The Matthews Japan Fund (Trades, Portfolio) released its equity portfolio for the second quarter of 2022 earlier this week.

Part of San Francisco-based investment firm Matthews Asia, the fund is managed by Taizo Ishida and Shuntaro Takeuchi. It invests in Japanese companies that have sustainable growth in order to generate long-term capital appreciation.

In their quarterly letter, the fund managers noted Japanese markets in the first half of the year were “dominated by two of the largest moves in decades.” They wrote:

“Japan’s currency hit 135 yen to the U.S. dollar toward the end of the second quarter, a level last seen in early 2002, and the biggest move between the currencies since the early nineties. Multiple rate hikes by the U.S. Federal Reserve and the accommodative stance of the Bank of Japan is resulting in a widening of the U.S.-Japan bond yield spread. Ongoing high energy prices are also adding pressure on the yen as Japan’s energy self-sufficiency ratio remains one of the lowest among Organisation for Economic Co-operation and Development (OECD) countries. As a result of the weakening yen, Japanese equity markets traded in-line with global developed market peers in U.S. dollar terms despite outperforming in local currency terms.

Secondly, the velocity of the widening of the spread between the performance of value stocks and growth stocks was the fastest in two decades. In the first quarter the spread was 1,556 basis points (15.56%), and in the second quarter it widened by another 730 basis points (7.30%). While this performance gap between value and growth can be seen across the world, it is especially large in Japan. In the first quarter it was more about rising rates resulting in equity multiple-compression of growth names while the second quarter was dominated by fears that multiple rate hikes to contain inflation will result in the world economy falling into a recession.”

Based on these considerations, the fund established six new positions during the three months ended June 30, sold out of nine stocks and boosted or trimmed a number of other existing investments. The most trades in the firm’s NPORT-P filing were new holdings in Tokio Marine Holdings Inc. (TSE:8766, Financial), Nippon Telegraph & Telephone Corp. (TSE:9432, Financial) and Toho Co. Ltd. (FSE:9602, Financial), a reduction to the Tokyo Electron Ltd. (TSE:8035, Financial) position and the divestment of NTT Data Corp. (TSE:9613, Financial).

Investors should be aware that, just like 13F reports, NPORT-P reports do not provide a complete picture of a guru’s holdings to the public. Filed by certain mutual funds after each quarter’s end, NPORT-P filings collect a wide variety of information on the fund for the SEC’s reference, but in general, the only information made public is in regard to long equity positions. Unlike 13Fs, they do require some disclosure for long equity positions in foreign stocks. Despite their limitations, even these restricted filings can provide valuable information.

Tokio Marine Holdings

Having previously sold out of Tokio Marine (TSE:8766, Financial) in the first quarter of 2021, the Japan Fund invested in a new 589,200-share holding, allocating 3.63% of the equity portfolio to it. The stock traded for an average price of 7,166.50 yen ($53.86) per share during the quarter.

It is now the fund’s fifth-largest holding.

The insurance company, which offers property and casualty products, has a market cap of 5.25 trillion yen; its shares closed at 7,799 yen on Wednesday with a price-earnings ratio of 12.72, a price-book ratio of 1.31 and a price-sales ratio of 0.93.

The GF Value Line, which takes historical ratios, past performance and future earnings projections into consideration, suggests the stock is modestly overvalued currently.

Tokio Marine’s financial strength was rated 5 out of 10 by GuruFocus. While the company has a comfortable level of interest coverage, it is struggling to create value while growing since the return on invested capital is overshadowed by the weighted average cost of capital.

The company’s profitability scored a 6 out of 10 rating on the back of margins and returns on equity, assets and capital that top over half of its competitors. Tokio Marine is also supported by a high Piotroski F-Score of 9 out of 9, meaning operations are healthy. Due to consistent earnings and revenue growth, it also has a predictability rank of 2.5 out of five stars. According to GuruFocus research, companies with this rank return an average of 7.30% annually over a 10-year period.

Matthews has the largest position in the company among the gurus with 0.09% of its outstanding shares. The iShares MSCI ACWI ex. U.S. Exchange-Traded Fund also holds the stock.

Nippon Telegraph & Telephone

After exiting a stake in Nippon Telegraph & Telephone (TSE:9432, Financial) in the third quarter of 2020, the fund picked up a new holding of 678,900 shares, dedicating 2.06% of the equity portfolio to it. Shares traded for an average price of 3,837.13 yen each during the quarter.

The telecommunications company headquartered in Tokyo has a market cap of 13.27 trillion yen; its shares closed at 3,747 yen on Wednesday with a price-earnings ratio of 6.20, a price-book ratio of 1.60 and a price-sales ratio of 1.10.

According to the GF Value Line, the stock is modestly overvalued currently.

GuruFocus rated Nippon’s financial strength 3 out of 10. Although the company has issued new long-term debt over the past three years, it is at a manageable level due to adequate interest coverage. The Altman Z-Score of 1.70, however, warns the company could be at risk of bankruptcy. The ROIC also eclipses the WACC, so value creation is occurring.

The company’s profitability fared better, scoring an 8 out of 10 rating due to margins and returns that outperform over half of its industry peers and a high Piotroski F-Score of 7. Due to steady earnings and revenue growth, Nippon also has a 4.5-star predictability rank. GuruFocus found companies with this rank typically return 10.60% annually.

The Japan Fund has the largest holding among the gurus with 0.02% of Nippon’s outstanding shares. The T. Rowe Price Japan Fund (Trades, Portfolio) and iShares MSCI ACWI ex. U.S. ETF also have positions.

