Liberty Global PLC (LBTYA, Financial) provides TV, broadband and wireless communications services in Europe. It operates in the following geographical areas: the U.K. and Ireland, Belgium, Switzerland, Central and Eastern Europe and Central and Corporate. Its products include broadband, WiFi, connectivity products, TV platforms and TV content.

Liberty Global is a John Malone company; Malone is the Chairman and his key lieutenant, Michael Fries, is the CEO. Malone was one of the pioneers of the U.S. cable industry and is known as the "Cable Cowboy." He has a long track record of creating value for shareholders. Malone controls the company through super-voting shares.

Liberty Global has been a difficult investment to grasp as there are lots of moving pieces coming together over more than a decade. It's basically structured as a holding company with following silos:

| Entity | Location | Ownership(1) |

| Telenet | Belgium | 60.7% |

| Sunrise UPC | Switzerland | 100.0% |

| Virgin Media | Ireland | 100.0% |

| UPC Poland (2) | Poland | 100.0% |

| UPC Slovakia | Slovakia | 100.0% |

| Virgin Media - O2 | United Kingdom (U.K.) | 50.0% |

| VodafoneZiggo | Netherlands | 50.0% |

The Fixed-Mobile Convergence (FMC) champions in the chosen markets of Belgium, Switzerland, U.K. and Ireland and the Netherlands are either #1 or #2 in their markets with over 85 million aggregate fixed and mobile subscribers delivering scale, synergies, organic growth and strategic optionality. Secular tailwinds of increased data usage should continue to drive free cash flow and shareholder value.

In addition, the company has a growing ventures platform. Its tech, content and infrastructure businesses are valued at $3.5 billion today by my estimates, or ~$6.70 per share.

Its to be noted that the cash flows and profit and losses of these businesses roll up into Liberty Global, but the debt is held in the individual silos. Debt is thus non-recourse to Liberty Global.

Source: Liberty Global investor presentation

The Malone playbook consists of the following strategies, most of which are being applied in the case of Liberty Global:

- Make long-term capital allocation decisions with really long (decade plus) time horizons. Malone and Fries have been shaping Liberty Global for nearly two decades now from a bunch of sub-scale European operators to a small number of large fixed and mobile converged (FMC) national champion operators with scale.

- Focus on operating and free cash flows (not GAAP earnings).

- Creative use of debt using a high leveraged equity model. Keep growing debt in line with operating cash flows. Debt is more tax efficient than equity and costs a lot less than the implied cost of equity. In the case of Liberty Global, the weighted average cost of debt is around 4.5% but the median free cash yield is between 10 to 15%. This huge spread is captured by the company.

- Create tax efficiency by depreciating capital fast. Why pay the country 20% to 40% of your earnings if you can avoid it with clever accounting tricks?

- Buy back stock aggressively. Its a lot more tax efficient than paying out dividends, which are taxed in the hands of the shareholders.

- Buy and sell assets to create scale and efficiency.

- Use of a central holding company - operating company structure of keeping debt in non-recourse operating silos. Debt in each operating silo is non-recourse to the central holding company and thus can be safely increased to a normally uncomfortable level of four to five times adjusted ebitda.

- Pay your key managers generous stock-based compensation to align their interests. Fries' compensation was $45 million last year.

The following diagram shows Liberty Global's operating cash flows and net income. Note that the company was at a loss for most of the decade except for brief periods when it was disposing of assets. However, cash flows have been solidly above the zero mark. This is classic Malone, which focuses on cash flows, not earnings.

