Cal-Maine Foods Inc (CALM, Financial) has recently shown a 2.04% daily gain, an 8% three-month gain, and an Earnings Per Share (EPS) (EPS) of 15.53. But the question remains, is the stock significantly undervalued? This article aims to provide a detailed valuation analysis of Cal-Maine Foods, encouraging readers to delve into the financial intricacies of the company.

Company Introduction

Cal-Maine Foods Inc is a leading producer and seller of shell eggs in the United States. The company's diverse product portfolio includes nutritionally enhanced, cage-free, organic, and brown eggs. With brands like Egg-Land's, Land O' Lakes, Farmhouse, and 4-Grain, Cal-Maine Foods caters to various customers, including grocery-store chains, club stores, and food service distributors. Despite a current stock price of $47.84, the GF Value estimates the fair value at $89.91, indicating that the stock may be significantly undervalued.

Understanding GF Value

The GF Value is a proprietary measure that estimates a stock's intrinsic value. It is calculated based on historical multiples, a GuruFocus adjustment factor based on past returns and growth, and future estimates of business performance. The GF Value Line denotes the fair value at which the stock should ideally trade.

Cal-Maine Foods (CALM, Financial) is believed to be significantly undervalued based on this valuation method. The stock's current price of $47.84 per share and a market cap of $2.30 billion suggests that the stock is significantly undervalued. As a result, the long-term return of its stock is likely to be much higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength

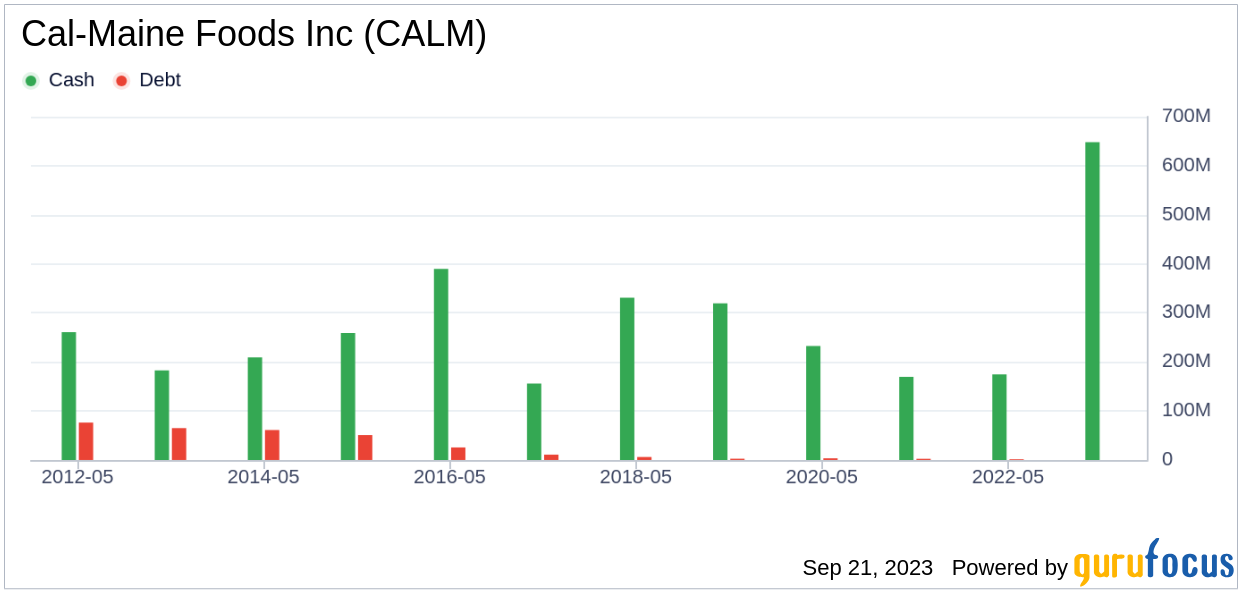

Investing in companies with poor financial strength can lead to a higher risk of permanent capital loss. Therefore, it's crucial to review a company's financial strength before investing. Cal-Maine Foods, with a cash-to-debt ratio of 10000, ranks better than 99.94% of 1799 companies in the Consumer Packaged Goods industry. This strong financial position is reflected in its overall financial strength rank of 10 out of 10 by GuruFocus.

Profitability and Growth

Investing in profitable companies, especially those with consistent profitability over the long term, poses less risk. Cal-Maine Foods has been profitable 9 out of the past 10 years. Over the past twelve months, the company had a revenue of $3.10 billion and an EPS of $15.53. Its operating margin is 30.65%, ranking better than 97.67% of 1844 companies in the Consumer Packaged Goods industry. GuruFocus ranks Cal-Maine Foods' profitability at 8 out of 10, indicating strong profitability.

One of the most important factors in the valuation of a company is its growth. Companies that grow faster create more value for shareholders, especially if that growth is profitable. Cal-Maine Foods' average annual revenue growth is 32.3%, ranking better than 91.91% of 1718 companies in the Consumer Packaged Goods industry. Its 3-year average EBITDA growth is 138.4%, ranking better than 98.3% of 1526 companies in the same industry.

ROIC vs WACC

Another method of determining the profitability of a company is to compare its return on invested capital (ROIC) to the weighted average cost of capital (WACC). When the ROIC is higher than the WACC, it implies the company is creating value for shareholders. For the past 12 months, Cal-Maine Foods's ROIC is 68.33, and its WACC is 4.84.

Conclusion

In summary, the stock of Cal-Maine Foods (CALM, Financial) is believed to be significantly undervalued. The company's financial condition is strong, and its profitability is robust. Its growth ranks better than 98.3% of 1526 companies in the Consumer Packaged Goods industry. To learn more about Cal-Maine Foods stock, check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.