The stock of Alamo Group Inc (ALG, Financial) has experienced a -3.98% change in the day's trading, with a -5.18% loss over the past three months. Despite these figures, the company's Earnings Per Share (EPS) stands at a robust 10.42. This raises a pertinent question: is Alamo Group's stock fairly valued? This article aims to unravel this query by providing a comprehensive valuation analysis of Alamo Group. Let's dive in.

Introduction to Alamo Group Inc (ALG, Financial)

Alamo Group Inc is a leading entity in the design and manufacturing of agricultural and infrastructure maintenance equipment. The company's product range includes tractor-mounted mowing equipment, street sweepers, excavators, vacuum trucks, snow removal equipment, and more. Alamo Group primarily generates its revenue from its Vegetation Management segment, with the United States being its major market.

The company's current stock price is $172.86, with a market cap of $2.10 billion. When compared to the GuruFocus Value (GF Value) of $187.95, it appears that the stock is fairly valued. But, to gain a deeper understanding of this valuation, we need to consider the company's financial performance and future prospects.

Understanding the GF Value

The GF Value is a proprietary measure that estimates the intrinsic value of a stock. It is calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line gives an overview of the fair value that the stock should be traded at. If the stock price is significantly above the GF Value Line, it is overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

At its current price of $172.86 per share, Alamo Group (ALG, Financial) appears to be fairly valued according to the GF Value calculation. This suggests that the long-term return of its stock is likely to be close to the rate of its business growth.

Financial Strength of Alamo Group

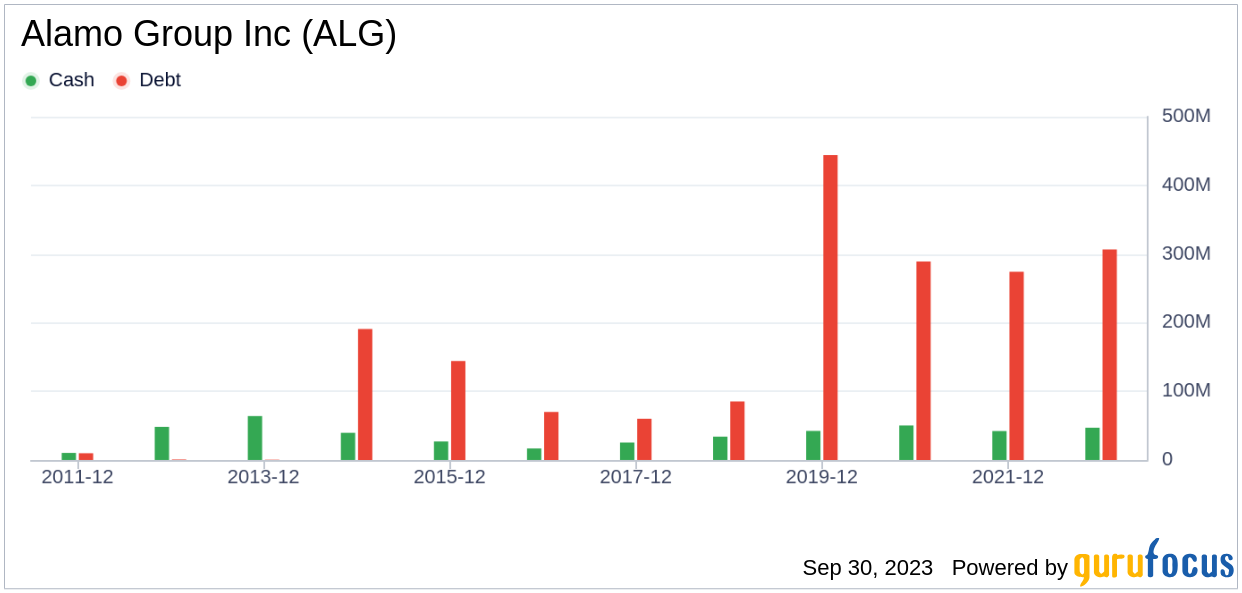

Investing in companies with poor financial strength carries a higher risk of permanent loss of capital. Therefore, it is crucial to assess a company's financial strength before deciding to buy its stock. Alamo Group's cash-to-debt ratio is 0.31, which is lower than 64.11% of 209 companies in the Farm & Heavy Construction Machinery industry. However, GuruFocus ranks Alamo Group's overall financial strength at 7 out of 10, indicating that it is fair.

Profitability and Growth of Alamo Group

Investing in profitable companies carries less risk, especially if they have consistently demonstrated profitability over the long term. Alamo Group has been profitable for 10 years over the past 10 years, with revenues of $1.60 billion and Earnings Per Share (EPS) of $10.42 in the past 12 months. Its operating margin of 11.32% is better than 73.68% of 209 companies in the Farm & Heavy Construction Machinery industry, indicating strong profitability.

Growth is a crucial factor in the valuation of a company. Alamo Group's 3-year average revenue growth rate is better than 61.08% of 203 companies in the Farm & Heavy Construction Machinery industry. Its 3-year average EBITDA growth rate is 15.5%, ranking better than 61.11% of 180 companies in the industry. These figures indicate promising growth prospects for Alamo Group.

Comparing ROIC and WACC

Another way to assess a company's profitability is to compare its Return on Invested Capital (ROIC) and the Weighted Average Cost of Capital (WACC). The ROIC measures how well a company generates cash flow relative to the capital it has invested in its business. The WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets. Ideally, the ROIC should be higher than the WACC. For Alamo Group, the ROIC is 12.56, and the WACC is 9.63, indicating a healthy financial position.

Conclusion

In conclusion, the stock of Alamo Group (ALG, Financial) appears to be fairly valued. The company's financial condition is fair, its profitability is strong, and its growth prospects are promising. To learn more about Alamo Group's stock, you can check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.