Insight into the Investment Guru's Latest 13F Filing for Q4 2023

Jeremy Grantham (Trades, Portfolio), the seasoned investment strategist and Chairman of the Board at Grantham Mayo van Otterloo (GMO) LLC, has once again made headlines with his latest 13F filing for the fourth quarter of 2023. Known for his acumen in identifying speculative market bubbles and his early index fund initiatives, Grantham's recent portfolio adjustments offer a window into his current market outlook and strategy.

Summary of New Buys

Jeremy Grantham (Trades, Portfolio)'s portfolio welcomed 38 new stocks in the fourth quarter. Noteworthy additions include:

- Pioneer Natural Resources Co (PXD, Financial) with 240,096 shares, making up 0.24% of the portfolio and valued at $53.99 million.

- Array Technologies Inc (ARRY, Financial), comprising 1,585,600 shares, which is approximately 0.12% of the portfolio, with a total value of $26.64 million.

- Illumina Inc (ILMN, Financial), with 174,552 shares, accounting for 0.11% of the portfolio and a total value of $24.30 million.

Key Position Increases

Grantham also bolstered his stakes in 168 stocks, with significant increases in:

- Texas Instruments Inc (TXN, Financial), adding 652,150 shares for a total of 3,195,338 shares. This represents a 25.64% increase in share count, impacting the current portfolio by 0.49%, and a total value of $544.68 million.

- Arcadium Lithium PLC (ALTM, Financial), with an additional 4,667,407 shares, bringing the total to 16,309,686.936. This marks a 221.06% increase in share count, with a total value of $121.88 million.

Summary of Sold Out Positions

Grantham exited 126 holdings in the last quarter, with significant sell-offs including:

- Adobe Inc (ADBE, Financial): All 591,327 shares were sold, resulting in a -1.42% impact on the portfolio.

- Activision Blizzard Inc (ATVI, Financial): The complete liquidation of 800,439 shares, causing a -0.35% impact on the portfolio.

Key Position Reductions

Reductions were made in 251 stocks, with notable decreases in:

- Lam Research Corp (LRCX, Financial) by 109,111 shares, leading to a -14.74% decrease in shares and a -0.32% impact on the portfolio. The stock traded at an average price of $681.51 during the quarter and has returned 31.97% over the past 3 months and 13.16% year-to-date.

- The Mosaic Co (MOS, Financial) by 1,813,071 shares, resulting in a -68.49% reduction in shares and a -0.31% impact on the portfolio. The stock traded at an average price of $35.32 during the quarter and has returned -12.78% over the past 3 months and -16.27% year-to-date.

Portfolio Overview

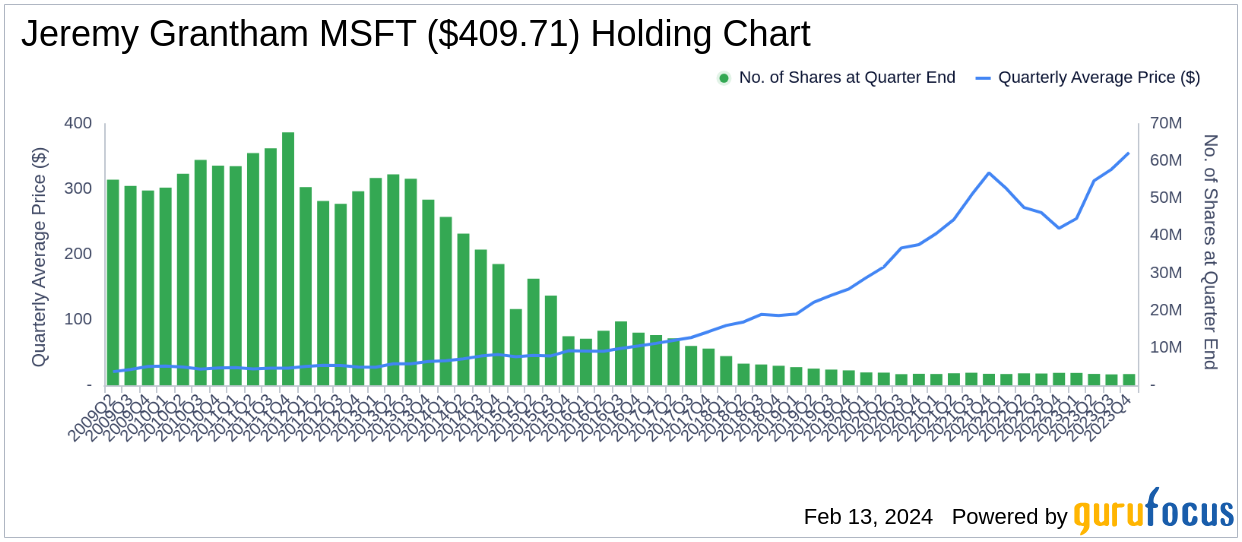

As of the fourth quarter of 2023, Jeremy Grantham (Trades, Portfolio)'s portfolio comprised 485 stocks. The top holdings included 4.98% in Microsoft Corp (MSFT, Financial), 3.69% in UnitedHealth Group Inc (UNH, Financial), 3.12% in Alphabet Inc (GOOGL, Financial), 2.92% in Meta Platforms Inc (META, Financial), and 2.76% in Johnson & Johnson (JNJ, Financial). The investments span across all 11 industries, with a focus on Technology, Healthcare, Financial Services, Consumer Cyclical, and Communication Services, among others.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.