Toho

Matthews entered a 500,800-share position in Toho (FSE:9602, Financial), giving it 1.92% space in the equity portfolio. The stock traded for an average per-share price of 4,600 yen during the quarter.

The Japanese film and theater production company, which is known for the Godzilla franchise and anime films, has a market cap of 930.49 billion yen; its shares closed at 4,600 yen on Wednesday with a price-earnings ratio 27.02, a price-book ratio of 2.32 and a price-sales ratio of 4.

Based on the Peter Lynch chart, the stock appears to be overvalued currently.

Toho’s financial strength was rated 10 out of 10 by GuruFocus, driven by a comfortable level of interest coverage and a high Altman Z-Score of 8.10 that indicates it is in good standing. The ROIC also exceeds the WACC, so value is being created.

The company’s profitability scored a 7 out of 10 rating. Although the operating margin is declining, the returns outperform over half of its competitors. Toho also has a high Piotroski F-Score of 7. While revenue per share has declined in recent years, it still has a one-star predictability rank. GuruFocus says companies with this rank return, on average, 1.10% annually.

The fund holds 0.28% of Toho’s outstanding shares.

Tokyo Electron

Impacting the equity portfolio by -2.02%, the Japan Fund curbed its Tokyo Electron (TSE:8035, Financial) position by 63.84%, selling 49,600 shares. The stock traded for an average price of 55,008.30 yen per share during the quarter.

Matthews now holds 28,100 shares, which account for 0.97% of the equity portfolio. GuruFocus estimates the fund has lost 11.17% on the investment so far.

The company, which manufactures electronics and semiconductors, has a market cap of 7.18 trillion yen; its shares closed at 46,110 yen on Wednesday with a price-earnings ratio of 16.51, a price-book ratio of 5.33 and a price-sales ratio of 3.60.

The GF Value Line suggests the stock is modestly undervalued currently.

Tokyo Electron’s financial strength and profitability were both rated 10 out of 10 by GuruFocus. In addition to a comfortable level of interest coverage, the company has a robust Altman Z-Score of 11.36 that indicates it is in good standing. Value is also being created since the ROIC outshines the WACC.

On top of operating margin expansion, the company is being supported by strong returns that outperform a majority of industry peers. Tokyo Electron also has a moderate Piotroski F-Score of 6, meaning conditions are typical for a stable company. Consistent earnings and revenue growth contributed to a four-star predictability rank. GuruFocus data shows companies with this rank return an annual average of 9.80%.

Matthews has the largest position in Tokyo Electron with 0.02% of its outstanding shares. The iShares MSCI ACWI ex. U.S. ETF also holds the stock.

NTT Data

With an impact of -1.96% on the equity portfolio, the fund exited its 1.25 million-share stake in NTT Data (TSE:9613, Financial). During the quarter, shares traded for an average price of 2,137.06 yen each.

GuruFocus says Matthews lost an estimated 4.71% on the investment.

The information technology company has a market cap of 2.81 trillion yen; its shares closed at 2,007 yen on Wednesday with a price-earnings ratio of 19.70, a price-book ratio of 2.22 and a price-sales ratio of 1.10.

According to the GF Value Line, the stock is fairly valued currently.

GuruFocus rated NTT Data’s financial strength 4 out of 10 on the back of sufficient interest coverage and an Altman Z-Score of 2.54 that indicates it is under some pressure currently. The ROIC also slightly surpasses the WACC, so value is being created.

The company’s profitability fared better with an 8 out of 10 rating as a result of operating margin expansion and returns that outperform over half of its competitors. NTT Data also has a high Piotroski F-Score of 9 and, due to steady earnings and revenue growth, a five-star predictability rank. GuruFocus says companies with this rank return, on average, 12.10% annually.

The iShares MSCI ACWI ex. U.S. ETF holds 0.01% of NTT Data’s outstanding shares.

Additional trades and portfolio performance

During the quarter, the Japan Fund also created positions in Itochu Corp. (TSE:8001, Financial), Mazda Motor Corp. (TSE:7261, Financial) and Septeni Holdings Co. Ltd. (TSE:4293, Financial), sold out of Kadokawa Corp. (TSE:9468, Financial) and trimmed the Shin-Etsu Chemical Co. Ltd. (TSE:4063, Financial) holding.

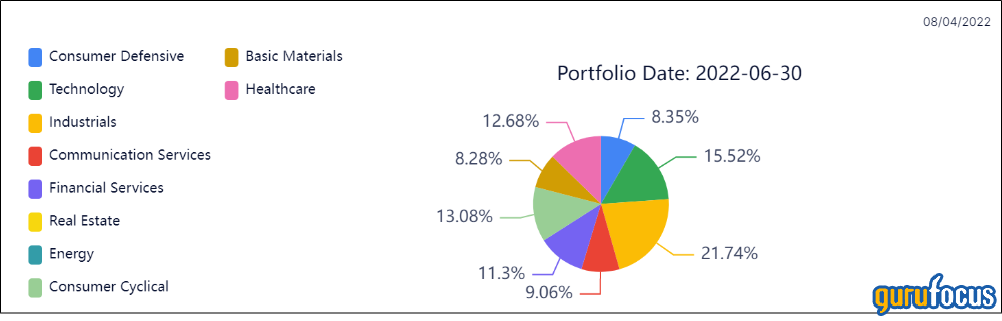

Matthews’ $946 million equity portfolio, which is composed of 50 stocks, is most heavily invested in the technology and industrials sectors.

The fund returned -1.92% in 2021, underperforming the MSCI Japan Index’s 2.04% return.