The stock market is a dynamic arena where prices fluctuate constantly, reflecting the ongoing reassessment of a company's value. For Best Buy Co Inc (BBY, Financial), a recent daily gain of 2.29%, coupled with a 3-month gain of 15.92%, suggests a positive trend. But the critical question remains: is the stock fairly valued? With an Earnings Per Share (EPS) of 5.8, the evaluation of Best Buy Co Inc (BBY)'s true market value is not just about numbers on a chart; it's about understanding the company's actual worth. The following analysis aims to provide a clear valuation perspective, inviting readers to delve into the financials and intrinsic value of Best Buy Co Inc (BBY).

Company Introduction

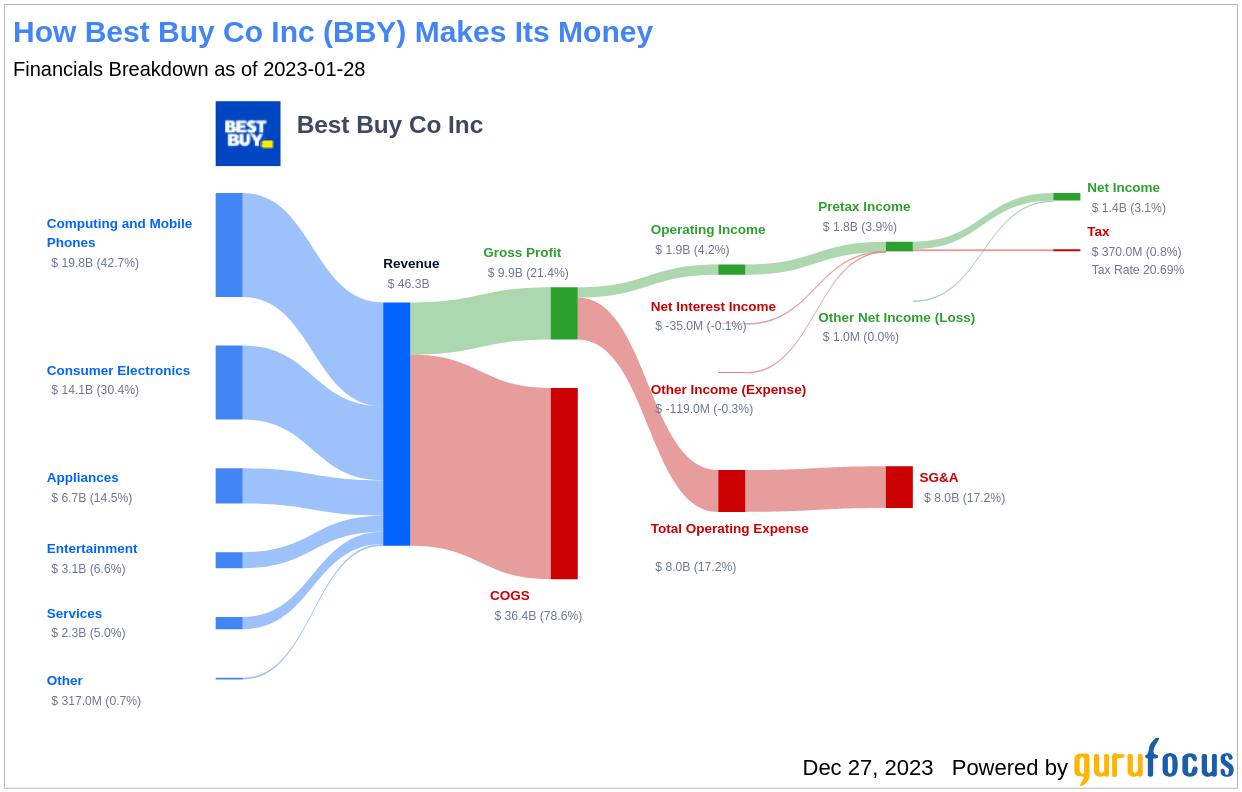

Best Buy Co Inc (BBY, Financial) stands as the largest pure-play consumer electronics retailer in the U.S., with a commanding market share and a significant portion of sales generated from in-store transactions. Despite the rise of e-commerce, which has doubled since the pandemic, Best Buy Co maintains a strong offline presence, especially in mobile phones, computers, and appliances. With a stock price of $77.88 and a GF Value of $81.93, it's crucial to compare the company's market cap of $16.80 billion against its fair value to assess whether the stock is priced appropriately.

Summarize GF Value

The GF Value is a comprehensive measure that calculates the intrinsic value of a stock, integrating historical trading multiples, a GuruFocus adjustment factor, and future business performance projections. For Best Buy Co (BBY, Financial), the GF Value suggests that the stock is fairly valued. This conclusion is drawn from an analysis of historical trading patterns, the company's past performance, and growth, as well as expert estimates of its future business trajectory. When a stock's price aligns closely with the GF Value Line, it indicates that the stock is trading at a price that reflects its true worth, making it neither overvalued nor undervalued.

Given that Best Buy Co is fairly valued, investors can anticipate that the long-term return on the stock will likely mirror the company's business growth rate. This presents a stable investment opportunity, provided the company maintains its trajectory.

Financial Strength

The financial strength of a company is a vital indicator of its ability to withstand economic challenges and avoid capital loss. Best Buy Co's cash-to-debt ratio of 0.16 places it in a less favorable position than many of its industry peers. With a financial strength rating of 6 out of 10, Best Buy Co's capacity to manage its debts is fair but warrants careful observation.

Profitability and Growth

A consistent track record of profitability is less risky for investors and often a sign of a sound investment. Best Buy Co has managed to stay profitable over the past decade, with a revenue of $43.50 billion and an EPS of $5.8 in the last twelve months. Its operating margin of 3.86% indicates that it is more profitable than over half of its competitors in the Retail - Cyclical industry. The company's profitability rank is a robust 8 out of 10.

Growth is equally important in valuing a company. Best Buy Co's annual revenue growth rate of 8% is commendable, surpassing over 60% of its industry counterparts. However, its 3-year average EBITDA growth rate of 4.3% falls short when compared to industry standards.

ROIC vs WACC

The comparison of Return on Invested Capital (ROIC) against the Weighted Average Cost of Capital (WACC) is a clear indicator of a company's efficiency in generating returns on investment. Best Buy Co's ROIC of 13.95% surpassing its WACC of 9.47% is a testament to its ability to create value for shareholders.

Conclusion

In summary, Best Buy Co (BBY, Financial) is assessed to be fairly valued at its current stock price. The company's financial health is sound, and its profitability is strong. Despite facing growth challenges, Best Buy Co's ability to create shareholder value is evident in its ROIC exceeding its WACC. For a more detailed financial analysis of Best Buy Co, interested parties can explore its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.