On January 26, 2024, American Express Co (AXP, Financial) released its 8-K filing, detailing a year of substantial financial achievements. As a global financial institution operating in approximately 130 countries, American Express provides a range of charge and credit card payment products, as well as a merchant payment network. The company operates through three segments: global consumer services, global commercial services, and global merchant and network services.

Chairman and CEO Stephen J. Squeri highlighted the company's record revenues and profits, emphasizing strong customer engagement and sustained demand for premium products. The addition of 12.2 million new proprietary cards in 2023 brought the total number of cards-in-force to over 140 million, a testament to the company's robust growth strategy initiated in January 2022.

Financial Highlights and Challenges

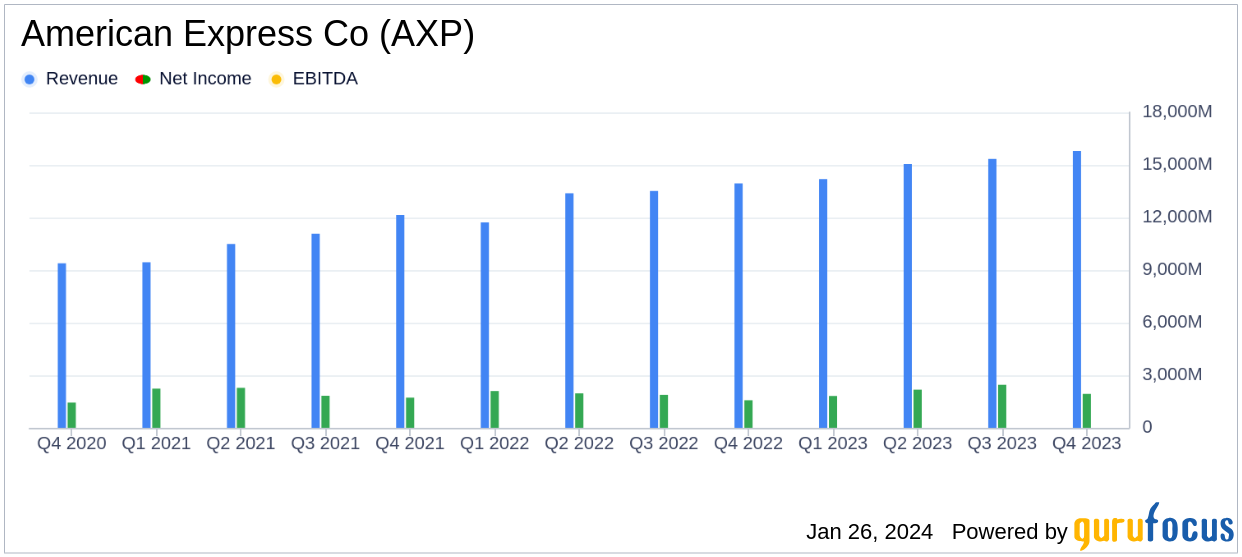

AXP's performance in 2023 was marked by a 14% increase in full-year revenue to $60.5 billion, driven by higher net interest income and increased Card Member spending. Despite these gains, the company faced a 40% surge in provisions for credit losses, which rose to $4.9 billion. This increase reflects higher net write-offs and a net reserve build, indicating a cautious approach to potential credit risks.

Net income for the year grew by 11% to $8.4 billion, and diluted earnings per share increased by 27% to $2.62 for the fourth quarter, and by 14% to $11.21 for the full year. These financial achievements underscore the company's ability to capitalize on its premium customer base and demonstrate the earnings power of its business model.

Income Statement and Balance Sheet Analysis

The company's income statement reveals a solid trajectory of revenue growth and profitability. The balance sheet remains healthy, with a strong cash position to support ongoing operations and strategic investments. Key metrics such as billed business, net income, and EPS are crucial indicators of the company's financial health and are particularly important to investors in the credit services industry.

Operating expenses for the full year increased by 10% to $45.1 billion, reflecting higher customer engagement costs due to increased Card Member spending and usage of travel-related benefits. However, these were partially offset by lower marketing expenses. The company's effective tax rate decreased to 20.3%, down from 21.6% the previous year, primarily due to changes in the geographic mix of income.

Looking Forward

With the momentum of 2023's performance, American Express Co (AXP, Financial) is providing optimistic guidance for 2024, with expected revenue growth of 9% to 11% and an EPS range of $12.65 to $13.15. The planned dividend increase further reflects the company's confidence in its financial stability and commitment to shareholder returns.

AXP's strategic focus remains on achieving revenue growth of 10% plus and mid-teens EPS growth, as it continues to invest in driving revenues and expanding the scale of its business while managing expenses effectively.

For value investors and potential GuruFocus.com members, American Express Co (AXP, Financial)'s latest earnings report presents a compelling picture of a company with strong fundamentals, a clear growth trajectory, and a commitment to delivering shareholder value. The full earnings report can be accessed through the provided 8-K filing link for a more detailed analysis.

Explore the complete 8-K earnings release (here) from American Express Co for further details.