Value-focused investors are always on the prowl for undervalued stocks, and Twist Bioscience Corp (TWST, Financial) is one such name that has piqued interest. With a current price of $38.61, the stock has seen a substantial 3-month increase of 94.31%. According to the GF Value, the fair valuation of Twist Bioscience stands at $60.19. But is this a golden opportunity or a siren's song leading to a value trap?

The GF Value is an intrinsic value estimate, a cornerstone of GuruFocus's valuation methods. It is determined by historical trading multiples like PE, PS, PB ratios, and price-to-free-cash-flow, adjusted for the company's past performance and anticipated future business outcomes. Ideally, a stock price will oscillate around this GF Value, with prices significantly below suggesting higher potential returns.

However, a deeper dive into Twist Bioscience's financials reveals concerning signals. The company's Piotroski F-score is a mere 2, indicating potential financial instability. These warning signs underscore the necessity for rigorous due diligence before considering an investment in Twist Bioscience (TWST, Financial).

Understanding the Piotroski F-Score and Financial Ratios

The Piotroski F-score is a robust indicator of a company's financial health, assessing aspects like profitability, leverage, liquidity, and operational efficiency. Twist Bioscience's low score suggests that it may not be on solid financial ground, raising red flags for potential investors.

Twist Bioscience's Business Model and Financial Synopsis

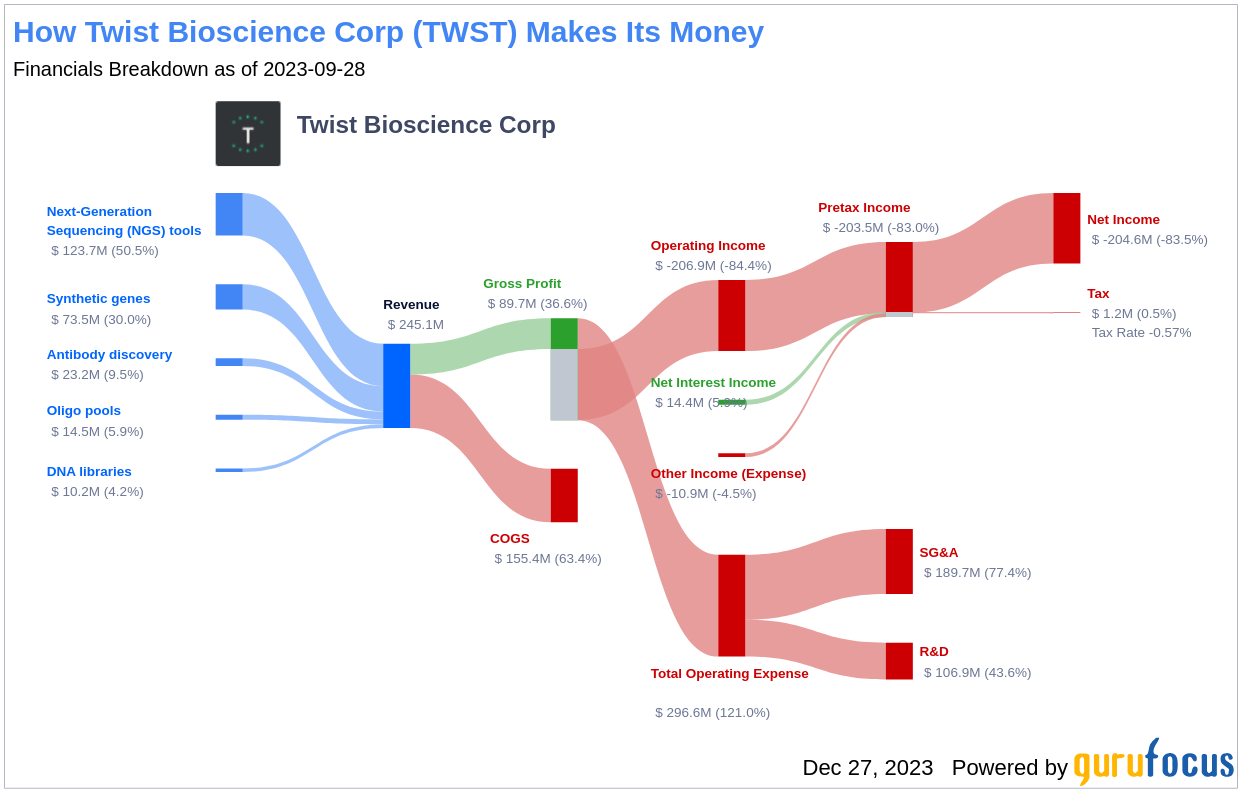

Twist Bioscience operates in the synthetic biology sector, leveraging a unique DNA synthesis platform to industrialize biology engineering. Despite the innovative nature of its business and a market cap of $2.20 billion, the company's financial metrics are less than ideal. With a Loss Per Share of 3.6, sales of $245.10 million, and a negative operating margin of 84.41%, Twist Bioscience presents a complex investment profile.

Profitability and Cash Flow Concerns

Twist Bioscience's profitability is in question with a negative Return on Invested Capital (ROIC) of -48.81% and a concerning Weighted Average Cost of Capital (WACC) of 15.67%. Additionally, a discrepancy between its cash flow from operations at $-142.47 million and a net income of $-204.62 million over the trailing twelve months signals poor earnings quality and potential sustainability issues.

Leverage, Liquidity, and Financial Risk

The company's leverage situation is worrying, with a debt-to-total assets ratio increasing from 0.09 in 2021 to 0.12 in 2023. This rising debt ratio, coupled with a declining current ratio from 8.67 in 2021 to 5.79 in 2023, points to heightened financial risk and reduced liquidity.

Operational Efficiency and Share Dilution

Operational efficiency at Twist Bioscience is another area of concern. The company's asset turnover has decreased over the past three years, suggesting less effective use of assets in generating sales. Additionally, an increase in diluted average shares outstanding from 49.36 in 2021 to 57.28 in 2023 indicates potential dilution of shareholder value.

The Verdict on Twist Bioscience's Financial Health

While the Piotroski F-score is not the sole determinant of investment worthiness, for Twist Bioscience, the low score combined with negative profitability indicators, increasing debt, declining liquidity, and operational inefficiencies paints a worrying picture. These factors suggest that Twist Bioscience (TWST, Financial) may indeed be a value trap, warranting caution from investors.

Conclusion: Tread Carefully with Twist Bioscience

Despite an attractive GF Value, Twist Bioscience's financial health raises serious concerns. With a complex mix of innovation and financial red flags, investors should approach this stock with caution. For those seeking more secure investments, GuruFocus Premium members can utilize the Piotroski F-score screener to find stocks with high financial strength scores.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.