Lassonde Industries Inc. (TSX:LAS.A, Financial) is the largest producer of fruit juices and drinks in Canada and one of the top producers of private label shelf-stable beverages in the U.S. The company has 17 plants in North America and extensive distribution system for its branded products in Canada. The fruit juice market is Canada is still quite fragmented, so the company continues to grow by making acquisitions.

Lassonde also makes fruit-based snacks, cranberry sauce and other cider-based beverages.

The stock has sold off over 60% from its 2018 all-time high and is down 45% from the 2021 peak. Shares are trading for 8 times Lassonde’s five-year average core free cash flow (see operating cash flow chart below).

Financial metrics

Operating profits (EBIT) in 2021 were about 118 million Canadian dollars ($88.85 million). Given the company's enterprise value of approximately CA$1 billion, this works out to an enterprise value/Ebit ratio of less than 9. Lassonde's 10-year median enterprise value/Ebit ratio was over 14. Therefore, a reversion to normalized enterprise value/Ebit would mean an upside of over 35%. The stock looks very cheap and the company is buying back shares aggressively.

Ticker | Company | Current Price | Market Cap ($M) | EV-to- EBITDA | EV-to-EBITDA (10y Median) | EV-to-EBIT | EV-to-EBIT (10y Median) | Price-to-Opera ting-Cash-Flow | Price-to-Operating-Cash-Flow (10y Median) | EV-to-FCF | EV-to-FCF (10y Median) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TSX:LAS.A | Lassonde Industries Inc | 109.94 | 573.10 | 6.36 | 9.98 | 10.11 | 13.95 | 49.76 | 9.38 | -50.15 | 16.83 |

Financial results are steady, with high single-digit operating margins and consistent cash generation. Recent performance has been negatively affected by inflation, causing margins to compress and the stock to fall. As can be seen in the chart below, operating profit and operating margins are below trend. I expect them to revert as the company adjusts to inflationary pressures.

With the exception of the post-pandemic period, the company's core free cash flow (adjusted for working capital, represented by the orange line in the chart below) has increased steadily at over a 6% compound annual growth rate.

Further, Lassonde's balance sheet as of June 30 has low long-term debt of $156 million.

Control

The company was started over 100 years ago from a Quebec fruit stand and is still family controlled by the Lassonde family via super-voting B shares, which are not traded.

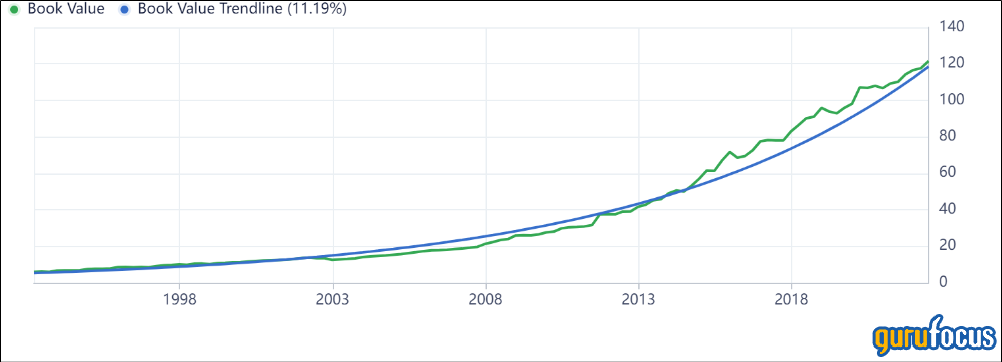

Lassonde's book value has been steadily increasing at double digits over the long term. The family control provides the company with good capital allocation and stewardship.

Return on Invested Capital (ROIC) has been consistently above Weighted Averge Cost of Capital (WACC) over the last decade, showing the company has been adding economic value.

Conclusion

Lassonde could be an excellent lower-risk opportunity in a recessionary environment. It has low leverage and a solid balance sheet.

In addition, the valuation panel suggests the stock is cheap on an absolute basis.

Due to the emergence of inflation, shares have traded down on the back of transient issues, but I believe they will recover as Lassonde adjusts its pricing to restore profitability. The company has been a boring but steady performer over the last 30 years and I expect this trend to continue. The company enjoys good scale and wide distribution and relationships with retailers. Further, it pays a decent 2.5% dividend, which is growing, and is buying back its stock.