After a turbulent 2022, small-cap value stocks have rebounded sharply so far this year, eclipsing the S&P 500 by more than 2%. Many investors might be wary of these stocks as economic uncertainty lingers, but statistical analysis indicates there is no reason to panic as small caps tend to outperform the broader market during stages of economic contraction and early recovery.

Source: KoyFin

Small-cap value in the current market environment

A U.S.-based regression analysis indicates that small-cap stocks ("size" in the diagram below) outperform the broader stock market during recessions and early-stage economic recoveries.

Source: Research Affiliates

The economic forecast for 2023 remains in the balance as some economists predict a recession, whereas others believe the U.S. will avoid an economic downturn amid moderating supply-side inflation and looser labor markets. If either of the two scenarios play out, small-cap value stocks will likely outperform the broader market.

The previously mentioned regression analysis' results are no fluke. In fact, they align with two prominent experts' philosophies, namely Eugene Fama and the Oracle of Omaha, Warren Buffett (Trades, Portfolio). Fama statistically discovered small-cap value assets' long-term outperformance, while Buffett's "cigar butt" approach (a strategy established by Benjamin Graham) assumes a practical vantage point. Although different in methodology, Fama and Buffett's approaches are closely aligned and provide a blueprint for investors to outperform the market by investing in beaten-down stocks that trade below their intrinsic value.

To simplify matters, small-cap value stocks essentially rely on simple mean reversion. However, there are many failing companies within the segment; thus, comprehensive research is required before executing any investment decisions.

Here are two lucrative small-cap value stocks worth considering.

Brandywine Realty Trust

Real estate investment trusts allow investors to invest in real estate without assuming any liquidity risk. Moreover, investors are able to realize similar percentage-based gains while investing smaller amounts of capital.

Brandywine Realty Trust (BDN, Financial) is an overlooked REIT that specializes in fully integrated mixed property investments across the U.S. Fully integrated REITs are advantageous as they grant funds operating autonomy, concurrently denying any principle-agent conflicts.

The fund blasted past its most recent quarterly estimates with an earnings per share beat of eight cents. The driving force behind Brandywine's impressive quarter was an increase in quarterly occupancy to 90.8%, accommodated by higher base rents, which resulted in a spike in total funds from operations.

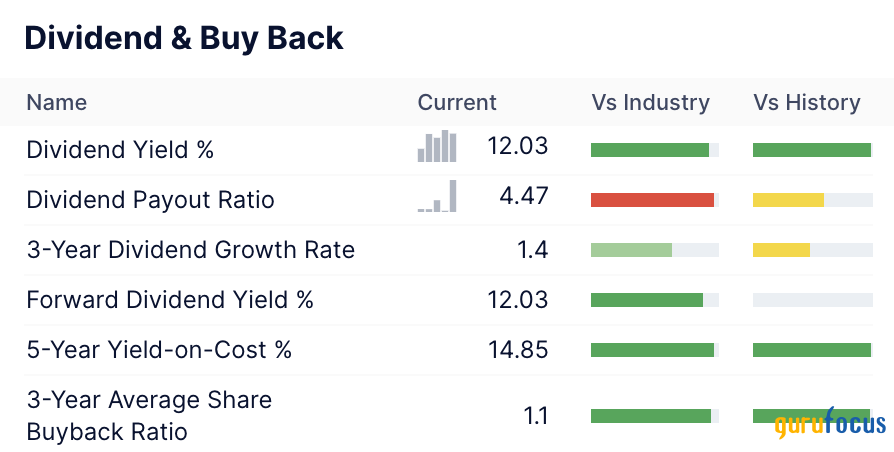

According to GuruFocus, Brandywine is relatively undervalued as its price-to-funds from operations ratio of 5.8 is within the top 20th percentile of the REIT space. In addition, its dividend yield of 12.2% is best in class, providing investors with a lucrative total return opportunity.

M/I Homes

M/I Homes Inc.'s (MHO, Financial) stock is in deep-value territory with a price-book ratio of 0.75, suggesting the market underestimates the company's breakup value.

Much of the stock's value gap is due to the market's skepticism of M/I's business model, which centers itself on U.S. homebuilding. The broad-based narrative is that homebuilders might feel the brunt of an economic downturn amid higher financing rates and resilient inflation. However, M/I Homes hosts a tremendously robust operating margin of 15.46%, attended by a three-year Ebitda growth rate of 43.5%, which illustrates secular growth attributes.

Based on M/I Homes' income statement, it operates a lean business model that thrives from customer loyalty, thereby providing it with the necessary tools to phase out its industry's systemic risk.

Sure, the company's latest earning release outlined risk factors as its backlog decreased by 16% while new contracts fell 31%. However, the market has ignored its retrospective results as the stock has gained by nearly 20% since then. The market's ignorance is probably due to the consensus that MI/ Homes could benefit from a rejuvenated economy in late 2023 as an interest rate pivot is in the works.

M/I Homes has not paid a dividend since 2008, yet the stock provides a sound price speculation opportunity as it is significantly undervalued.

Risks worth considering

Small-cap value investing is often applied to beaten-down stocks that are likely to recover. Thus, a contrarian view is usually assumed, which can be risky if one's short-term market outlook is inaccurate.

Both Brandywine Realty Trust and M/I Homes are cyclical securities faced with an uncertain economy. As such, their risk-adjusted returns might not be suitable for all investors. Nevertheless, speculative investors might benefit from such opportunities as ultimate risk-reward plays.

Concluding thoughts

Statistical analysis and Buffett's cigar butt strategy are more valid than ever in today's financial market climate. The year-to-date performance of small-cap value assets coupled with regression analysis indicates the segment could outperform the broader market amid a transition in macroeconomic variables.

Securities such as Brandywine Realty Trust and M/I Homes could benefit from the small-cap value anomaly in 2023, providing investors with opportunities to secure lucrative total returns.