of a United States based e-commerce platform. In December of 2012, TJX Corporation acquired Sierra Trading Post for $200 million in cash. Sierra was a privately held off-price Internet retailer of apparel and home decor. Sierra had over $200 million in revenue annually, which means that TJX was able to purchase the company for 1x annual revenue.

End Notes

What are you thoughts? Is the company a good buy right now?

Disclosure: No current position held at the time of writing.

Disclaimer: The opinions and ideas in this article are for informational and educational purposes only. They are not a recommendation to buy or sell any stock at any given time. As always, it is imperative for each individual investor to do their own due diligence and perform their own research on any and all stocks before making an investment decision.

In early 2011, TJX Companies completed a consolidation of their once operated A.J. Wright Division. This consolidation converted 91 A.J. Wright stores into T.J. Maxx, Marshalls or HomeGoods brands, and closed the remaining 71 stores, as well as A.J. Wright’s two distribution centers and home office.

At the end of Februrary, 2013, TJX Companies operated 1,036 T.J. Maxx locations, 904 Marshalls locations, 415 HomeGoods locations, and 4 Sierra Trading Post store in the United States. The company also maintained 222 Winners locations, 88 HomeSense locations, and 14 Marshalls stores in Canada; and 343 T.K. Maxx store, as well as 24 HomeSense store in Europe. In comparison, at the beginning of August, 2013 (5 months later), TJX Companies operated 1,052 T.J. Maxx stores, 914 Marshalls stores, and 430 HomeGoods locations in the United States. The company’s international stores saw the same type of increase as well.

With over 3,000 locations worldwide, TJX Companies has enormous buying power. The company strives to offer prices that are usually 20% to 60% lower than department and specialty store prices, and believes that it offers a competitive advantage by offering a constantly changing assortment of quality brand name and designer merchandise at these prices. TJX takes advantage of over 16,000 vendors worldwide. The company is able to offer these low prices by purchasing their goods during a different buying cycle than most department stores. TJX normally makes purchases for the current season, as opposed to purchasing before the season begins, and takes advantage of closeouts and cancelled orders from other department stores This enables them to purchase at great discounts.

Financial Strength

TJX drives growth primarily by opening new locations worldwide. From fiscal year 2013 through fiscal year 2015, the company is hoping to increase retail square footage by 4-5%. During the same time period, the company is expecting to see a 2% growth in consolidated same-store sales. In fiscal year 2013 alone, total retail square footage increased by roughly 4% with the addition of 147 locations, and consolidated same-store sales rose 7% due to an increase in customer traffic. TJX’s fiscal year ends on the last Saturday in January. TJX Corporation has stated that they believe the current United States market is able to sustain at least 2,400 Marmaxx and 750 HomeGoods locations. The company also believes that there is potential for 240 Winners stores, 90 HomeSense locations, and 90 to 100 Marshalls locations in Canada, as well as roughly 650 T.K. Maxx locations, and 100 to 150 HomeSense stores with their current European markets.

With their business model, TJX locations have to constantly replenish and refresh its stores with exciting merchandise to drive same-store sales. One could consider this a great risk because the company’s entire inventory is essentially liquid, purchasing during current market trends. Quantity, timing, and the basic nature of inventory flowing into the stores on a constant basis can all be viewed as risks, but clearly the company has been doing it and doing it right for quite some time. Check out the consistent growth in their five-year price chart:

TJX Corporation has an impressive operating margin of 12.02% and a net profit margin of 7.47%. Revenue growth over the last 10 years has been 10.8%, with FCF growth of 20.2% over the same time period. The company’s Book Value growth has been 13.8% over the last 10 years as well.

TJX has put up over $26 billion in revenue over the last 12 months. With a cost of goods sold at around $19 billion, the company is raking in over $7 billion of gross profit. The company currently has over $2 billion in cash alone, even after their recent $200 million acquisition. TJX has also seen pretty consistent growth year over year in almost every category.

This consistent year over year growth can also be seen through the company’s U.S. segment with increases in net sales, stores opened, and selling square footage.

TJX has also been authorizing hefty share repurchases. Under the company’s repurchase program, TJX has spent $1.3 billion to repurchase 30.6 million shares in fiscal year 2013, $1.37 billion for 49.7 million shares in fiscal 2012, and $1.201 billion to repurchase 55.1 million shares in fiscal 2011. In February of 2013, the company’s board of directors authorized an additional $1.5 billion in repurchases for fiscal year 2014. The company has stated that they plan to repurchase between $1.3 billion and $1.4 billion throughout the year.

Management

With a Return on Assets of 21.54%, Return on Equity of 55.22%, and a Return on Invested Capital of 33.61%, the company’s management has been pretty effective at reinvesting earnings. In fact, the company’s Return on Equity is greater than 99% of competitors in the Retail Apparel Industry.

Like most companies, Chief Executive Officer Carol Meyrowitz’s pay is based on performance. Looking at the CEO’s pay over the last five year, I’d say they’ve been performing pretty well.

Valuation

Using the conventional P/E method, we can subtract the company’s current $2.09 billion in cash from their $39.75 billion market cap, showing that the company’s actual operations can be bought for $37.66 billion. With [url=http://www.gurufocus.com/stock/TJX]TJX’s net income of $1.999 billion (TTM), the company is technically trading at a P/E of 18.84x as opposed to the current 20.40x.

If we were to use Graham’s calculation of intrinsic value, we can take the TTM EPS of 2.55 multiplied by 8.5 + 2 times the estimated growth rate over the next 7-10 years (I’m using 11% here, which is actually pretty conservative speaking as how the past 10 years they have averaged 17.3% EPS growth). We then multiply this number by 4.4, and divide the total by today’s AAA Corporate Bond Rate (4.93). Here is Graham’s formula:

This brings us to a conservative (in my opinion, due to the discounted growth estimate) intrinsic value of $69.41. Not bad, right?

Catalysts

I believe the biggest catalyst to an increase in growth for the company is their growing opportunity to be able to offer e-commerce options to reach new customers and expand their product offering. By doing this, [uTJX will be able to compliment their in-store sales with their online sales, rather than hurting their brick-and-mortar locations. Ever since the company’s fiscal year 2011, they have been testing off-priced e-commerce sales with its T.K. Maxx brand in the United Kingdom. In fiscal year 2013, the company began the development of a United States based e-commerce platform. In December of 2012, TJX Corporation acquired Sierra Trading Post for $200 million in cash. Sierra was a privately held off-price Internet retailer of apparel and home decor. Sierra had over $200 million in revenue annually, which means that TJX was able to purchase the company for 1x annual revenue.

End Notes

What are you thoughts? Is the company a good buy right now?

Disclosure: No current position held at the time of writing.

Disclaimer: The opinions and ideas in this article are for informational and educational purposes only. They are not a recommendation to buy or sell any stock at any given time. As always, it is imperative for each individual investor to do their own due diligence and perform their own research on any and all stocks before making an investment decision.

.jpg)