Unraveling the Dividend History, Yield, and Growth of BNY Mellon Municipal Bond Infrastructure Fund, Inc.

BNY Mellon Municipal Bond Infrastructure Fund, Inc.(DMB, Financial) recently announced a dividend of $0.04 per share, payable on 2023-10-02, with the ex-dividend date set for 2023-09-19. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's deep dive into BNY Mellon Municipal Bond Infrastructure Fund, Inc.'s dividend performance and assess its sustainability.

Understanding BNY Mellon Municipal Bond Infrastructure Fund, Inc.

BNY Mellon Municipal Bond Infrastructure Fund, Inc. is a diversified closed-end management investment company. The fund's investment objective is to provide as high a level of current income exempt from regular federal income tax as is consistent with the preservation of capital. It invests in sectors such as transportation, energy and utilities, social infrastructure, and water and environmental sectors.

Exploring BNY Mellon Municipal Bond Infrastructure Fund, Inc.'s Dividend History

BNY Mellon Municipal Bond Infrastructure Fund, Inc. has maintained a consistent dividend payment record since 2013. Dividends are currently distributed on a monthly basis. Below is a chart showing annual Dividends Per Share for tracking historical trends.

Dissecting BNY Mellon Municipal Bond Infrastructure Fund, Inc.'s Dividend Yield and Growth

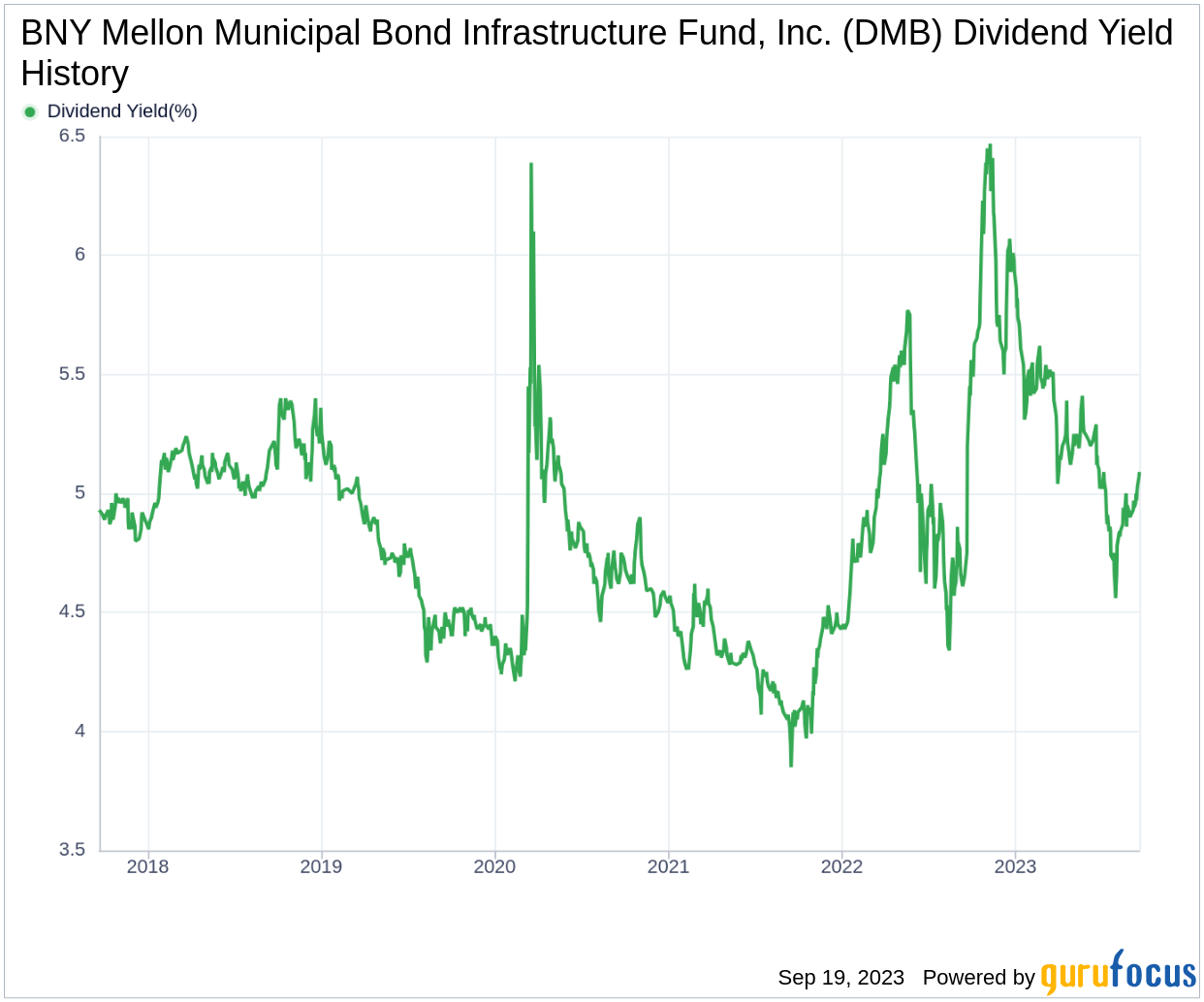

As of today, BNY Mellon Municipal Bond Infrastructure Fund, Inc. currently has a 12-month trailing dividend yield of 4.95% and a 12-month forward dividend yield of 4.69%. This suggests an expectation of decrease dividend payments over the next 12 months.

Over the past three years, BNY Mellon Municipal Bond Infrastructure Fund, Inc.'s annual dividend growth rate was -2.80%. Extended to a five-year horizon, this rate increased to -1.20% per year. Based on BNY Mellon Municipal Bond Infrastructure Fund, Inc.'s dividend yield and five-year growth rate, the 5-year yield on cost of BNY Mellon Municipal Bond Infrastructure Fund, Inc. stock as of today is approximately 4.65%.

Evaluating Dividend Sustainability: Payout Ratio and Profitability

To assess the sustainability of the dividend, one needs to evaluate the company's payout ratio. The dividend payout ratio provides insights into the portion of earnings the company distributes as dividends. A lower ratio suggests that the company retains a significant part of its earnings, thereby ensuring the availability of funds for future growth and unexpected downturns. As of 2023-02-28, BNY Mellon Municipal Bond Infrastructure Fund, Inc.'s dividend payout ratio is 0.00.

BNY Mellon Municipal Bond Infrastructure Fund, Inc.'s profitability rank, offers an understanding of the company's earnings prowess relative to its peers. GuruFocus ranks BNY Mellon Municipal Bond Infrastructure Fund, Inc.'s profitability 2 out of 10 as of 2023-02-28, suggesting the dividend may not be sustainable. The company has reported net profit in 4 years out of past 10 years.

Assessing Future Outlook: Growth Metrics

To ensure the sustainability of dividends, a company must have robust growth metrics. BNY Mellon Municipal Bond Infrastructure Fund, Inc.'s growth rank of 2 out of 10 suggests that the company has poor growth prospects and thus, the dividend may not be sustainable.

Concluding Thoughts

While BNY Mellon Municipal Bond Infrastructure Fund, Inc. has a consistent dividend payment record, its negative dividend growth rate, low profitability rank, and poor growth prospects raise concerns about the sustainability of its dividends. Therefore, investors should tread cautiously and consider these factors while making investment decisions.

GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.