Amgen Inc (AMGN, Financial) recently recorded a daily gain of 5.81%, with an Earnings Per Share (EPS) (EPS) of $14.71. Given these figures, a pertinent question arises: is Amgen (AMGN) fairly valued? This article aims to answer this question through an in-depth valuation analysis. We encourage you to continue reading to gain valuable insights on this topic.

A Closer Look at Amgen Inc (AMGN, Financial)

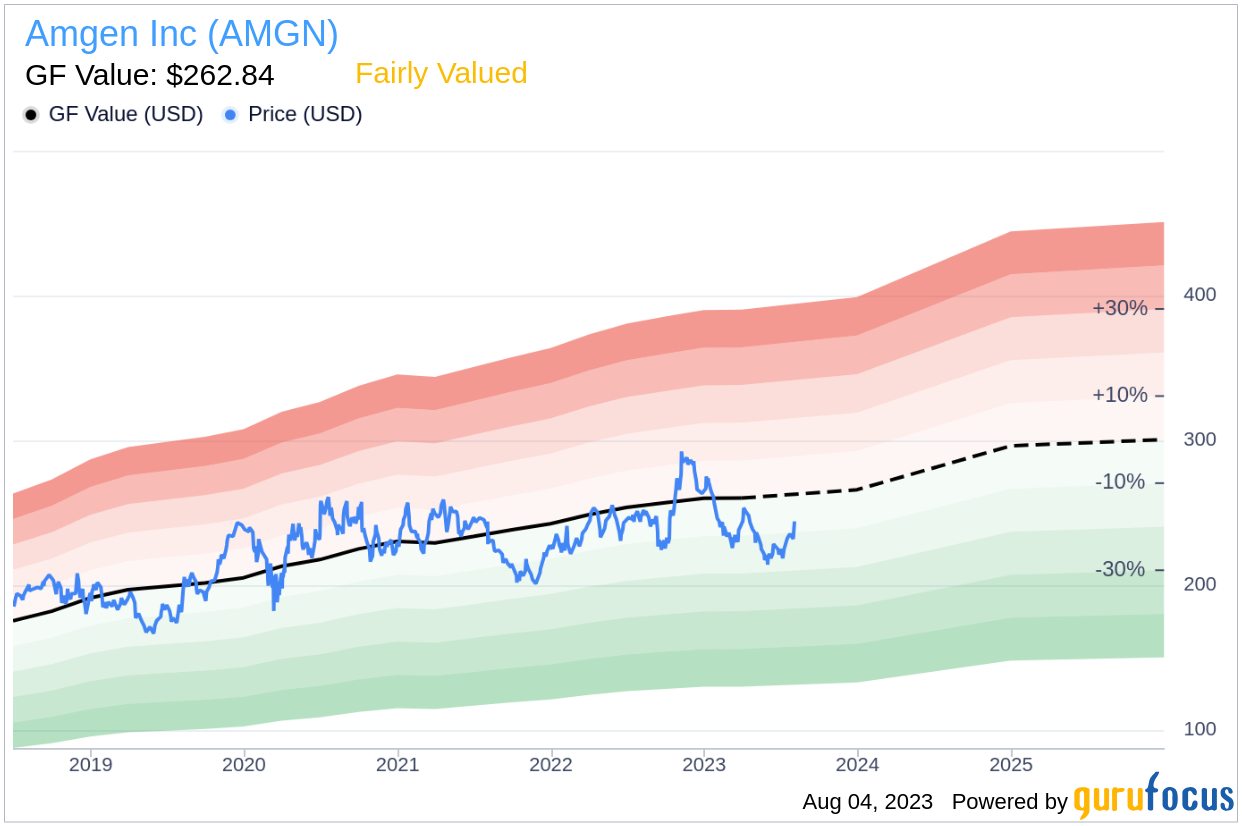

Amgen is a leading biotechnology company specializing in human therapeutics, notably in renal disease and cancer supportive-care products. The company's flagship drugs include red blood cell boosters Epogen and Aranesp, immune system boosters Neupogen and Neulasta, and inflammatory disease treatments Enbrel and Otezla. With its first cancer therapeutic, Vectibix introduced in 2006, Amgen has continued to expand its portfolio with bone-strengthening drugs and biosimilars. The stock price of Amgen (AMGN) currently stands at $244.1, while the GF Value, an estimation of its fair value, is $262.84.

Understanding the GF Value of Amgen

The GF Value is a proprietary measure that provides an estimation of a stock's intrinsic value. The calculation of the GF Value is based on three factors: historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. If a stock's price is significantly above or below the GF Value Line, it indicates that the stock is overvalued or undervalued, respectively.

Amgen's current stock price and market cap of $130.4 billion suggest that the stock is fairly valued. This means that the long-term return of its stock is likely to be close to the rate of its business growth.

Link: These companies may deliver higher future returns at reduced risk.

Evaluating Amgen's Financial Strength

Investing in companies with poor financial strength poses a high risk of permanent capital loss. Therefore, it's crucial to assess a company's financial strength before purchasing its shares. Amgen's cash-to-debt ratio of 0.51 ranks worse than 60.44% of companies in the Drug Manufacturers industry, indicating its financial strength is relatively poor.

Profitability and Growth of Amgen

Investing in profitable companies, especially those with consistent profitability over the long term, is generally less risky. Amgen has been profitable for 10 years, with an operating margin of 34.31%, which ranks better than 96.62% of companies in the Drug Manufacturers industry. This indicates strong profitability.

However, growth is also a critical factor in a company's valuation. Amgen's average annual revenue growth is 8.2%, which ranks better than 57.38% of companies in the Drug Manufacturers industry. However, its 3-year average EBITDA growth is 2.7%, which ranks worse than 62.42% of companies in the industry.

Comparing Amgen's ROIC and WACC

Another method to evaluate a company's profitability is to compare its Return on Invested Capital (ROIC) to its Weighted Average Cost of Capital (WACC). Over the past 12 months, Amgen's ROIC was 18.2, while its WACC came in at 6.98. This indicates that the company is creating value for shareholders.

Conclusion

In conclusion, Amgen Inc (AMGN, Financial) stock appears to be fairly valued. The company's financial condition is poor, but its profitability is strong. Its growth ranks worse than 62.42% of companies in the Drug Manufacturers industry. For more details about Amgen stock, you can check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.