Also, now that Malone and Fries have achieved the capital structure they want, they are buying back stock vigorously.

| Ticker | Company | 3-Month Share Buyback Ratio | 6-Month Share Buyback Ratio | 1-Year Share Buyback Ratio | 3-Year Share Buyback Ratio | 5-Year Share Buyback Ratio | 10-Year Share Buyback Ratio |

| LBTYA | Liberty Global PLC | 3.40 | 5.57 | 9.20 | 10.90 | 10.40 | -1.40 |

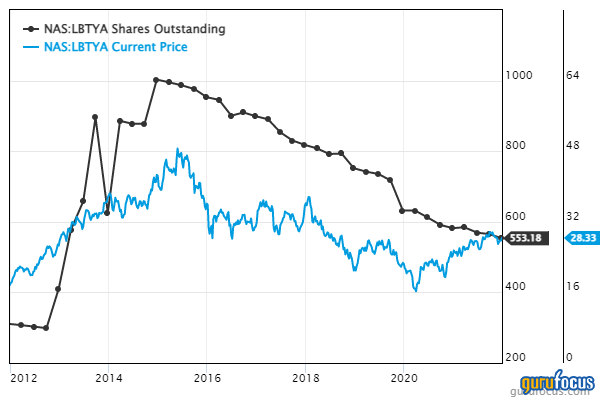

Liberty Global is using its cash flow to buy back stock rapidly. As you will note in the chart below, since 2015, Liberty Global has been buying back stock at around a 10% pace, and I believe this is likely to continue. Strangely enough, the stock has not responded to all these buybacks even though the number of shares outstanding has almost halved from the peak. This shows that most investors don't appreciate Malone's playbook and are overly focused on conventional metrics like earnings per share, price-earnings ratios and dividends.

Valuation

It's not easy to put a value to Liberty Global given its irregular earnings and cash flow. However, I think given Malone and Fries' governing strategy of focusing on free cash flow, it makes sense to try to value the stock through a FCF lens.

GuruFocus has devised a proprietary metric called the Projected FCF value to deal with situations where FCF is erratic. Essentially, the metric takes 80% of the book value and adds it to the present value of free cash flow averaged over six years. Details of the calculations are given here.

Looking at the projected FCF value, we get a fair value estimate of over $102 for Liberty Global. While I would not hang my hat on that number, it does give validation to my impression that Liberty Global is highly undervalued. It is also interesting to note that projected FCF has been increasing over the years, so whatever Malone and Fries are doing seems to be working according to their plans.

Another way of visualizing the value of Liberty Global is computing the cap rate. Think about it this way: companies like Liberty Global build long-term assets (fiber, mobile networks, etc.) and then earn income by charging for the use of these assets. This is like a real estate business, more specifically an REIT that collects rent from tentants. A cap rate for a long-term asset can be calculated as follows:

( `Operating Income` + `Depreciation, Depletion and Amortization` ) / `Enterprise Value ($M)` * 100

Using this formula to calculate Liberty Global's cap rate, we get a value of 14.07%. This is a really good cap rate. As a comparison, the cap rate of the French commercial real estate company Klepierre SA (XPAR:LI, Financial) is 4.72%.

Conclusion

Now that Malone and Fries are close to realizing their desired business structure for Liberty Global, they are setting the company up for long-term success. The last couple of sub-scale businesses in middle income countries (e.g. Poland) are being sold off, and the company is busy concentrating the equity through buybacks. In 2021, buybacks amounted to $1.6 billion. Management is committed to repurchasing 10% of shares outstanding per year in 2022 and 2023.

The company plans to continue building out fiber to the premises and rolling out 5G in its chosen markets. This will require continued high capex and debt far in the future.

This stock is not for everyone. There are no consistent earnings, no dividends, and there is high debt. Malone and Fries only care about cash flow and building the company's intrinsic value for the long-term. In the end, there will likely be some kind of value crystallizing event. We saw this recently with Discovery (DISCA, Financial), another Malone company, which is combining with AT&T's (T, Financial) media businesses.

I think one day, investors are going to wake up and discover the long-term compounding machine Malone and Fries have built. When this will happen, one cannot be sure, but I have faith it will eventually happen. Meanwhile, I continue to hold and add to my position. This is just the beginning of the home stretch.