Soros Fund Management LLC recently released its 13F report for the third quarter of 2022, which ended on Sept. 30.

Founded by George Soros (Trades, Portfolio) in 1969, Soros Fund Management is the primary advisor for the Quantum Group of Funds. After helping define the modern hedge fund, the firm converted to a family office in 2011, becoming closed to outside investors. Soros’ investing principles are based on his “theory of reflexivity,” which holds that individual investor biases affect both market transactions and the economy, resulting in chaotic financial markets and the mispricing of assets.

On any given quarter, there’s a good chance that most of the firm’s top trades are related to merger arbitrage opportunities – either buys for stocks that are about to be acquired or sells for holdings that were recently acquired. However, the firm does make non-arbitrage trades as well.

In the most recent quarter, Soros Fund Management’s biggest acquisition plays were Duke Realty Corp. (DRE, Financial) and Biohaven Pharmaceutical Holding Co Ltd (BHVN, Financial), which have already been bought out by Prologis Inc. (PLD, Financial) and Pfizer Inc. (PFE, Financial), respectively. Meanwhile, the biggest buys that likely weren’t made due to upcoming acquisitions were Booking Holdings Inc. (BKNG, Financial), Agree Realty Corp. (ADC, Financial) and Bank of New York Mellon Corp. (BK, Financial).

Investors should be aware that 13F reports do not provide a complete picture of a guru’s holdings. They include only a snapshot of long equity positions in U.S.-listed stocks and American depository receipts as of the quarter’s end. They do not include short positions, non-ADR international holdings or other types of securities. However, even this limited filing can provide valuable information.

Booking Holdings Inc.

The firm initiated a new stake in Booking Holdings Inc. (BKNG, Financial) worth 10,800 shares after selling out of its previous investment in the stock in the first quarter of 2022. At the quarter’s average share price of $1,878.43, this gives the stock a weight of 0.44% in the equity portfolio.

Based in Norwalk, Connecticut, Booking Holdings is a world leader in online travel services, providing booking services for everything from flights and cars to hotels and vacation packages. The company’s focus is mainly on the more fragmented European and Asian hotel markets rather than the U.S. market.

Booking is big enough and has stable enough business and financial conditions that it is unlikely to be acquired any time soon. Its leadership in the European online travel services space gives it a huge competitive advantage.

As of Nov. 18, shares of Booking traded around $1,940.28 for a market cap of $75.26 billion and a price-earnings ratio of 31.87. The GF Value chart rates the stock as a possible value trap as revenue and earnings are on the decline alongside the share price.

However, as we can see in the chart below, the numbers are beginning to improve again in recent quarters:

Agree Realty Corp

Soros Fund Management also took a 231,728-share stake in Agree Realty Corp. (ADC, Financial), giving it a weight of 0.39% in the equity portfolio at the third-quarter average share price of $75.16.

Agree Realty is a real estate investment trust (REIT) that focuses on owning and operating net lease retail properties throughout the U.S. In addition to acquiring properties to lease, Agree Realty is a leading development partner for some of the country’s largest retailers.

Just like with Booking, Agree Realty is unlikely to become an acquisition target due to the strength and size of its business, though analysts haven’t ruled out a merger due to the company’s focus on growth. The stock offers a solid dividend yield of 3.97%.

As of this writing, shares of Agree Realty traded around $69.98 for a market cap of $6.20 billion and a price-to-funds-from-operation ratio of 16.28. The stock is fairly valued according to its GF Value chart.

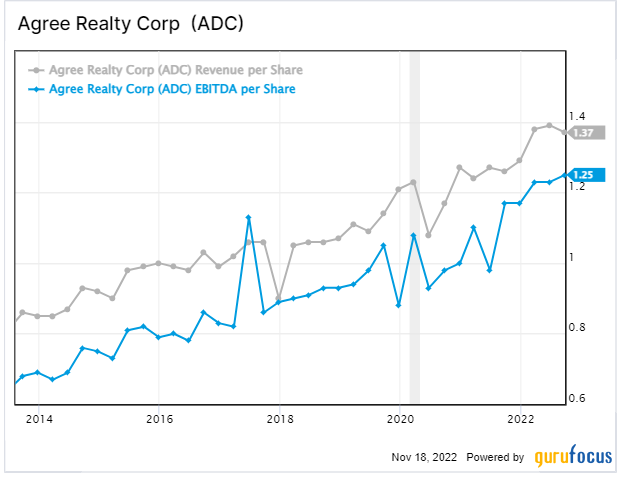

The company has a solid three-year revenue per share growth rate of 6.1% and a three-year Ebitda per share growth rate of 6.4%, showing that it is achieving growth even amid a difficult economic backdrop.

Bank of New York Mellon Corp

The firm added 395,600 shares to its Bank of New York Mellon Corp. (BK, Financial) investment for a total holding of 401,227 shares. The trade added 0.37% to the equity portfolio. During the quarter, shares changed hands for an average price of $42.63 apiece.

Bank of New York Mellon is a New York-based corporate investment banking company that styles itself the “bank of banks.” It helps clients such as banks, asset managers, broker-dealers, companies and governments manage and service their financial assets throughout the investment lifecycle.

As a custody bank, Bank of New York Mellon derives most of its profits from fees charged for holding assets, giving it a very sturdy business that hasn’t faltered much outside of the Financial Crisis. It also boasts a dividend yield of 3.21% and a three-year dividend growth rate of 7.7%.

On Friday, shares of the bank traded around $44.56 apiece for a market cap of 36.02 and a price-book ratio of 1.03. The GF Value chart rates the stock as fairly valued.

The company’s revenue growth has been pretty slow, but the book value has been faster since exiting the Financial Crisis:

See also

As of the quarter’s end, Soros Fund Management held shares of 234 common stocks in an equity portfolio valued at $4.04 billion. The turnover for the quarter was 20%. You can see the firm’s full trades here.

The top holdings were Rivian (RIVN, Financial) with 13.33% of the equity portfolio, Duke Realty Corp. (DRE, Financial) with 7.62% and Amazon (AMZN, Financial) with 5.54%. However, investors should note that Duke Realty has already been acquired by Prologis Inc. (PLD, Financial), which just goes to show that we have to take the 13F reports with a grain of salt, as the situation may have already changed after the reporting period ended. Without Duke, the third-largest holding becomes D.R. Horton Inc. (DHI, Financial) with a 4.36% portfolio weight.

In terms of sector weighting, the firm was most invested in the consumer cyclical sector, followed distantly by financial services, health care and technology.