The MS Global Franchise Portfolio (Trades, Portfolio), part of Morgan Stanley’s (MS, Financial) mutual funds, disclosed in a regulatory filing that its top five trades during the fourth quarter of 2021 included the closure of its position in British American Tobacco (LSE:BATS, Financial) and boosts to its holdings in Broadridge Financial Solutions Inc. (BR, Financial), Visa Inc. (V, Financial), SAP SE (XTER:SAP, Financial) and Fidelity National Information Services Inc. (FIS, Financial).

The fund seeks long-term capital appreciation by investing primarily in companies with resilient business franchises and growth potential. The management team follows a disciplined investment process based on bottom-up stock selection, with sector, industry and stock weights driven by the team’s assessment of each stock’s quality and valuation characteristics.

As of December 2021, the fund’s $3.89 billion 13F equity portfolio contains 32 stocks with a quarterly turnover of 7%. Investors should be aware that 13F reports do not give a complete picture of a firm’s holdings: While the reports only include U.S. holdings and American depository receipts, they can still provide valuable information. Further, the reports only consider trades and holdings as of the latest portfolio filing date and thus, do not reflect trades made after the filing date.

The top three sectors in terms of weight are consumer staples, health care and technology, representing 28.97%, 24.20% and 23.22% of the equity portfolio.

British American Tobacco

The fund sold all 2,044,398 shares of British American Tobacco (LSE:BATS, Financial), chopping 2.14% of its equity portfolio.

Shares of British American Tobacco averaged 26.17 pounds ($34.52) during the fourth quarter; the stock is modestly overvalued based on Friday’s price-to-GF Value ratio of 1.15.

The U.K.-based tobacco company has a GuruFocus financial strength rank of 4 on several warning signs, which include a weak Altman Z-score of 1.56 and interest coverage and debt ratios that are underperforming more than 70% of global competitors.

Broadridge Financial Solutions

The fund invested in 174,968 shares of Broadridge Financial Solutions (BR, Financial), expanding the position by 507.37% and its equity portfolio by 0.82%.

Shares of Broadridge Financial Solutions averaged $175.95 during the fourth quarter; the stock is fairly valued based on Friday’s price-to-GF Value ratio of 0.93.

The Lake Success, New York-based investor communication software company has a GuruFocus profitability rank of 9 based on several positive investing signs, which include a 4.5-star business predictability rank and profit margins and returns that outperform more than 80% of global competitors.

Visa

The fund added 138,657 shares of Visa (V, Financial), boosting the position by 17.27% and its equity portfolio by 0.77%.

Shares of Visa averaged $214.28 during the fourth quarter; the stock is modestly undervalued based on Friday’s price-to-GF Value ratio of 0.90.

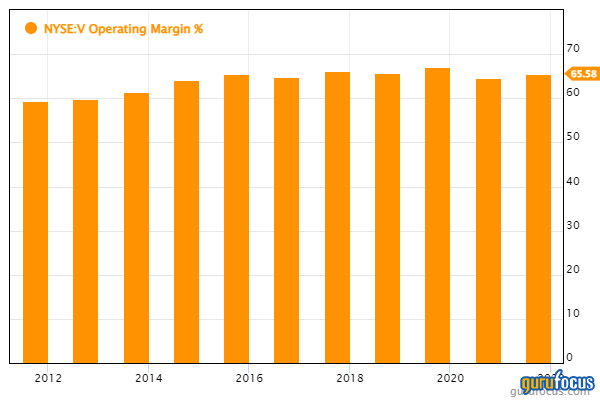

The San Francisco-based payment processing company has a GuruFocus profitability rank of 10 based on several positive investing signs, which include a five-star business predictability rank, a high Piotroski F-score of 8 and profit margins and returns that outperform more than 90% of global competitors.

SAP

The fund added 201,757 shares of SAP (XTER:SAP, Financial), boosting the position by 17.7% and its equity portfolio by 0.73%.

Shares of SAP averaged 112.02 euros ($123.03) during the fourth quarter; the stock is modestly undervalued based on Friday’s price-to-GF Value ratio of 0.82.

The German database software company has a GuruFocus profitability rank of 9 based on several positive investing signs, which include a 3.5-star business predictability rank, a high Piotroski F-score of 8 and profit margins and returns that are outperforming more than 80% of global competitors.

Fidelity National Information Services

The fund added 218,007 shares of Fidelity National Information Services (FIS, Financial), boosting the position by 37.74% and its equity portfolio by 0.61%.

Shares of Fidelity National Information Services averaged $112.73 during the fourth quarter; the stock is modestly undervalued based on Friday’s price-to-GF Value ratio of 0.73.

The Jacksonville, Florida-based payment processing software company has a GuruFocus financial strength rank of 5 on the back of interest coverage and debt ratios underperforming more than 70% of global competitors despite having a high Piotroski F-score of 8.