Value-focused investors are always on the hunt for stocks that are priced below their intrinsic value. One such stock that merits attention is Kohl's Corp (KSS, Financial). The stock, which is currently priced at $26.38, recorded a gain of 7.02% in a day and a 3-month increase of 12.89%. The stock's fair valuation is $46.47, as indicated by its GF Value. However, a closer look at various financial health indicators suggests that Kohl's (KSS), despite its apparent undervaluation, might be a potential value trap. This complexity underlines the importance of thorough due diligence in investment decision-making.

Understanding the GF Value

The GF Value is a proprietary measure that represents the current intrinsic value of a stock. It is derived from a combination of historical trading multiples such as PE Ratio, PS Ratio, PB Ratio, and Price-to-Free-Cash-Flow, adjusted for the company's past performance and growth, and incorporates future business performance estimates. Ideally, the stock price will oscillate around the GF Value Line, with significant deviations signaling overvaluation or undervaluation. However, this metric alone is not sufficient to make an investment decision, as it does not account for the underlying financial health and future prospects of the company.

Decoding Financial Health Scores

The Piotroski F-score is a robust tool for assessing a company's financial strength, considering aspects such as profitability, leverage, liquidity, and efficiency. Kohl's Corp (KSS, Financial) currently has a lower score, indicating potential financial weaknesses. The Altman Z-score, on the other hand, predicts the likelihood of bankruptcy. With a Z-score of 1.6, Kohl's is in a zone that implies a higher risk of financial distress. These indicators, combined with a historical decline in revenue and earnings of at least 5%, paint a concerning picture for Kohl's as a potential investment.

Kohl's Corp (KSS, Financial) Company Profile

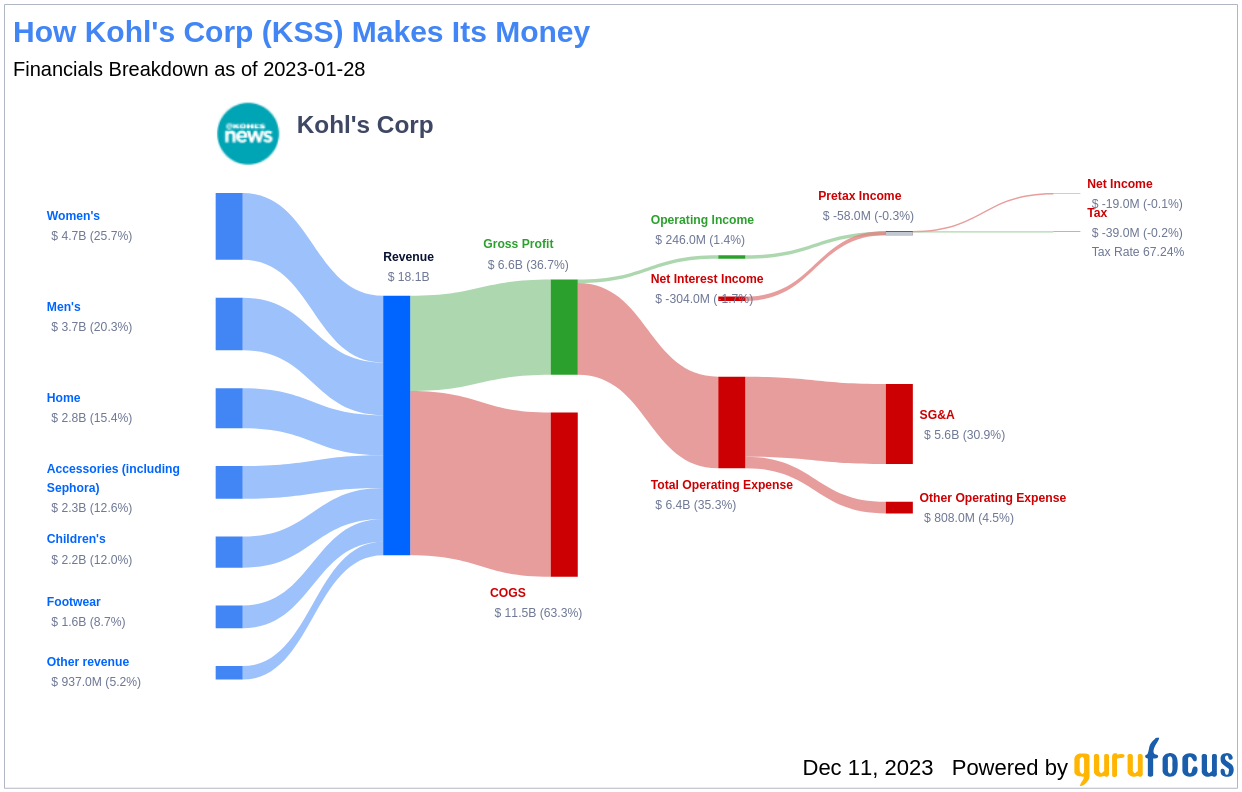

Kohl's operates approximately 1,170 department stores across 49 states, offering a range of moderately priced products from private-label and national brands. With a significant digital sales presence and women's apparel as its largest category, Kohl's has been a retail staple since 1962. Despite its established market presence, the company's financials, including a market cap of $2.90 billion and sales of $17.50 billion, must be scrutinized in conjunction with its operational margin of 0.66 and ROIC of 0.61, especially when compared to the GF Value estimation of fair value.

Breaking Down Kohl's Low Altman Z-Score

Examining Kohl's's financial ratios that contribute to its low Altman Z-score provides insight into its financial stability. The declining Retained Earnings to Total Assets ratio, from 0.88 in 2021 and 2022 to 0.18 in 2023, signals a weakening ability to reinvest or manage debt. Additionally, the EBIT to Total Assets ratio shows a concerning trend, with a decrease from 0.08 in 2021 to 0.01 in 2023, indicating a lack of asset utilization for operational profits. Furthermore, the asset turnover ratio's drop from 1.24 in 2021 to 1.16 in 2023 suggests reduced operational efficiency and potential underutilization of assets. These key drivers are red flags for investors considering Kohl's as a value investment.

Conclusion: The Hidden Risks of Investing in Kohl's

While Kohl's Corp (KSS, Financial) presents an enticing valuation on the surface, the underlying financial health indicators suggest caution. The combination of a low Piotroski F-score, an alarming Altman Z-score, and declining efficiency ratios point towards the characteristics of a value trap. Investors are advised to delve deeper into these metrics and consider the potential risks before making an investment decision. For those looking to avoid such pitfalls, GuruFocus Premium members have access to tools like the Piotroski F-score screener and the Walter Schloss Screen to identify stocks with stronger financial health. In the case of Kohl's, investors must ask themselves: Is the potential reward worth the risk of falling into a value trap?

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.