Automatic Data Processing Inc (ADP, Financial) has been garnering attention from the investment community, thanks to its solid financial position and promising growth prospects. With a current share price of $248.16, ADP has experienced a slight daily dip of 0.26%, yet it boasts a notable three-month appreciation of 14.51%. A comprehensive evaluation using the GF Score indicates that Automatic Data Processing Inc is on a trajectory for significant expansion in the foreseeable future.

What Is the GF Score?

The GF Score is an innovative stock performance ranking system created by GuruFocus. It evaluates stocks based on five key aspects of valuation, which have demonstrated a strong correlation with long-term stock performance from 2006 to 2021. Stocks with higher GF Scores typically yield better returns than those with lower scores, making the GF Score a valuable tool for investors seeking high-performing investments. The GF Score ranges from 0 to 100, with 100 representing the pinnacle of potential outperformance.

- Financial strength rank: 6/10

- Profitability rank: 9/10

- Growth rank: 10/10

- GF Value rank: 6/10

- Momentum rank: 8/10

Each component of the GF Score is individually ranked, with each rank positively correlated with long-term stock performance. These aspects are weighted differently in the total score calculation to reflect their varying impacts on stock price performance. With high ranks in profitability and growth, and slightly lower yet strong ranks in financial strength, GF Value, and momentum, GuruFocus has assigned Automatic Data Processing Inc a GF Score of 95 out of 100, signaling a high potential for outperformance.

Understanding Automatic Data Processing Inc's Business

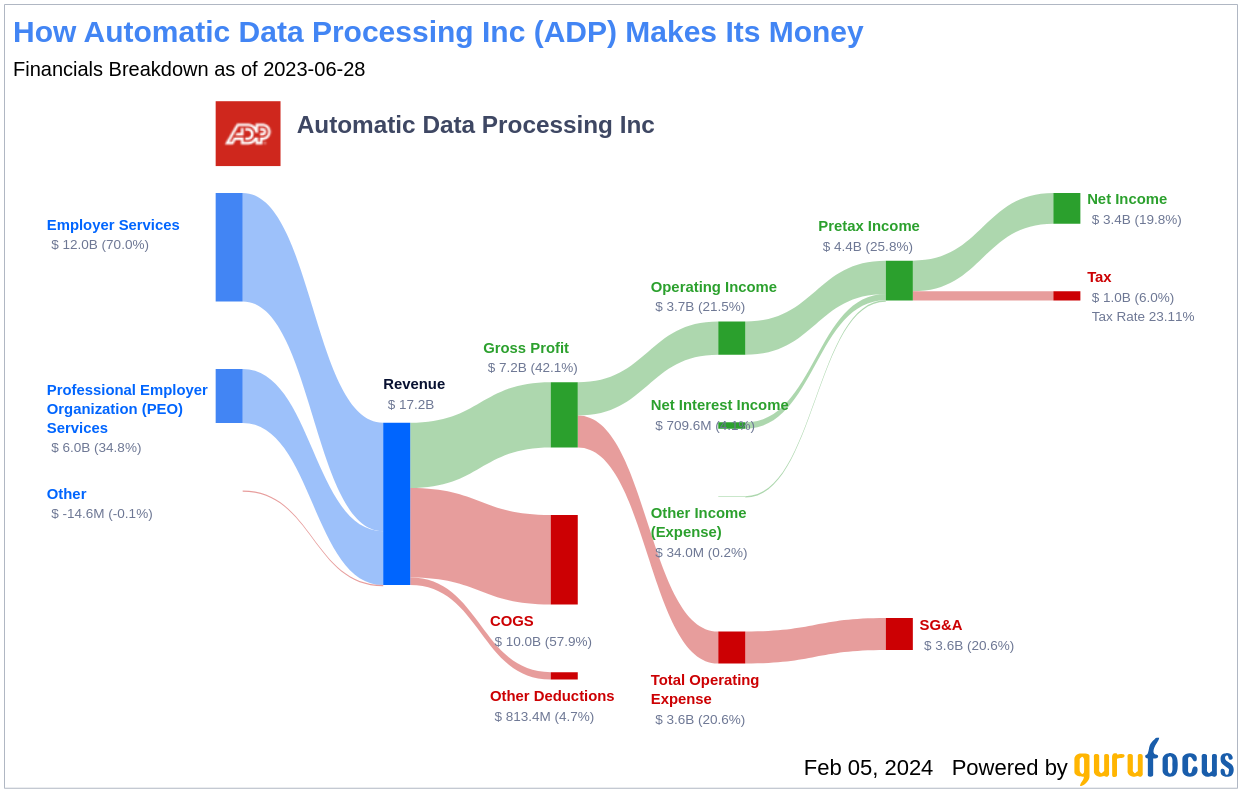

Automatic Data Processing Inc, with a market cap of $101.94 billion and annual sales of $17.67 billion, is a leading provider of payroll and human capital management solutions. Founded in 1949, ADP serves over 1 million clients, primarily in the United States. The company's employer services segment offers a comprehensive suite of services including payroll, human capital management, human resources outsourcing, insurance, and retirement services. The smaller, yet rapidly growing professional employer organization segment delivers HR outsourcing solutions to small and midsize businesses through a co-employment model. ADP's operational efficiency and market reach have positioned it as a formidable player in the business services sector.

Financial Strength Breakdown

Automatic Data Processing Inc's Financial Strength rating reflects a resilient balance sheet capable of withstanding economic fluctuations, indicative of a well-managed capital structure. The company's Interest Coverage ratio is an impressive 11.09, highlighting its ability to comfortably meet interest obligations—a quality highly regarded by the esteemed investor Benjamin Graham. ADP's strategic debt management is further evidenced by its favorable Debt-to-Revenue ratio of 0.19, reinforcing its financial stability.

Profitability Rank Breakdown

The Profitability Rank underscores Automatic Data Processing Inc's exceptional ability to generate profits relative to its industry peers. The company's Operating Margin has shown a consistent upward trend over the past five years, with the latest figure at 21.48%. This increase reflects ADP's growing efficiency in converting revenue into profit. Additionally, the company's Gross Margin has also been on an upward trajectory, reaching 42.13% in 2023. The Piotroski F-Score further affirms ADP's sound financial condition, while its 5-star Predictability Rank instills confidence in investors due to the company's consistent operational performance.

Growth Rank Breakdown

Automatic Data Processing Inc's high Growth Rank reflects its dedication to business expansion. The company's 3-Year Revenue Growth Rate of 8.4% surpasses 60.55% of companies in the Business Services industry. ADP's EBITDA has also seen significant growth, with a three-year growth rate of 13.1 and a five-year rate of 13.2, highlighting its ability to sustain growth momentum.

Conclusion: ADP's Position for Outperformance

Considering Automatic Data Processing Inc's robust financial strength, impressive profitability, and sustained growth metrics, the GF Score accentuates the company's exceptional position for potential outperformance. Investors seeking to capitalize on such financially sound and growing companies can explore more opportunities with the GF Score Screen available to GuruFocus Premium members.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.